Current account income balance and net international investment position

Post on: 12 Май, 2015 No Comment

Exploring the deterioration in the UK’s current account in recent years.

The current account deficit widened in Q3 2014, to 6.0% of nominal Gross Domestic Product GDP, representing the joint largest deficit since Office for National Statistics (ONS) records began in 1955.

This deterioration in performance can be partly attributed to the recent weakness in the primary income balance, which captures income flows into and out of the UK economy. This also reached a record deficit in the Q3 2014 of 2.8% of nominal GDP; a figure that can be primarily attributed to a fall in UK residents’ earnings from investment abroad, and broadly stable foreign resident earnings on their investments in the UK.

Primary income is made up of investment income, compensation of employees and other primary income. Investment income forms the largest component of primary income and consists of 3 main entities: direct investment income (earnings from investments that account for more than 10% of an enterprise), portfolio investment income (earnings on investment representing less than 10% equity securities and debt securities) and ‘other investment income’ that captures flows into and out of the UK from bank loans and deposits. If the income flows out of the UK exceed the income flows into the UK, primary income will be in deficit.

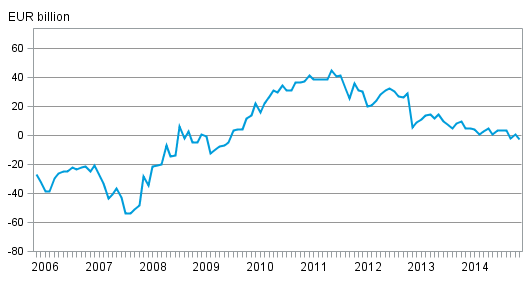

Figure 1 presents the contributions to primary income from these constituent parts. This shows that the recent decline in the income balance has been partly driven by a falling direct investment income balance, as well as a falling debt security balance. The ‘other investment income’ and ‘equity securities portfolio investment income’ balance remains in deficit, but has improved in recent quarters to partially offset downward movements elsewhere.

Figure 1: Primary income (excl compensation of employees), percentage of GDP, current price, seasonally adjusted

Download chart

(27 Kb)

To analyse these movements further, earnings on investment can be related to the stock of assets held and the rate of return on those stocks. As previously mentioned, UK residents have been receiving lower income on their overseas Foreign Direct Investment (FDI). As a proportion of GDP, this income received has fallen from 6.8% in Q2 2011 to 3.8% in Q3 2014, and this can be attributed to changes in the stock of assets UK residents’ hold, as well as their rates of return on those assets. Stock holdings of these foreign FDI assets has fallen sharply from 92% annual GDP in Q4 2008 to 67% in the 2014 data. In contrast, foreign residents have continued to expand their holdings of UK assets, a phenomenon that may be linked to the strength in the UK’s recent recovery. Similarly, foreign residents have owned higher amount of UK debt securities than UK residents since 2003. The rates of return for UK residents on foreign debt securities have also been below foreign residents’. This may explain the deterioration in the debt security balance and the worsening of the UK’s current account position.

An additional short story on the latest FDI data, Recent trends in Foreign Direct Investment has been published by ONS.

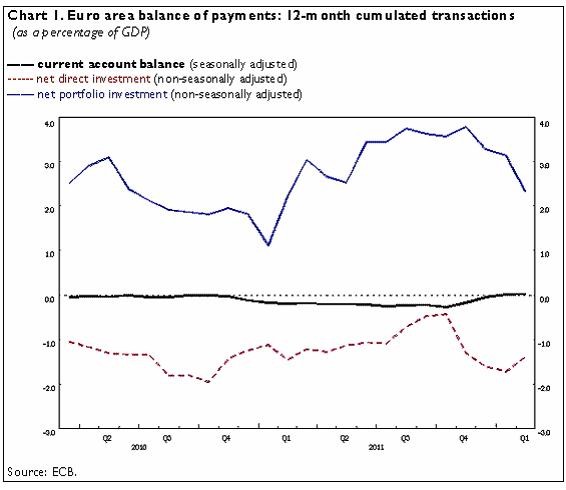

With UK residents investing in overseas assets at a slower rate compared to their foreign counterparts, there has also been a worsening of the International Investment Position (IIP). The UK’s IIP comprises of UK assets (UK residents’ holdings of overseas assets), and UK Liabilities (foreign owned assets in the UK); with the Net International Investment Position (NIIP) simply the difference between them. It broadly represents the accumulated deficits that the UK has run with the rest of the world and gives an indication of the degree of external balance that the UK experiences.

Since 1985, the UK’s NIIP has been on a downward trend. During the economic downturn, it briefly turned positive, reaching £88.9 billion (around 5.9% annual GDP), but has declined since and remained negative for 5 consecutive years, dropping to -£450.7 billion in Q3 2014 (around 25.5% of annual GDP).

With this in mind, the recent deterioration in the primary income balance is a particularly interesting development, in part because the positive income balance experienced prior to the economic downturn came in spite of a negative NIIP (UK liabilities exceeded UK assets). This suggests that UK investors had, on average, obtained a higher rate of return on assets held abroad compared to foreign rates of return UK assets.