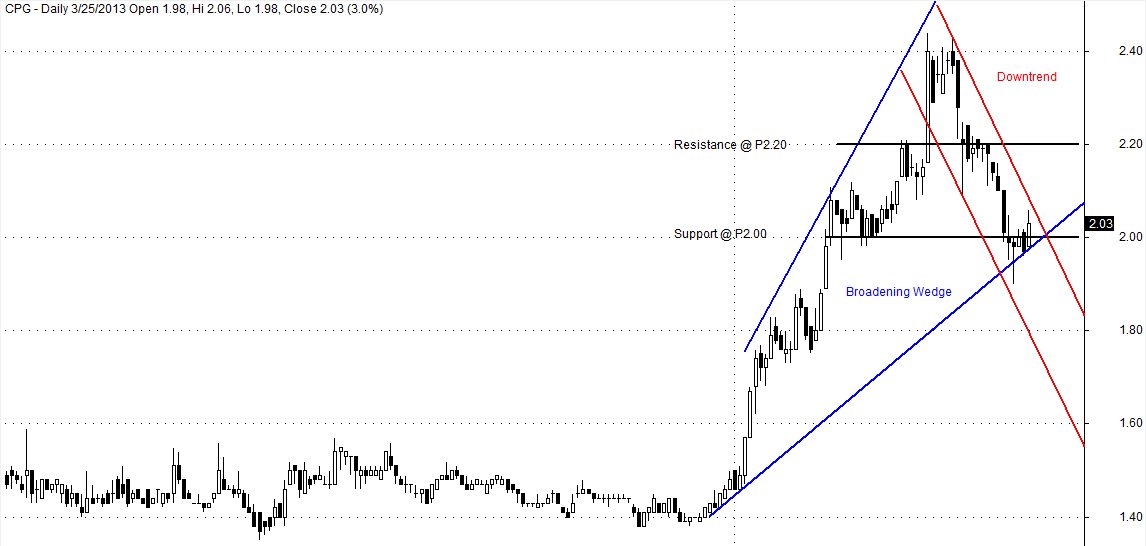

CPG Stock

Post on: 4 Май, 2015 No Comment

Get TheStreet Quant Ratings’ exclusive 5-page report for ( CLMT ) now.

Editor’s Note: Any reference to TheStreet Ratings and its underlying recommendation does not reflect the opinion of TheStreet, Inc. or any of its contributors including Jim Cramer or Stephanie Link.

TheStreet Ratings’ stock model projects a stock’s total return potential over a 12-month period including both price appreciation and dividends. Our Buy, Hold or Sell ratings designate how we expect these stocks to perform against a general benchmark of the equities market and interest rates.

While plenty of high-yield opportunities exist, investors must always consider the safety of their dividend and the total return potential of their investment. It is not uncommon for a struggling company to suspend high-yielding dividends which could subsequently result in precipitous share price declines.

TheStreet Ratings’ stock rating model views dividends favorably, but not so much that other factors are disregarded. Our model gauges the relationship between risk and reward in several ways, including: the pricing drawdown as compared to potential profit volatility, i.e. how much one is willing to risk in order to earn profits?; the level of acceptable volatility for highly performing stocks; the current valuation as compared to projected earnings growth; and the financial strength of the underlying company as compared to its stock’s valuation as compared to its stock’s performance.

These and many more derived observations are then combined, ranked, weighted, and scenario-tested to create a more complete analysis. The result is a systematic and disciplined method of selecting stocks. As always, stock ratings should not be treated as gospel — rather, use them as a starting point for your own research.

The following pages contain our analysis of 3 stocks with substantial yields, that ultimately, we have rated Hold.

Dividend Yield: 8.90%

Crescent Point Energy (NYSE: CPG ) shares currently have a dividend yield of 8.90%.

Crescent Point Energy Corp. is engaged in the acquisition, exploration, development, and production of oil and natural gas properties in Western Canada and the United States. The company has a P/E ratio of 31.02.

The average volume for Crescent Point Energy has been 340,300 shares per day over the past 30 days. Crescent Point Energy has a market cap of $11.0 billion and is part of the energy industry. Shares are up 10% year-to-date as of the close of trading on Tuesday.

STOCKS TO BUY: TheStreet Quant Ratings has identified a handful of stocks that can potentially TRIPLE in the next 12 months. Learn more.

TheStreet Ratings rates Crescent Point Energy as a hold. The company’s strengths can be seen in multiple areas, such as its robust revenue growth, compelling growth in net income and expanding profit margins. However, as a counter to these strengths, we find that the stock has had a generally disappointing performance in the past year.

Highlights from the ratings report include:

- CPG’s very impressive revenue growth greatly exceeded the industry average of 20.1%. Since the same quarter one year prior, revenues leaped by 66.8%. Growth in the company’s revenue appears to have helped boost the earnings per share.

- The gross profit margin for CRESCENT POINT ENERGY CORP is currently very high, coming in at 82.16%. It has increased from the same quarter the previous year. Along with this, the net profit margin of 23.04% significantly outperformed against the industry average.

- CPG’s debt-to-equity ratio is very low at 0.25 and is currently below that of the industry average, implying that there has been very successful management of debt levels. Even though the company has a strong debt-to-equity ratio, the quick ratio of 0.43 is very weak and demonstrates a lack of ability to pay short-term obligations.

- The return on equity has improved slightly when compared to the same quarter one year prior. This can be construed as a modest strength in the organization. Compared to other companies in the Oil, Gas & Consumable Fuels industry and the overall market, CRESCENT POINT ENERGY CORP’s return on equity significantly trails that of both the industry average and the S&P 500.

- CPG’s stock share price has done very poorly compared to where it was a year ago: Despite any rallies, the net result is that it is down by 29.37%, which is also worse that the performance of the S&P 500 Index. Investors have so far failed to pay much attention to the earnings improvements the company has managed to achieve over the last quarter. Although its share price is down sharply from a year ago, do not assume that it can now be tagged as cheap and attractive. The reality is that, based on its current price in relation to its earnings, CPG is still more expensive than most of the other companies in its industry.

- You can view the full Crescent Point Energy Ratings Report .

STOCKS TO BUY: TheStreet Quant Ratings has identified a handful of stocks that can potentially TRIPLE in the next 12 months. Learn more.

1 of 3