Credit Report Companies Inaccuracies History Scores

Post on: 16 Март, 2015 No Comment

A credit report is a document compiled by credit reporting agencies that describes your financial history and your ability to be responsible with money.

It includes information about loans you have (and ones you have paid off), credit card accounts. credit payment history, bankruptcy and any other major financial matters.

Credit reports exist so that potential lenders to you – a car dealership, a mortgage lender, a credit card company or even a jewelry store – can evaluate their risk of lending you money.

Likewise, insurance and utility companies can use your credit information to gauge whether you are responsible and trustworthy.

Credit reports were created more than 100 years ago as better transportation allowed Americans to sprawl across the country into areas where they were new to established banks and businesses.

They started as informal records of peoples reliability, only taking on their modern form in the 1970s. At this point, computers enabled them to become unified across the country, and new laws regulated the type of information included.

Today, credit reports are strictly factual, making them more reliable and useful.

If your credit report is damaged, it may be because you have more debt than you can handle .

Whats in a Credit Report?

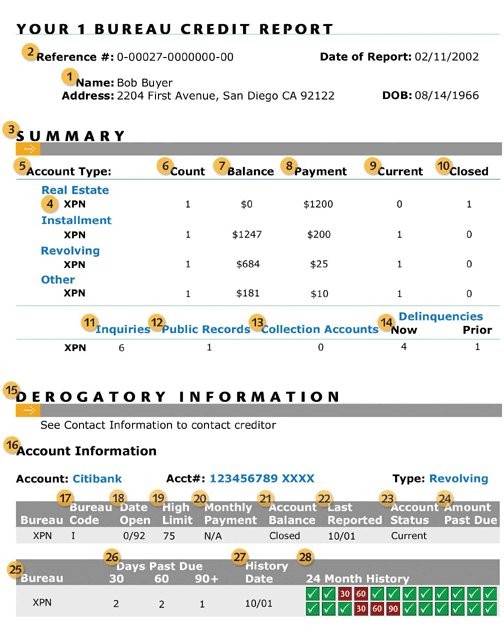

Your credit report contains recent and current information pertaining to your financial standing. This information is aggregated by three major credit bureaus: Equifax, Experian and TransUnion .

Bits and pieces of your credit history may vary slightly among the three companies, but the broad picture should be relatively consistent. Each credit report has four parts – identity, credit information, public records and recent inquiries.

Heres how they break down:

- Identity. You are identified by name, address, date of birth, social security number and employment information.

- Credit Information. This includes detailed information about any credit accounts (credit cards, mortgages and loans). The report states when each account was created, your credit limit or loan total, co-signer information and a two-year history of payments. All or part of your account numbers is attached. Any negative information in this section typically remains on the credit report for seven years.

- Public Records. This information is generated from transactions recorded by local, state and federal governments. It can include property purchases, bankruptcies, foreclosures, court judgments, divorces and liens. A bankruptcy stays on your credit report for a decade, and criminal convictions may remain on it indefinitely.

- Recent Inquiries :This is a list of companies and individuals who received a copy of the report in the past two years.

Credit Reporting Companies

Each credit reporting agency reports whatever information is given to them. Some companies do not report to every agency, which may create inconsistencies among your three credit reports. Minor inconsistencies should not have a large effect on your credit report or credit score.

In general, the same credit history will be shown on all three reports. Theyll even take a similar form. All your credit reports have the same basic sections for your identifying information, public record history, credit information and payment history, and recent requests for your credit report.

The national bureaus — Equifax, Experian and TransUnion —also determine your credit score. Each bureau uses a different formula, but all three were developed by Fair Isaac Corporation to be as consistent as possible.

Despite consistent credit reports, you may still have three different credit scores.Your scores are all your true scores and should be relatively close to each other.

How to Fix an Inaccurate Credit Report

Know that by law you have a right to see your credit report. You can request a copy from each of the three national credit reporting companies. All three companies are required to provide this report free of charge once every 12 months upon request. (They can charge you for extra requests.)

Government agencies encourage you to request copies periodically and check for inaccurate or outdated information. While credit bureaus make every effort to report accurate and up-to-date information, your reports may have misinformation and are subject to human error.

If you notice wrong information in any one of your credit reports, you can start a dispute with the bureau which made the error.

When you start a dispute, contact the bureau reporting the error as well as the company you believe supplied the inaccurate data. For example, if you notice that your Equifax report has an error about your credit card payments, contact both Equifax and the credit card company.

To contact the credit bureau, follow the instructions listed on your credit report, or visit the bureaus dispute page.

Start a dispute with:

The best way to contact the company that reported an error is to write a letter and send it to the address listed on your last bill or statement.

When contacting both the reporting agency and your creditor, youll need to give identifying information like your name, address and account number.

