Currency Hedged ETFs

Post on: 24 Май, 2015 No Comment

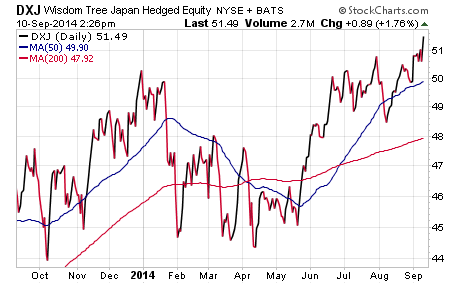

On February 4, Blackrock’s iShares launched three new currency hedged ETFs as investors have increasingly sought exposure to foreign equity markets whilst minimizing the exchange rate risk. According to ETF.com, net inflows into the WisdomTree Japan Hedged Equity Fund ( DXJ ) totaled $9.7 billion. making it the second most popular ETF in 2013, after the SPDR S&P 500 ETF (NYSEARCA:SPY ) which has seen annual net inflows totaling almost $16 billion. Despite the recent outflows in many equity funds, the DXJ ETF remains immensely popular, with year-to-date net inflows totaling $220 million.

An investment in an unhedged foreign equity ETF is for investors with a bullish outlook on foreign markets; but it is also effectively a short US dollar trade, because a strengthening dollar would reduce the returns of the ETF. Conversely, if the dollar depreciates against the underlying foreign currency, the unhedged ETF would outperform its hedged peer. Currency hedged ETFs attempt to match the local currency performance of the underlying index, which makes them particularly attractive with investors who expect the dollar will continue to strengthen.

iShares’ three new ETFs will track MSCI hedged equity indices which are already being tracked by ETFs offered by Deutsche Asset & Wealth Management’s db X-trackers series of equity funds. Whilst the new iShares ETFs will initially be very small, these funds will minimize costs by investing in a combination of their related unhedged parent iShares ETFs, which already track the underlying MSCI indices, and foreign currency forward contracts.

The new iShares ETFs are:

1. The iShares Currency Hedged MSCI Japan ETF ( HEWJ ). which will invest in the iShares MSCI Japan ETF (NYSEARCA:EWJ ). This ETF will compete directly against Deutsche’s db X-trackers MSCI Japan Hedged Equity Fund ( DBJP ). It would also compete against the more popular WisdomTree Japan Hedged Equity Fund. WisdomTree’s ETF tracks its own proprietary index of large-cap dividend paying Japanese companies, with a tilt towards companies with a more significant global revenue base. Net inflows into the (unhedged) iShares MSCI Japan ETF totaled $7.1 billion in 2013, making it the fourth most popular ETF in 2013, according to data from ETF.com.

2. The iShares Currency Hedged MSCI Germany ETF ( HEWG ). which will invest in the iShares MSCI Germany ETF (NYSEARCA:EWG ). This ETF will compete directly against Deutsche’s db X-trackers MSCI Germany Hedged Equity Fund ( DBGR ). The MSCI Germany Index tracks the performance of the 55 largest listed stocks in Germany, which covers around 85% of the German equity market.

3. The iShares Currency Hedged MSCI EAFE ETF ( HEFA ). which will invest in the iShares MSCI EAFE ETF (NYSEARCA:EFA ). EAFE stands for Europe, Australasia and the Far East, and the MSCI EAFE Index measures the performance of equity markets in twenty-one developed countries excluding the U.S. and Canada. This ETF will compete directly against Deutsche’s db X-trackers MSCI EAFE Hedged Equity Fund ( DBEF ). Net inflows into the (unhedged) iShares MSCI EAFE ETF totaled $6.3 billion in 2013, making it the seventh most popular ETF, according to data from ETF.com.

With iShares moving into the currency hedged equity ETF market and increasing net inflows into such funds, investors will likely benefit from increasing choice, competition and scale. On February 10, Deutsche Asset & Wealth Management announced that it would immediately reduce their investment advisory fee from 0.50% to 0.45%, for the db X-trackers MSCI Japan Hedged Equity Fund and the db X-trackers MSCI Germany Hedged Equity Fund. The db X-trackers MSCI EAFE Hedged Equity Fund will continue to offer a total expense ratio of 0.35%. Deutsche’s recent fee reduction leaves the db X-trackers series of ETFs with a slightly lower total expense ratio than all three of the corresponding new ETFs offered by iShares.

As the Federal Reserve starts to move away from its expansionary monetary policy, central banks in Europe and Japan are unlikely to do the same given the slower economic recovery and the persistent risk of deflation. With such a scenario, where the dollar is likely to strengthen against the euro and the yen, currency hedged equity ETFs are particularly attractive with investors who expect equity markets in Europe and Japan will outperform domestic markets in local currency terms.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.