Customer Reviews An Introduction to ConnorsRSI 2nd Edition (Connors Research Trading Strategy

Post on: 10 Апрель, 2015 No Comment

This review is from: An Introduction to ConnorsRSI 2nd Edition (Connors Research Trading Strategy Series) (Kindle Edition)

(If you have read my review of one of the books in the following list you can, without loss of continuity or meaning, resume beneath the list at the _BookTitle of interest to you.)

I was already the satisfied owner of three hardback books from Connors Research (CR) when the Fed began to step back from QE in October 2014. I watched market volatility reassert itself and, perhaps, breathe new life into trading. I took on these CR works electronically:

Advanced ConnorsRSI Strategy for ETFs—available at the CR site

The CR books on my shelf do not do what these do: introduce the ConnorsRSI indicator and then apply it to individual names and ETFs. Before I describe how these books differ, what traits do they share?

Connors Research applies a simple approach rigorously to define and quantify ideas that are worth testing for yourself. For a nights-and-weekends analyst like me, these books are worth my time and money at the prices posted as of this review date. The saved research time is precious. (The Introduction, especially, was a jaw-dropping bargain.)

The blend of conceptual introduction and lab reporting is a sweet spot. If you: (1) want unambiguous, formulaic trading, (2) understand basic trading concepts, and (3) can follow simple equations, then you will get CR’s work into your head quickly and easily. In testing for yourself with foundational work, you don’t have to start from a blank screen and prove the basics. You can focus on nuances that matter to you and then select parameter values and financial products that fit your needs. You can start near your own Finish line.

My experience includes technical writing and editing, some for system developers and advisors (though not for CR), so I seldom rate quantitative trading books at the top of the scale. Most quants write better in R or C++ than in English, and most of their management is better with the spoken than written word. But whether on paper or screen, CR is refreshingly direct, simple, and consistently clever at converting fuzzy ideas into quantitative results in the time it takes to read a white paper at the office. That’s an accomplishment.

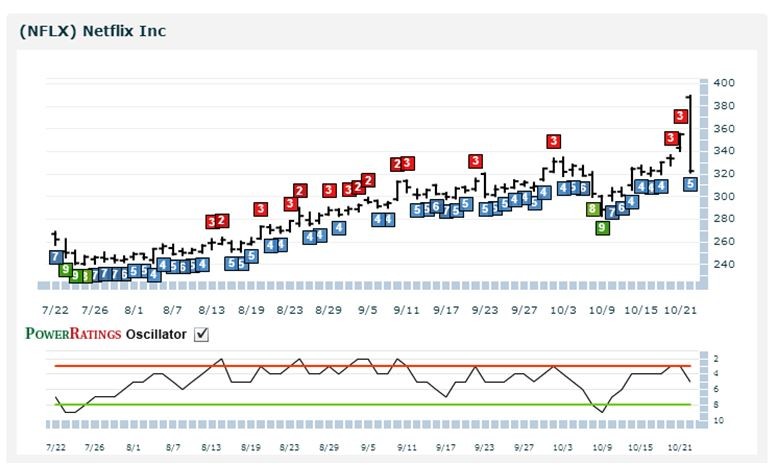

Each of the books develops a concept into formulaic Rules that are processed as part of a trade Setup, Entry, and Exit, and visually introduced with clearly marked price charts. This part of the presentation is quite clear.

Exit gets as much attention as Entry, placing these books a cut above much of what is published, above mid-scale.

By running its universe through Setup, Entry, and Exit for every combination of parameter values, each book evaluates strictness or lenience of Rules, and then walks you through quantified tradeoffs in Top 20 tables for highest win rate and average gain. The parameter sets are diverse in quantity of trades, from a few hundred to thousands over the test window. There’s something for everyone. So you don’t get lost conceptually, CR walks you through these tradeoffs with words and tables. A parameter-space graph would help reinforce the tradeoffs. As with Setup, Entry and Exit, the words and numbers are good and a graph would nail it.

In discussing limit entries, the books consider slippage only in terms of price. You will want to model partial fills as part of your own parameter selection. Your tests must also quantify risk, such as drawdowns. CR mentions drawdowns but does not quantify or analyze them. Lack of DD quantification is too much of an omission for me, on its own preventing a top-of-scale rating.

Each book includes an option strategy with clear, easy-to-implement rules. I am the satisfied owner of an edition of McMillan’s Options as a Strategic Investment that runs 700 pages. Larry McMillan is a guru and his book is strong. The fact that CR canvassed its industry contacts to identify a suitable option strategy and implementation rules in only a few pages is also strong. If your test time is tight and your sleep-at-night requirements include knowing your maximum dollar risk before you enter a trade, the option strategy is a no-brainer.

Connors Research closes each book by addressing stops in a uniform way, omitting data and concluding that Whether you use them or not is a personal choice. Of course it is, if you are trading for yourself. Ensure that your own tests inform that choice.

Which trading principle does the Introduction define and quantify? Mean reversion in liquid equities is how I would put it: both in the design of the ConnorsRSI indicator and by applying it to a strategy. The test universe of this book is individual stocks across most of the U.S. universe from January 2001 to February 2014. This breadth and depth of history hint at the headache that this book helps you to avoid. For any real depth, you test for survivorship bias, so you need data on delisted names with a flexible means to adjust for every material change. None of my sources sells that data on a retail license these days. Proving an indicator from the ground up requires some tenacity. If you exhaustively examine variations on a basic idea with 6,000 names, as CR does here, you probably produce and need to manage millions of rows of test data. While doing so, you must guard against data mining bias. (For help with that, try David Aronson Evidence-Based Technical Analysis: Applying the Scientific Method and Statistical Inference to Trading Signals and Howard Bandy Quantitative Trading Systems, 2nd Edition .)