Identify each item you dispute, explain your position and request that the items be deleted or corrected. Provide copies of documents that support your claim, such as credit card statements or court documents, and include a copy of your credit report with the disputed items circled or highlighted.

The credit reporting agency must contact your creditor within 30 to 45 days after you file a dispute. If your creditor cannot find a record of the information in question, the credit bureau will delete it from your report.

If the credit bureau finds that the information is incomplete or inaccurate, it will delete wrong information and add missing information. In this case, the credit bureau typically mails you an updated copy of your report.

Once your report is updated, the agency should send the new information to the other two national credit reporting agencies. However, it is up to you to confirm that all three of your credit reports are accurate.

At your request, the agency can also send a notice of correction to any creditor that viewed your report in the last six months.

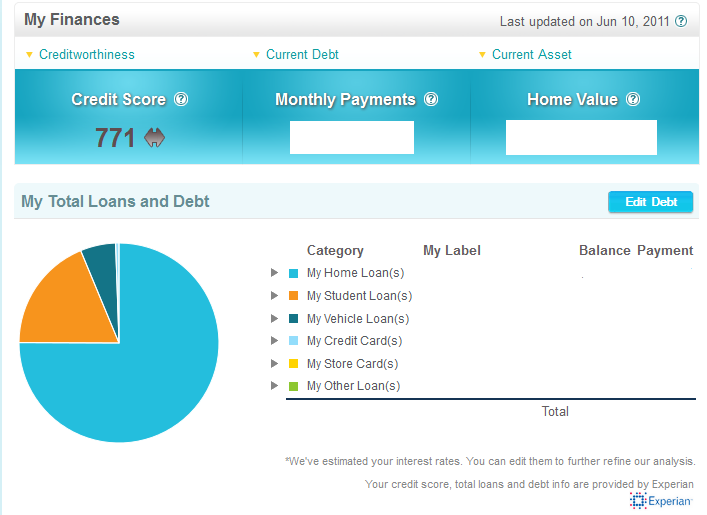

Credit Report vs. Credit Score

Your credit report is a brief history of your debts and credit accounts, as well as relevant data like bankruptcy information.

Your credit score, on the other hand, is a number ranging from 300 to 850. It provides no context or background information but it quickly summarizes your credit standing. A higher score reflects a better credit history, showing lenders you are a good investment and are most likely make payments on time.

While you can obtain a free annual copy of your credit report, you typically have to pay for your credit score.

Who Sees a Credit Report?

Because your credit report contains personal information, only select businesses, agencies and people can obtain copies legally. Credit bureaus can only provide copies of credit reports to those with a valid need to see credit history.

Access is limited to:

- Lenders and potential lenders

- Utility companies that provide or may provide service

- Insurance companies that supplied or may supply insurance

- Government agencies reviewing eligibility for government benefits

- Employers or prospective employers, but only with permission from the employee

- Others with a legitimate need, such as banks providing checking accounts or potential landlords

Lenders may use credit reports to decide if they should lend to you and, if so, at what interest rate. Reports are similarly used by insurance and utility companies and by potential employers to judge your level of financial responsibility.

Along with your full credit report, potential lenders typically also view your credit score. The number can put you into one of a number of categories. In the case of an insurance company, those categories can shape your monthly payments. In the case of a utility company, they can determine how much you may have to pay as a security deposit.

There is no defined boundary between a good credit score and a bad one. Potential creditors and lenders decide their own minimum requirements. If you have a lower score, you may be subject to higher interest rates.

History of the Credit Report

Credit reporting is a century-old practice that started unofficially in the late 1800s and early 1900s. At first, people around the country conducted informal surveys with retailers and bankers, taking notes about the reliability of customers.

Most of these early credit reporters were specific to certain industries, like banking or retail, and the files they created were subjective. When a customer sought a new line of credit, the retailer or banker called the local credit reporter to review notes on the customer. From this, the retailer determined whether to grant the customer a line of credit.

Over several decades, credit reporting became a more formal process. Rather than including subjective statements about customers, reports included facts about payment history and employment details. They also encompassed wider geographic areas. Credit reporting was no longer specific to one city but spanned entire regions.

In the 1970s, two things changed the makeup of credit reports: computers and new legislation.

Congress voted in the Fair Credit Reporting Act (FCRA) effective in 1970. It was the first set of regulations for credit reporting.

The FCRA, which is in place today with only a few minor changes, dictates what the credit report includes and who can receive a copy.

Around the same time the FCRA was being implemented, computers were introduced into the American business world. They made it possible for your reports to include information from creditors across the country. (They also made it possible for creditors around the country to get your reports.)

Since, credit reports have adjusted with the times, but their contents remain constant, as does the regulation of them.

At its core, a credit report is still a personal document that tells potential creditors how responsible you are with money and with credit.