Customer Reviews Dividends Still Don t Lie The Truth About Investing in Blue Chip Stocks and

Post on: 6 Май, 2015 No Comment

This review is from: Dividends Still Don’t Lie: The Truth About Investing in Blue Chip Stocks and Winning in the Stock Market (Hardcover)

As a public service to my fellow hapless investor, who may be thinking of reading (if not actually buying, you cheap ——d!) this gem of a little book, I have a few brief words of sage advice to impart to you.

First, read the book, cover to cover. Thankfully, it is a light, fast read, that at times is a bit on the repetitive side, but nonetheless very informative. Then set it aside for a week, during which time you allow your first impressions of the book to subside, and then read it again. After the second reading, put the book aside but in a prominent place, such as facing out to you on your bookshelf or on your desk, where you can see the title almost beckoning to you. Then, and this is the hard part, do the following:

Do what you normally would do when investing. If you are like most people, you’ll lose money. That’s OK, after all, you are only human and this state of affairs not only confirms that but also confirms that like your fellow man (or woman- it pays not to discriminate), you have absolutely no idea what you are doing. Then, one day, after having lost a tidy sum of money, this book will beckon you, and then, maybe, just maybe, you will see the light, and glean from it its carefully gathered wisdom over some four decades or so. You might be so taken aback by its very simplicity that you take the heretical step of subscribing to the Investment Quality Trends newsletter.

OK, all jokes aside now- for those of you who are sick of losing money in the stock market, or just plain tired of middling results in return for all of your effort and study of the market, this is the book you need to read and ultimately use in your quest to 1) preserve your limited and precious capital, 2) generate a respectable income and 3) grow your investment account. Whether you are in retirement and looking to protect what you have amassed, or you are young (or young-ish) and looking to invest for an eventual retirement (in this economy. Good luck with that.), this is the book you need to buy, read, understand, and use- repeatedly.

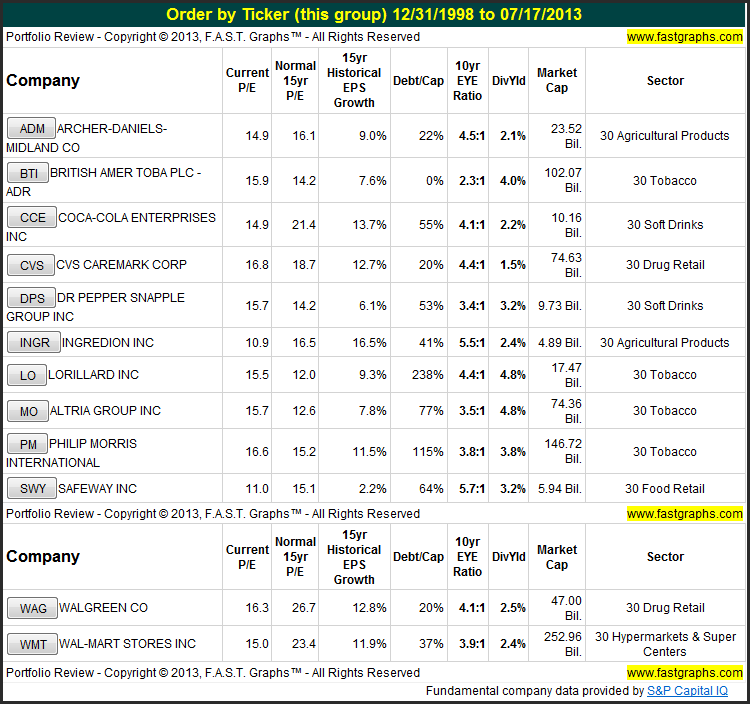

For seasoned investors like myself, the book may read a bit too simple and too basic (this I suspect may be due to the fact that the book is pitched moreso to the novice or beginning investor that is unsure of him- or herself vis-a-vis stocks). More than a few of you will take issue with how restrictive the stock universe that it inhabits is. All of you need to trust me on this one thing: using this book will keep you out of serious trouble (by minimizing your risk in stock investing and protecting your modest grubstake), and for those of you who find the book to be too restrictive in terms of the number of stocks to choose from, pay very close attention to Chapter 4 of the book, modify Chapter 4 a bit to suit your needs, and broaden the list of likely stock investment targets.

The method espoused in the book really is as simple as the author makes it out to be. In passing, I have found this book, along with The Future For Investors by Jeremy J. Siegel (author of Stocks For The Long Run), to be good, strong, positive reinforcement.

Here are a few final free-bies: Using this book as a guide (and perhaps a subscription to the IQT newsletter- no pressure from me here), screen for the truly indispensable outfits. Then, dollar cost average into them. Do this preferably via some tax-advantaged account (IRA of some sort in a pinch, but ideally a 401-k type deal if you have it available to you). And for the coup-de-gras, I noticed that more than a few of the outfits that make the Wright-Weiss cut for quality and value offer direct stock purchase plans with optional cash purchases of as little as 50 bucks in some cases (some even offer IRAs). The truly intelligent and astute small investor would take advantage of this wherever possible (in a pinch, a Sharebuilder account would suffice)- just be mindful of the paperwork, which will require the use of a spreadsheet and a modicum of organization. Oh, and one more thing, since the outfits chosen are indispensable, you never have to sell them (unless of course, their investment quality has fundamentally eroded) and you can value-cost-average (buy on the dips) at your leisure as well. Check out Craig L. Israelsen’s lovely little book, The Thrifty Investor (an older and somewhat dated but nonetheless very relevant text), for further enlightenment on these free-bies.

In sum, you can either work for your money, or you can put your money to work for you. Granted, if you are like most of us, you have to work for- that is to say, earn- your money, so it behooves you to put your hard-earned money to work using a safe and sound strategy that thankfully, this book provides.

As always, caveat emptor people. Caveat emptor.

Help other customers find the most helpful reviews

Was this review helpful to you? Yes No