Crude Oil Energy Roundup ETFs and Stocks in the sector

Post on: 18 Май, 2015 No Comment

The ongoing situations in Iraq and in the Ukraine have put crude oil front and center amongst the issues most important to investors these days. Whether they are bullish or bearish on the short-term outlook for the economy, just about every analyst is in agreement that a spike in crude oil prices would be a major drag on both the U.S. and global economy. And one has to think that the next spike in oil prices whether it hits in 2014 or not will pack more of a punch here at home than ever before. Because whether or not you noticed it while it was happening, the U.S. has become the largest crude oil producer on the planet.

But in the meantime, tailwinds support the sector in two key areas that should interest investors energy provides higher EPS forecasts than the S&P 500 while offering earnings valuations lower than the overall market.

Investors Flocking to Value and Growth

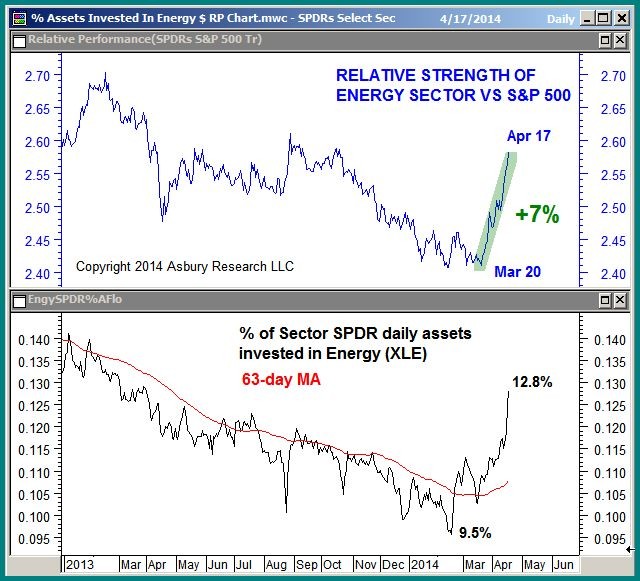

Crude oil's recent price rally has driven the energy sector to become the best performer of the year through the first six months; the largest energy sector ETF, the SPDR Energy Select Sector Fund (NYSE Arca: XLE ), is up over 15% this year. That outpaces what are some pretty strong returns from the healthcare (13%) and technology (10%) sectors through the first two quarters.

As one tends to see, investor dollars are following these returns money flows into the XLE are up a net of $3 billion so far this year. But value investors are attracted to the energy space too, and we need look no further than the XLE's holdings list to see why. Over 27% of the cap-weighted fund is invested in Exxon Mobil (NYSE: XOM ) and Chevron (NYSE: CVX ), the two largest U.S. oil conglomerates.

Owning Exxon or Chevron is a fine proxy for the entire energy space; they won't give you the volatility and therefore the increased upside potential of say a pure drilling stock or a refining stock, but both Dow components have their hands on the entire energy production cycle. They both pay dividend yields over 2.5%, have earnings valuations well below the S&P average, and make good core holdings in a lower-risk and/or income-seeking portfolio. And yet both XOM and CVX have slightly underperformed the 6.5% return of the S&P 500 this year.

What really highlights how well the smaller players have been doing is that XLE is up over 15% YTD while its two mega-holdings XOM and CVX aren't currently pulling their weight.

Oilfield Services Finally Getting Their Due

The real breakout stars of the year so far are the oilfield services stocks. Names like Schlumberger NV (NYSE: SLB ), Halliburton (NYSE: HAL ) and Baker Hughes (NYSE: BHI ) are all up over 30% this year, thanks to increased fracking business and the expectation that higher crude oil and natural gas prices will spur more drilling activity.

The services players have long been my favorite way to approach the energy space, and I'm glad to see what looks like an acceptance by investors for P/E expansion within the group. I feel more secure betting on the prospects of the picks and shovels suppliers than I do betting on the drilling success of player XYZ, because I have absolutely no idea how much oil is under my feet right now, or anywhere else in the world for that matter.

While there are several well-run companies within oilfield services, I would put my dollars to use in either Schlumberger (for their overall product portfolio and leading market share) or into Halliburton (for their geographic footprint and margin potential). Investors who want to diversify a bit more can check out the Market Vectors Oil Service ETF (NYSE Arca: OIH ), which is pretty top-heavy towards SLB and HAL but will serve to reduce some singular company risk.

On Picking Your Battles

In today's all-you-can-eat world of ETF choices, you can approach a given strategy in a number of different ways. If you really think crude oil is going to spike, you can always invest in the U.S. Commodity Oil Fund (NYSE Arca:USO ) or another non-equity proxy of the raw commodity itself. I would advise against it, just like I would advise against betting on the price activity for any individual commodity.

The most important decision is how much exposure you want to energy; while green options like wind and solar make great whiteboard sessions, it's the black stuff that still powers the world. And that's not going to change anytime soon. I recommend over-weighting the sector, or having at least 10% direct energy exposure.

The views and opinions expressed above are those of the author and do not necessarily reflect the views of CapitalCube .com, AnalytixInsight, Inc. its affiliates, or its employees.