Creative Accounting When It s Too Good To Be True

Post on: 28 Апрель, 2015 No Comment

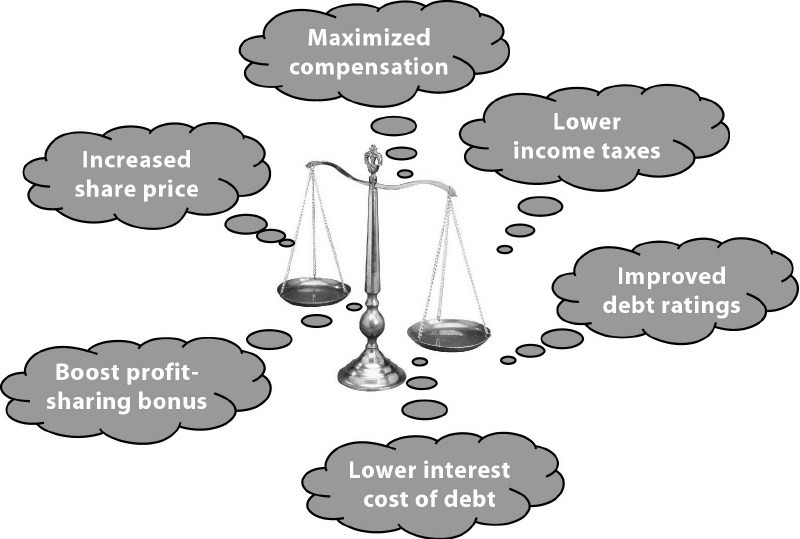

Accounting practices in the United States have matured over the years, but there are still plenty of ways that companies can disguise their financial results. You can spot these practices in instances when financial statements are depicting excessively positive earnings in combination with negative cash flow or in under-regulated micro-cap stocks or restatements in larger companies.

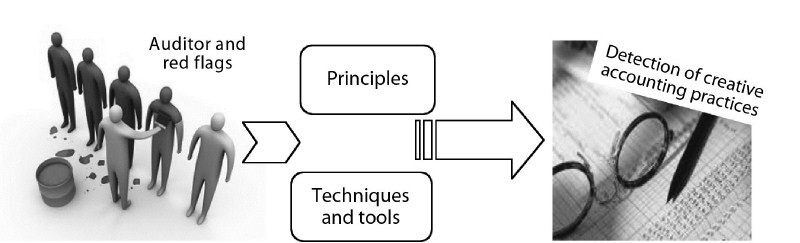

In this article, we’ll explore why companies utilize creative accounting and how it can be detected by looking at a company’s financial statements and disclosures. Investors armed with this information will be able to steer clear of potential problems and – on the other side – find opportunities for investment in misunderstood companies. (To learn about the essentials behind creating an income statement, read Find Investment Quality In The Income Statement .)

Premature or Fictitious Revenues

One of the most common techniques used by public companies looking to artificially boost their income is to prematurely recognize revenues or simply fabricate them altogether. Exactly when revenues should be recognized varies greatly, but in the end, the point where payment and the delivery of goods are guaranteed is the defining criteria of when revenues should be realized.

- Look at the Revenue Recognition

The easiest way to detect premature revenues is to look at a company’s revenue recognition policies found in their 10-Q or 10-K financial statements filed with the U.S. Securities and Exchange Commission (SEC). Investors should carefully read these footnotes and look for the ways in which companies recognize their revenues and note any recent changes in the policies. If revenues have increased from a previous period, compare the recognition policies to ensure that the increase is actually due to enhanced business operations.

Since revenues that are prematurely recognized, and in some instances artificially created, are subject to collection uncertainty, accounts receivable will typically increase on the company’s balance sheet, while its uncollectable charge will gradually increase as well. Investors that see a liberal revenue recognition policy may want to check for unusual increases in accounts receivable to see if there’s a problem.

In many cases, companies that fabricate revenues will not have the manufacturing capacity to justify the sales that they record. As a result, investors can check the manufacturing capacity in order to identify possible fraud. The process of checking this will vary by industry and may include looking at revenue per employee, revenue per property or a consideration of total assets. These figures should be compared with other similar firms in the competing industry. (Footnotes often serve as a means to properly interpret financial results. For more information refer to Footnotes: Start Reading The Fine Print . )

Common Types of Revenue Manipulation

- Side Letters

Letters outside of normal corporate reporting channels between the company and its customers which may include misleading conditions such as liberal rights of return, rights to cancel orders at any time, contingencies that could nullify the sale, or even total absolution of payment in some cases.

Sometimes sales transactions will occur as a result of an existing arrangement with a customer that may not have the same recurring self-financed prospects of an unrelated party transaction.

Contracts may be accounted for either by using the percentage-of-completion or the completed-contract method. The former can be easily abused by companies by aggressively estimating their progress.

Channel stuffing occurs when a company ships products to distributors who are encouraged to buy under a short-term offer of deep discounts. Effectively, these are not a proper indicator of future sales and can be considered unsustainable.

Pro-Forma Earnings, Classification and Disclosure

Non-GAAP Manipulation

Many companies issue pro-forma income statements, in addition to GAAP -adjusted statements, as a way to provide a better understanding of changes in operating results. In legitimate cases, this means taking out one-time charges to smooth results. However, companies can also manipulate their financial results under the guise of pro-forma income statements. (To learn how to interpret financial results check out Understanding Pro-Forma Earnings .)

Pro-forma income statements are financial results that do not adhere to GAAP; these modified statements are legitimately used by companies to smooth earnings by removing one-time items, thus providing investors with a picture which reflects the usually business operations of the firm. For example, a one-time expense to fix a building as a result of weather damage can be rightfully viewed as an item which does not contribute to the representative valuation of the company.

Despite the positive reasoning behind these measures, there are many ways in which pro-forma earnings can be manipulated. For example, companies can selectively add back a variety of adjustments beyond interest, taxes, depreciation and amortization. such as non-recurring, non-cash and non-operating items. As a result, it is important for investors to always remember to look at GAAP earnings for a clearer picture of true financial performance.

- Operating income is not strictly defined under the GAAP because classification lines are often subject to discretion — items that are classified into this element can be selectively chosen by management. For example, non-recurring income such as special charges, shareholder class action settlements, and unusual events may be included or omitted within the metric to present a value which is appeasing to shareholders.

- Sales and gross profits can also be manipulated in many ways within the constraints of the GAAP. For example, companies can classify sales as either the gross amount billed to a customer or expected amount to be received. Furthermore, sales can also depend on whether or not shipping and handling is treated as a part of revenues. Finally, gross margins can be manipulated by moving certain expenses between SG&A and other costs of sales.

In the end, these changes do not impact net income like fictitious sales figures, but they do create artificially higher or lower income statement metrics that can mislead shareholders. As a result, it is very important for investors to look closely at a company’s GAAP results in addition to pro-forma results, in addition to closely looking at each line item.

Conclusion

There are many ways in which public companies can creatively manipulate their income statesmen t, from modifying revenues themselves, to creatively classifying income, to utilizing misleading pro-forma income statements. While these practices are often legitimate, as long as they are not abused, investors should dig a little deeper for some real peace of mind. (For more information refer to Uncovering A Career In Forensic Accounting. )