Create a Permanent Portfolio using ClosedEnd Funds

Post on: 26 Апрель, 2015 No Comment

Over thirty years ago, Harry Browne recommended that his newsletter clients invest in a Permanent portfolio whose holdings stay constant, except for annual rebalancing.

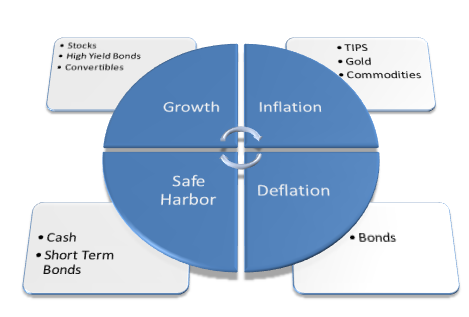

Browne suggested a group of asset classes that are relatively uncorrelated, so that when one asset classes was doing poorly, another may be holding its value or even appreciating in value. Browne’s original four asset classes were- equities, long term treasury bonds, gold and treasury bills, with a 25% allocation to each.

A mutual fund- Permanent Portfolio Fund (ticker: PRPFX ) was started in 1982 that uses a variation on Browne’s original idea. After getting off to a slow start its first few years, the fund has done well over time, and has earned a 10% return over the last ten years, and 9% over the last five years. It has earned a 5-star Morningstar rating and has attracted over $6 Billion in assets.

The current allocations for PRPFX are:

25% Gold and silver

35% US Treasuries

15% Aggressive growth equities

15% Real-estate and natural resource stocks

10% Swiss-franc denominated assets.

There have been a number of ETF porfolios published that attempt to replicate the Permanent Portfolio Fund. I’ve decide to publish a variation on this portfolio that uses only closed-end funds.

I tried to restrict the selected funds to those selling at a discount to NAV. The idea is that the asset class allocation is permanent, but the portfolio itself need not be permanent. If a particular CEF holding loses its discount and develops a premium over nav (or a greatly reduced discount), it can be swapped with another fund with a more attractive discount. This should add alpha over time.

Here is a list of closed-end funds that can be used. Discounts are as of July 23.

1) 25% Gold and silver

-*ASA discount to NAV= -8.99%

(Central Fund of Canada (ticker:CEF ) is currently at a 6% premium above NAV which is below the 52 week average premium of 9%. It is a good alternative to ASA and also has exposure to silver. It is attractively priced when the premium goes below 5%.)

2) 35% US Treasuries

BKT discount to NAV= -10.64%

3) 15% Aggressive Growth

-*ADX discount to NAV= -16.29%

-*TY discount to NAV= -16.03%

-*RMT discount to NAV= -16.42

4) 15% Real estate and Natural Resources

-*RNP discount to NAV= -18.19%

-*DRP discount to NAV= -15.17%

Aside from the attractive discounts to NAV, some of the holdings listed above are owned by CEF activists who are attempting to narrow the fund discounts (e.g. DRP, SWZ).

Full disclosure: Long some of the funds listed above.