Day Trading Breakouts

Post on: 16 Апрель, 2015 No Comment

19 Flares Twitter 5 Facebook 11 Google+ 3 Filament.io More Info ‘> 19 Flares

What are Breakouts?

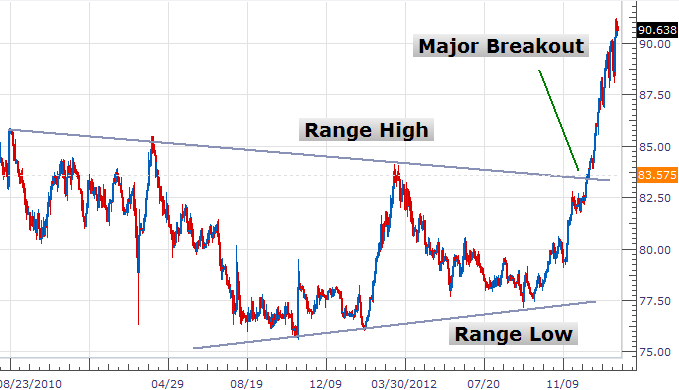

When you think of day trading breakouts, what comes to mind? Stocks making daily highs, two-day highs, weekly highs, all-time highs? As you see, breakout means a lot of things to a lot of people. So, why do so many people lose money day trading breakouts? Why are traders constantly buying stocks when they hit intraday highs, only to have them rollover within minutes. How many times have you shorted a stock on a breakdown through a critical support level, go get coffee, come back and see the stock has bounced and you just bought a five-thousand dollar no foam, soy latte? Well, in this article I will give you the secret that so many breakout day trading professionals use everyday to take themselves from ordinary to extraordinary.

Biggest Misconception about Day Trading Breakouts

If I buy a breakout or sell a breakdown, I will make money, right? If you believe this statement, immediately contact your broker, withdraw your funds and put them in a savings account. If you follow this system, you will lose money. Often times professional floor traders and the like will wait for stocks to break new lows, look for large buy orders in the tape and then start scooping up every share in sight. This will leave you the novice trader, looking at your screen scratching your head. Asking yourself the question, how did this happen? My technical indicators were in alignment. The stock has been below its simple moving average the last 10 bars. The last 15 bars have been down, now when I put on my short position, the stock has the bounce of its life. If you are ready to end your streak of tough trading days. continue reading.

Avoid Trading During Lunch

In the morning, there is news, earnings, gossip, and a multitude of other reasons that cause stocks to move swiftly with heavy volume. Then around lunch, traders take a step back and begin to digest all of the events from the morning. This does not mean there are no good breakouts in the market, but the odds of finding the stocks that will move are not in your favor. Its a known fact on the street that lunch time trading is for accumulating sizeable positions that you can then unload at some point in the future. That is why, during the middle of the day, stocks go through an endless process of breaking out and failing, over and over again. This process is known as intraday accumulation. Think for a second, if you are attempting to accumulate 200,000 shares of a stock. Could you just run out there and put one large order in the market without anyone seeing you? Maybe on a stock like Yahoo, but this is a much harder task in a stock that is not traded heavily. Well if the trading is light, Ill just put the trade on in the morning. Wrong. If you put the trade on in the morning, you can easily get caught up in the morning volatility and may not get the best price. However, if you wait until the afternoon, you can quietly accumulate shares, 10,000 or so each time you buy, without many noticing. So, if you were doing this, would you want the stock to breakout? Of course not, this would mean you would have to pay more per share. So, instead you keep things quiet and by 2 pm, you have been able to acquire your 200,000 shares, over the last 3 hours, under the radar. So, if you are a smaller trader, why get trapped taking on positions during the accumulation period? Why put yourself through the emotional stress of watching your stock breakout and fail, over and over again? If you only remember one thing from this article, middle of the day is for hedge funds and large institutions to build sizeable positions, not for you to day trade breakouts.

Who is Making Money Day Trading Breakouts

The secret for day trading breakouts is knowing when to trade them. Are you ready for this? Are you sitting down? There are only 2 to 3 hours per trading session you can day trade breakouts on an intraday basis. Thats right. If you are day trading breakouts, you only have about 2 hours a day where you can make money easily, quickly, without much effort.

What Times Work

The optimum times to day trade breakouts is between 9:45 am and 10:45 am and 2:00 pm 3:15 pm. Most traders say stay away from the morning and late afternoon trading, because its too volatile, right? Well, that is partially a true statement, if you just go out into the market putting on trades without any defined rules or systems in place. Below are some basic rules that will help you identify winning breakout trades during these volatile time periods:

- Only trade stocks greater than 30 bucks

- Cheap stocks get cheaper. Often times traders like the idea of trading cheap stocks in hopes of greater returns. What about the inherit risk of trading cheaper stocks, the volatile swings, and not to mention the commissions?

In Summary

There are times you can day trade breakouts throughout the entire day, but more times than others you will either breakeven, or make little money. Remember, day trading breakouts should be easy money, not a fight. So, continue to average up and let your profits run.