The Introduction converts the trading principle into eight Rules: six in the Setup and one in each of the Entry and Exit. Two of the setup rules define the universe in terms of liquidity and likely institutional interest. The standard tables of results indicate that the principle tests well. The Top 20 variations for average gain include these averages: trade counts of 479-1,438, gains no lower than 12.31%, accuracies a reassuringly tight 75.8-80%, and days-in-trade of 1.8-7.9. The Top 20 for highest accuracy includes these averages: trade counts of 597-1,058, gains no lower than 11.27%, trading days 1.8-3.2, and an accuracy range that’s even tighter, 78-80%.

Connors varies the parameters in five of the Rules to produce a range of outcomes for evaluation. To convey that range, this book presents a table that the others do not. It analyzes the Top 20 variations based on average days held. The news is surprisingly pleasant. The longest average trade duration is under two days, and these variations include average gains per trade of 6.7%-13%! Trade counts vary from just under 500 to just over 2,200, plenty of decision space for opportunity. These results suggest a compelling trading concept and implementation.

I’m glad I started my trip through these three books with the Introduction. Starting here makes conceptual sense and, at the price posted today, great economic sense. I couldn’t beat this value doing the work on my own.

Which trading principle does SP500 Trading with ConnorsRSI define and quantify? Buy large-cap stocks when others are fearful is one way to say it. CR converts that principle into five Rules: three in the Setup and one in each of Entry and Exit. Four of the Rules use parameters that produce a range of outcomes for evaluation. Of course ConnorsRSI is one of the parameter-enabled indicators in the Rules.

The standard tables of results indicate that the principle tests well. For the Top 20 variations by accuracy, the lowest average win rate is 76%. In the Top 20 by average gain, the lowest average gain is 9.8% over 2.4 days. Nine of the top ten variations on average gain are also in the top ten on win rate, a compelling overlap. From the book: Finding a quantified, back-tested strategy that produces a profit on 75% of trade signals is somewhat unusual; having 20 different variations that all generate winners 76 — 86% of the time is a testament to the power and consistency of the ConnorsRSI S&P 500 trading strategy!

With three summary tables that are specific to its Rules, SP500 Trading with ConnorsRSI articulates the essence of the tradeoffs in testing and selecting your own parameter values: [F]or entries the tradeoff is between more trades and higher gains per trade, while for exits the tradeoff is between shorter trade durations and higher gains per trade. In the first such table, with two parameters constant and two varying, the trade count ranges from 626 to 2,087. In the second, with three constants and one variable, the trade count ranges from 779 to 8,052. There’s something for everyone here, certainly enough to get me interesting in out-of-sample tests.

Connors Research includes but does not quantify this fascinating pair of sentences: When comparing a strategy variation that exits trades at the close with one that exits the next day using average price, the long‐term results are generally quite similar. Individual trades may perform better under one scenario than the other, but over time these differences tend to average out. That is worth a book of its own. A Graceful Exit, perhaps?

_Advanced ConnorsRSI Strategy for ETFs_ at tradingmarkets dot com

Which trading principle does Advanced ConnorsRSI Strategy for ETFs define and quantify? Buy liquid ETFs when others are panic-selling is a good way to describe it. If you like the concept of dip-buying and prefer to avoid company-specific risk, this is a set of test results for you.

Connors converts the trading principle into six Rules: three in the Setup and one in each of Entry and Exit. Because it is specific, CR’s description is clearer than this summary. Two of the Setup rules are volume-driven. For Entry, you choose—before trade entry—one of two parameter-enabled alternatives. The Exit is also your choice, made before trade entry, from among three alternatives, two of which are parameter-enabled. Thus, parameters appear in the Setup, Entry and Exit, producing a range of outcomes for evaluation from the nearly eight-year backtest window. Of course ConnorsRSI is one of the parameter-enabled indicators in the Rules.

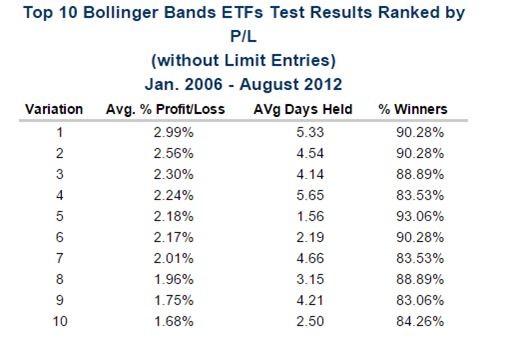

The standard tables of results indicate that the principle tests well. In the Top 20 by highest win rate, the lowest win rate is 89%. In the Top 20 by average gain per trade, the lowest average gain is 8.36% in less than three days. Twelve variations span the tables, an impressive degree of overlap. The lowest win rate among the Top 20 average gains is 87.5%—a compelling set of results. If one wants to quibble here, leveraged ETFs are included (explicitly) in the table of average gains. I would prefer two tables, one with and the other without the leveraged products.

With five summary tables that are specific to its Rules, Advanced ConnorsRSI Strategy for ETFs quantifies the effect of differing entry methods and thresholds, and exits, on leveraged funds. Trade counts with varying entry thresholds cover a wide range, from 77 to 3,540. Average gains range from 1.69% to 7.37%, highest win rates from 70.8% to 88.7%. Varying the exits with other parameters constant indicates that longer holds are worth higher average gain and higher win rates, an attractive set of outcomes. The most interesting comparison is between percentage- and volatility-driven entries: simplicity might be attractive, but is not always optimal.

The best part of Advanced ConnorsRSI Strategy for ETFs might be the candid context that it sets in its introduction: [T]he strategy trades infrequently. To overcome this drawback, we believe it is best to trade several strategies. Well said.

Help other customers find the most helpful reviews

Was this review helpful to you? Yes No