Currency crisis is gathering storm

Post on: 16 Март, 2015 No Comment

Ed Harrison sent us a link to his latest post, and its a doozy.

Most of us in the US who are financially-minded have been sufficiently caught up with the three ring circus of market turmoil, seemingly-a-new-trick-every-day Fed and Treasury interventions, and continuing financial firm implosions that we havent looked up much to see what is happening in the wider world. Yes, the Baltic Dry Index is tanking, a bunch of Eurobanks nearly failed, but hey, that was two weeks ago, old news, Iceland collapsed, Argentina is on the ropes again (but that seems to happen every five years), South Korea is wobbly, and plunging commodity prices are giving exporting countries big shocks. But in the generally-provincial US, that amounts to background noise.

Your humble blogger has taken note of further worrisome developments, such as the dramatic fall in the Australian and New Zealand dollars (7% on Friday, ouch, on top of steep falls before that), the pound and the euro without being sure what to make of that. It appears to go beyond flight to quality; some of its is high demand for dollars to unwind dollar-related trades, and the Friday action in particular, with big moves in the dollar and an even bigger rise in the yen, versus huge bid-asked spreads in some other currencies, seemed to be a flight to liquidity. And then we have other countries looking shaky: the Baltics, Russia, a lot of Eastern Europe. and Latin America.

Harrison has focused on this constellation, and what he sees is not pretty :

In the last few weeks, the currency market is where the action has been.all of this is a prelude to some sort of currency crisis.

But, it is in commodity and emerging market currencies where the trouble is brewing. First, we saw a nightmarish plunge of the Australian and Kiwi Dollar as commodities plummeted. This all out assault on commodity and emerging market currencies then widened to include the Icelandic Krona, the South African Rand, the Polish Zloty, the South Korean Won, the Hungarian Forint, and the Mexican Peso amongst others.

This speaks to hot money fleeing emerging markets wholesale. today, I caught two interesting perspectives on this debacle that made me blanch. One was the cover story in the Economist .

A few months ago, many emerging economies hoped they could take mass casual leave from the credit crisis

This detachment has proved illusory. The IMF, which has shed staff this year because of the lack of custom, is now working overtime (see article). The governments of South Korea and Russia have shored up their banking systems. Their foreign-exchange reserves, $240 billion and $542 billion respectively, no longer look excessive. Even China’s economy is slowing more sharply than expected, growing by 9% in the year to the third quarter, its slowest rate in five years.

The emerging markets, which as the table shows enter the crisis from very different positions, are vulnerable to the financial crisis in at least three ways. Their exports of goods and services will suffer as the world economy slows. Their net imports of capital will also falter, forcing countries that live beyond their means to cut spending. And even some countries that live roughly within their means have gross liabilities to the rest of the world that are difficult to roll over. In this third group, the banks are short of dollars even if the country as a whole is not.

Yves here. The whole article is very much worth reading. Back to Harrison:

But, the analysis penned by Ambrose Evans-Pritchard is what really caught my eye. He makes the case for us to worry about a full-scale currency crisis worse than the 1931 currency crisis of the Great Depression. The link: Bank credit. You can think of Sweden in the Baltics, Austria in Central Europe, Spain in Latin America and you begin to picture the interconnectedness that will imperil Europes banking system much more than either Japans or Americas:

The financial crisis spreading like wildfire across the former Soviet bloc threatens to set off a second and more dangerous banking crisis in Western Europe, tipping the whole Continent into a fully-fledged economic slump

Experts fear the mayhem may soon trigger a chain reaction within the eurozone itself. The risk is a surge in capital flight from Austria – the country, as it happens, that set off the global banking collapse of May 1931 when Credit-Anstalt went down – and from a string of Club Med countries that rely on foreign funding to cover huge current account deficits.

The latest data from the Bank for International Settlements shows that Western European banks hold almost all the exposure to the emerging market bubble, now busting with spectacular effect.

They account for three-quarters of the total $4.7 trillion £2.96 trillion) in cross-border bank loans to Eastern Europe, Latin America and emerging Asia extended during the global credit boom – a sum that vastly exceeds the scale of both the US sub-prime and Alt-A debacles.

Europe has already had its first foretaste of what this may mean. Iceland’s demise has left them nursing likely losses of $74bn (£47bn). The Germans have lost $22bn.

