Covered Calls Learn How to Trade Stock and Options the Right Way

Post on: 16 Март, 2015 No Comment

Covered Calls are one of the simplest and most effective strategies in options trading. The art and science of selling calls against stock involves understanding the true risks of the trade, as well as knowing what kind of outcomes you can have in the trade.

Covered calls, also known as buy-writes. give you a way to reduce volatility in your portfolio as well as give you a better basis in your trades but youll need to put the work in to figure out how to select the best stocks and the best options for this strategy.

New to covered calls? This guide will get you up and running in under 15 minutes.

What are covered calls?

Covered calls are a combination of a stock and option position.

Specifically, it is long stock with a call sold against the stock, which covers the position. Covered calls are bullish on the stock and bearish volatility.

Covered calls are a net option-selling position. This means you are assuming some risk in exchange for the premium available in the options market. This risk is that your long stock will be taken away from you by the call option buyer this is known as assignment risk.

Covered calls are unlimited-risk, limited-reward. The unlimited risk is similar to owning stock, and the limited reward comes from the short call premium and the transactional gains you may have. In exchange for limiting your risk, you have better odds of profitability than a simple long stock play.

Construction of a Covered Call

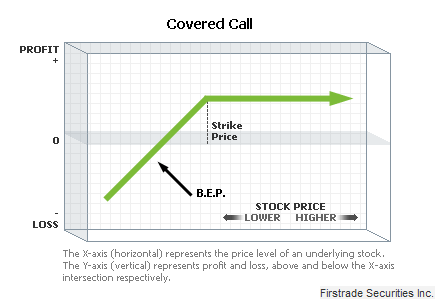

The best way for new traders to truly understand covered calls is visually.

Remember, in the options market you can both get long options and short options each with its own unique risk characteristic.

Lets start off with 100 shares of stock this is pretty easy to represent. When a stock goes up you make money, and when it goes down you lose money. This is also on a 100:1 basis if a stock goes up $1, you make $100. In options terms, this gives us a delta of 100.

The next part is the short call option that covers the stock. Because this is an option, it can get a little tricky because the delta (directional exposure) can change. But at options expiration it has very clear risk parameters.

At expiration, if the short option is out of the money, it will have a delta of 0. If the option is in the money, it will have behave just like 100 shares of short stock.

The cool thing about combinations in the options market is that they have aggregate risk that means you just have to add them together. Heres what a covered call looks like total.

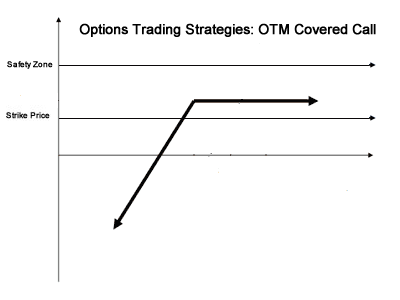

At expiration, if the stock is under the strike price, the position will behave like stock. And if the stock is above the strike price, the position will have no directional exposure.

But wait not so fast! This is what the risk looks like at expiration. But what about when there is time left? Well that time means more risk, and that means more extrinsic value in the short option. So your actual risk when you put on a trade will look something like this:

3 Major Covered Call Calculations

There are 2 big numbers you have to know if you get into a covered call position.

Keep in mind, there are a few different ways to do these calculations, but this is the best way because the formulas are inclusive for both in the money and out of the money options, and is the simplest to explain to new option traders.

The first is your basis. which is your breakeven level at expiration. This is a little complex, because it depends on whether the option you are selling is In the Money or Out of The Money

The main difference here is whether you are looking at the option strike or the cost of your stock trade as your transactional basis. There are simpler ways to calculate this, but this is the best for new option traders.

The next calculation is the max return. Here we are looking at the maximum possible reward you can get out of the position.

Keep this in mind if you are using an in-the-money option, the transactional value will be negative, but will be compensated for the total value amount. This is a workaround to deal with all options, regardless of moneyness.

To calculate the return on basis. simply divide the maximum return by the basis previously calculated. This will give you a percentage that will show you the maximum gains you can get in the position.