Current Account Deficit Definition Components Causes

Post on: 29 Апрель, 2015 No Comment

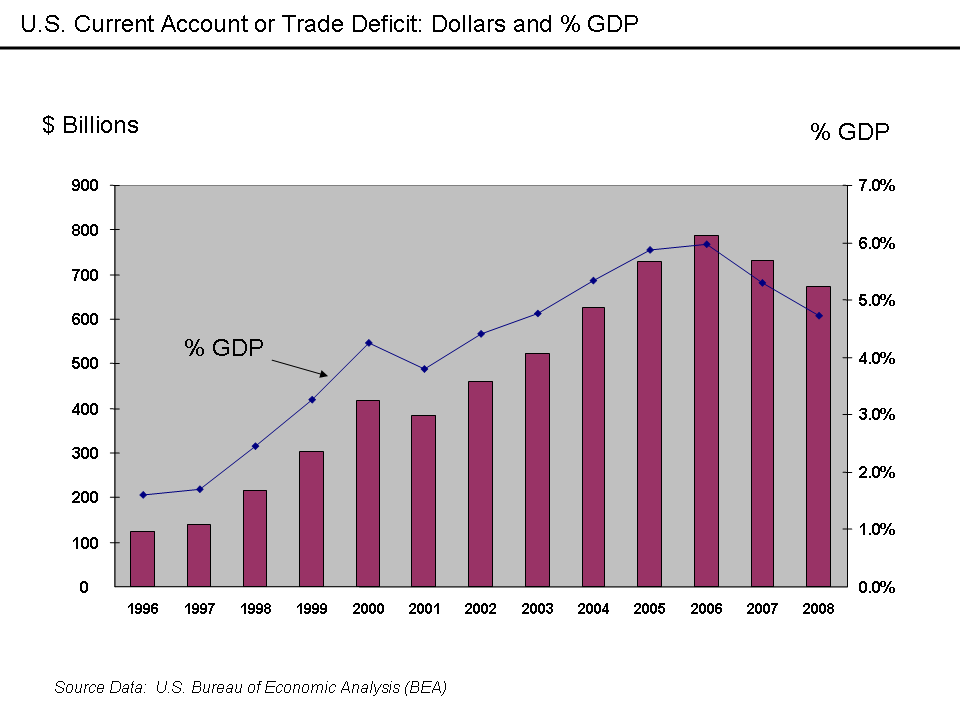

Definition: A current account deficit is when a country’s government, businesses and individuals import more goods, services and capital than they export. That’s because the current account measures trade, as well as international income. direct transfers of capital, and investment income made on assets, according to the Bureau of Economic Analysis .

When those within the country rely on foreigners for the capital to invest and spend, that creates a current account deficit. Depending on why the country is running the deficit, it could be a positive sign of growth, or it could be a negative sign that the country is a credit risk.

What Are the Components of a Current Account Deficit?

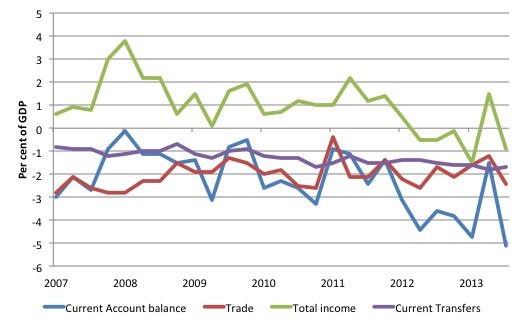

The largest component is the trade deficit. That’s when the country imports more goods and services than it exports. (Find out the Current U.S. Trade Deficit )

The second largest component is a deficit in net income. This is when foreign investment income exceeds the savings of the country’s residents. This foreign investment can help a country’s economy grow. However, if they don’t get a return on their investment in a reasonable amount of time, they will withdraw their funds, causing a panic. Net income is measured by payments made to foreigners in the form of dividends of domestic stocks. interest payments on bonds, and wages paid to foreigners working in the country.

The last component of the deficit is the smallest, but often the most hotly contested. These are direct transfers, which includes government grants to foreigners. It also includes any money sent back to their home countries by foreigners. (Source: Bureau of Economic Analysis, Current Account )

What Causes a Current Account Deficit?

Countries with current account deficits are usually big spenders that are considered very credit worthy. These countries’ businesses can’t borrow from their own residents, because they haven’t saved enough in local banks. Businesses in a country like this can’t expand unless they borrow from foreigners. That’s where the credit-worthiness comes into the picture. If a country has a lot of spendthrifts, it won’t find any other country to lend to it unless it is very wealthy and looks like it will pay back the loans.

Why would another country lend to such a spender, even if it is credit-worthy? Well, usually the lender country also exports a lot of goods and possibly even some services to the borrower. Therefore, the lender country can manufacture more goods and give jobs to more of its people by lending to the spendthrift country. Both countries benefit.

What Are the Consequences of the Current Account Deficit?

In the short-run, a current account deficit is mostly advantageous. Foreigners are willing to pump capital into a country to drive economic growth beyond what it could manage on its own.

However, in the long run, a current account deficit can sap economic vitality. Foreign investors may begin to question whether economic growth can provide an adequate return on their investment. Demand could weaken for the country’s assets, including the country’s government bonds. As foreign investors withdraw funds, bond yields will rise. The national currency will lose value relative to other currencies. This automatically lowers the value of the assets in the foreign investors’ currency, which is now getting stronger. This further depresses the demand for the country’s assets. This could lead to a tipping point, at which investors will dump the assets at any price.

The only saving grace is that the country’s holdings of foreign assets are denominated in foreign currency. As the value of its currency declines, the value of the foreign assets rise, thus further reducing the current account deficit. In addition, a lower currency value should increase exports, as the goods and services become more competitively priced. Similarly, demand for imports should lessen, as inflation on foreign goods and services sets in. These trends should eventually stabilize any current account deficit. Regardless of whether the current account deficit unwound via a disastrous currency crash or a slow, controlled decline, the consequences of a current account deficit would be the same — a lower standard of living for the country’s residents.

The best solution is for a country that’s running a current account deficit to wisely invest the foreign capital into building infrastructure, such as roads, education of its workers, and ports to boost international trade. The country’s leaders should work toward building a current account surplus as soon as possible. This means they should improve domestic productivity and the competitiveness of its local businesses. It should also seek to reduce imports of basic necessities, such as oil and food, by boosting that ability at home. Article updated September 29, 2014