Daily Stock Market News My 2014 Target for the S P 500

Post on: 16 Март, 2015 No Comment

Recent Posts:

My 2014 Target for the S&P 500

In a day of back-and-forth trading, stocks closed mixed with large-cap stocks, represented by the Dow industrials, off 0.4%, while the broader market S&P 500 closed flat and the Nasdaq rose 0.3%.

A better-than-expected private sector job growth report started the day on a bright note. However, the minutes from the last Federal Reserve meeting of the year provided little guidance as to the Feds future policy, though most of the governors appeared to agree that a steady winding down of their bond buying was appropriate.

Micron Technology (MU ) shares popped 9.9% on better-than-expected earnings (see the Trade of the Day ), and that helped advance the Nasdaq. But Microsoft (MSFT ) fell 1.8%, putting pressure on the Dow. Mr. Softie has been looking for a new CEO, but the front-runner, Fords (F ) CEO Alan Mulally, dropped out of consideration, sending shares lower.

At Wednesdays close, the Dow Jones Industrial Average fell 68 points to 16,463, the S&P 500 broke even at 1,837, and the Nasdaq gained 12 points at 4,166. The NYSE traded total volume of 3.7 billion shares, and the Nasdaq crossed 2.3 billion. Decliners outpaced advancers on the Big Board by 1.3-to-1, and on the Nasdaq, there were slightly more decliners than advancers.

Click to Enlarge

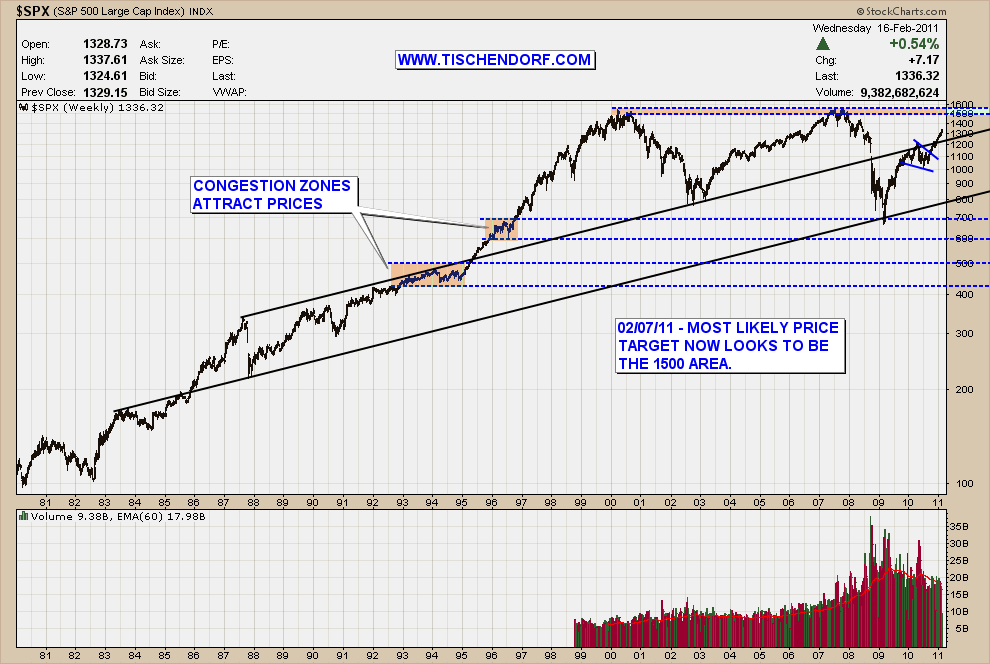

The stock market, as illustrated by the broad-based S&P 500, appears to be in phase 3 of a 5-phase bull market. Phase 1 began at the March 2009 bear market low of 667 and ended in late April 2011 after doubling from that low. A phase 2 correction started at 1,365 and ended in October 2011 after a decline of over 21%. We are currently in a phase 3 advance that has run for almost 27 months, appreciating over 70%.

The current bull market is a mega-bull in that it has smashed two prior bull market highs, that of 2000 at 1,553 and 2007 at 1,576, and it is only in its third phase. Most bull markets last from two to five years, but the current bull appears capable of smashing all prior records and could, in my estimation, run for several more years.

Phase 3, which should end shortly, is characterized by massive institutional participation and is met with disbelief, fear and skepticism by the public. But following a phase 4 correction, which I believe is due shortly, phase 5 will draw in the public and the result could be a massive advance and final blow-off that could add 50% above the top of a phase 4 correction. But the correction will most likely drive the S&P 500 down more than 12% to the major bullish support line (red dotted line).

Currently, the S&P 500 is selling at a price-to-earnings (P/E) ratio of almost 19 times trailing 2013 estimated earnings and 16.25 times forward estimated 2014 earnings. The consensus earnings estimates by Standard & Poors are $109 for 2013 and $123 for 2014. Thus, the S&P 500 is currently at 16.8 times 2013 earnings.

A modest P/E expansion to 18 times earnings could result in an advance to 2,214. Thus, my target for this year is 2,200-plus, an advance of about 20% from current levels. There are a host of variables assumed in this calculation; however, unless S&P changes their earnings target, or an unlikely event occurs that changes the overall direction of the market, this is my guestimate and Im sticking with it. As always, your comments are appreciated.

Todays Trading Landscape

To see a list of the companies reporting earnings today, click here .

For a list of this weeks economic reports due out, click here .