Currency carry trades make comebac now

Post on: 16 Март, 2015 No Comment

JamesRamage

Stable currency prices have encouraged investors to revive a reliably profitable strategy known as the carry trade—but some wonder how long the good times for the strategy can endure.

Since early this year, many investors have put on so-called carry trades using major-market and, increasingly, emerging-market currencies as they search for investments offering yield amid generally low interest rates globally.

In carry trades, investors borrow in a currency from a country where interest rates are low, such as dollars and euros. They then exchange it for currency in a country where rates are higher, such as India or Turkey. By carrying the higher-yielding currency, they can collect the difference in interest rates.

Essentially, ‘carry’ has returned in the pursuit of yield, said Anjun Zhou, who is head of multiasset research and manages more than $30 billion at Mellon Capital Management Corp.

From February to late-June, a Deutsche Bank index tracking trades between lower-yielding developed-market currencies and higher-yielding developing-market currencies shows them generating returns over the three-month London interbank offered rate—a standard benchmark—of 7.7%. In 2013, by comparison, such trades lost 3.4%, according to the index.

Many investors prefer to put on carry strategies in stable environments, or when the values of the currencies involved move little—conditions that have prevailed since February in both developed and developing markets more so than at any time since May 2007, numbers compiled by RBC Capital Markets show.

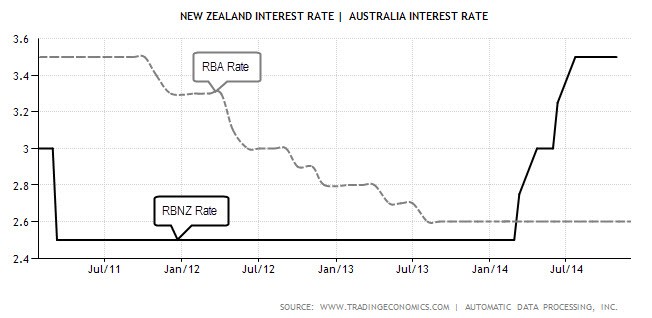

Mellon Capital Management’s developed-market carry strategies have been doing well for most of this year, Ms. Zhou said, particularly those where bearish euro and Swiss-franc positions are used to fund bullish Aussie- and New Zealand-dollar positions.

Against the greenback, the Australian and New Zealand dollars have gained 5.7% and 6.8%, respectively, for the year through late-June. Meanwhile, the U.S. dollar slipped 0.2% against the Swiss franc. The euro lost 0.7% versus the dollar over that span.

But short-term and longer-term risks loom, currency investors and analysts say, arising from flagging growth, geopolitical tensions and rising interest rates, making some investors leery of the carry trade’s longevity.

There’s a fear that it’s based on unsustainable market factors, like low interest rates and volatility in both [foreign exchange] and fixed income, said Steven Englander, head of developed-market foreign-exchange strategy at Citi.

Many investors expect interest rates to rise in the U.S. and U.K. and some say the valuations for emerging-market currencies aren’t as favorable for entering a carry position as they were a few months ago.

If you haven’t put on the ‘carry’ already, it’s become a harder trade, said Alan Ruskin, global head of developed market foreign-exchange strategy at Deutsche Bank.

The European Central Bank’s recent decision to lower interest rates has encouraged more carry-trade financing in euros versus dollars, Mr. Ruskin said. But if U.S. interest rates are expected to rise, Mr. Ruskin added, it is better to stay away from that trade.

Eric Stein, co-director of global income overseeing $12.8 billion in assets at Eaton Vance Management, likes certain carry trades. The firm has done well, he says, with its bullish carry positions against the dollar in the Indian rupee, Indonesian rupiah and Philippines peso. The dollar lost more than 3% against the rupee and peso, and fell 1% against the rupiah, from February through late-June.

But while those trades have benefited from a period of low volatility in developed-market interest rates and currencies, Mr. Stein said that can make investors too complacent.

Volatility may pick up significantly from its current extremely low levels Mr. Stein said, and that would lead to a selloff in many carry trades.

Write to James Ramage at james.ramage@wsj.com