Stephen Jen, currency chief at Morgan Stanley, says the emerging market crash is a vastly underestimated risk. It threatens to become “the second epicentre of the global financial crisis”, this time unfolding in Europe rather than America.

Austria’s bank exposure to emerging markets is equal to 85pc of GDP – with a heavy concentration in Hungary, Ukraine, and Serbia – all now queuing up (with Belarus) for rescue packages from the International Monetary Fund.

Exposure is 50pc of GDP for Switzerland, 25pc for Sweden, 24pc for the UK, and 23pc for Spain. The US figure is just 4pc. America is the staid old lady in this drama.

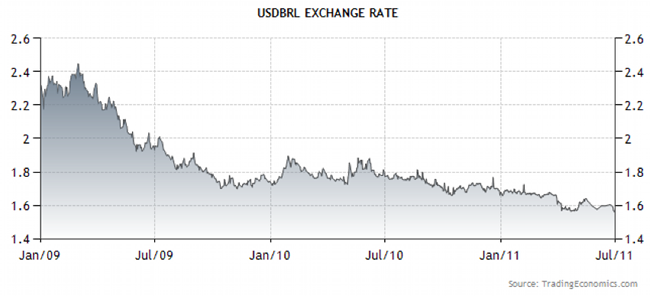

Amazingly, Spanish banks alone have lent $316bn to Latin America, almost twice the lending by all US banks combined ($172bn) to what was once the US backyard. Hence the growing doubts about the health of Spain’s financial system – already under stress from its own property crash – as Argentina spirals towards another default, and Brazil’s currency, bonds and stocks all go into freefall.

Broadly speaking, the US and Japan sat out the emerging market credit boom. The lending spree has been a European play – often using dollar balance sheets, adding another ugly twist as global “deleveraging” causes the dollar to rocket. Nowhere has this been more extreme than in the ex-Soviet bloc.

The region has borrowed $1.6 trillion in dollars, euros, and Swiss francs. A few dare-devil homeowners in Hungary and Latvia took out mortgages in Japanese yen. They have just suffered a 40pc rise in their debt since July. Nobody warned them what happens when the Japanese carry trade goes into brutal reverse, as it does when the cycle turns.

When the markets open on Monday, I expect the crisis in Emerging markets to take top priority. Iceland was the first victim of this crisis. The dreadful events there should be a warning to policy makers to address this now or else we could see some awful writedowns at European institutions in the very near future not to mention the potential economic destruction this turmoil could cause.

Yves again. Now the meltdown may resume Monday, but another scenario may play out. Recall 40 nations (EU and Asian) met in Beijing over the weekend, endorsing Nicolas Sarkozys call for a revamping of international banking regulations and more coordinated, tougher supervision. None of this directly addresses the looming currency crisis, but the markets sold off badly Friday, and if there is any stabilization or reversion on Monday, the backing away from the abyss plus the hope that the next phase of meetings, scheduled for November 15 in Washington DC, might ameliorate the situation, may put the currency crisis in abeyance for a couple of weeks.

And while we are on the topic of “stabilizing speculation,” China could also shift some of its portfolios from dollars to euros and pounds and Brazilian real and Australian dollars and Russian rubles. This is the time to diversify – not when the dollar is under pressure! Dollar strength amid US weakness strikes me as a growing problem.

*Rescue is the wrong word. Countries typically invests abroad to achieve their own policy goals — whether financial returns or strengthening their own ambitions to be a global financial center — not to “rescue” another country’s banks and help another country stabilize its markets. True rescues – investments with a high probability of a loss done to assure domestic financial stability – are generally done the government of the country that regulates the troubled financial institution. No country wants to “rescue” another countries’ banking system if that means losing money.

**The argument that China needs liquidity and only Treasuries are liquid doesn’t really work – China’s Treasury holdings are already so large that they are effectively illiquid, especially in the current market environment.

In this fraught environment, for China visibly (and the key is visibly) to start buying other currencies would have a disproportionate effect on psychology (and be rewarding to China, since it would profit from the rally it helped engineer). That might stem the panicked capital flight, and while it is probably insufficient to restore real stability, it could keep a necessary (and painful) revauluation/readjustment process from morphing into a rout.