Cross Currency Swaps And EUR

Post on: 27 Апрель, 2015 No Comment

Cross Currency Swap (XCCY in the following) spreads are by convention quoted on the currency side against USD Libor flat: USD Libor vs. Foreign Currency Libor +/- a spread. The spread can be a penalty or a premium. This credit risk premium has to be explained.

If a U.S. company has issued a loan in euros, it will exchange principal and coupons payments in EUR for principal and coupons payments in USD. If the cross currency basis is negative, it will have to pay Libor but will receive Euribor MINUS the basis.

Investors sometimes mention corporate supply and hedging activity as a potential driver of the XCCY basis. If the corporate issuance in EUR is high and most of it is swapped in USD, there could be a premium or penalty to exchange EUR payments in USD payments. Corporate bond issuance may explain small moves, but only in normal times.

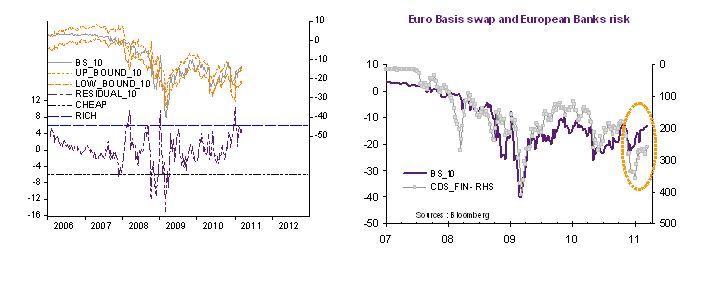

It cannot account for the huge swings of the XCCY basis over the last few years. The main factor behind changes in the XCCY basis is the USD funding needs by non-U.S. banks. Any asset/liability currency mismatch can increase the penalty, — lower rate received in swapping EUR for USD.

An excess demand of USD by non-U.S. banks drove the EUR/USD XCCY basis down sharply during the dollar shortage crisis of 2008. The withdrawal from European banks of U.S. Money Market funds in Fall 2011 also explained the decline of XCCY basis. The basis of XCCY is, above all, a mater of relative creditworthiness of banks across different countries. The embedded risk premium reflects mostly banks’ credit risk.

The level of XCCY spread is not related to the risk-free interest rate differential. The non-arbitrage condition suggests that the XCCY swap basis is, at inception, equal to the banks’ risk premium spread. In other words, monetary policy moves are neutral on cross currency basis as long as they don’t affect the credit risk of banking institutions.

For that reason, there should be no link between the EUR/USD and the XCCY basis spread, but as can be seen in the charts below, there is. The only rationale for this is the existence of a common driver: uncertainty on the joint crisis between sovereigns and banks .

The focus of the euro crisis is becoming more and more about the links between banks’ capital requirements and sovereign debt, which explains why the correlation between core/non-core sovereign spreads and the cross currency basis is negative (see chart below).

This the only reason why the EUR/USD remains correlated to FX cross currency swap spreads.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.