Covered Call Options Trading Strategy

Post on: 16 Март, 2015 No Comment

Covered Call Writing Using TradingTrainer.com’s BlackBox Software

How does a covered call work? If you are long the stock (i.e. you are the owner of the shares), you can sell one

Covered Call Writing Demystified

A Novice’s Guide to Writing Covered Call Options Using the Internet

Anxiety Free Option Investing: Using Covered Spreads as a Hedge vs. Downside Risk

covered call contract for every 100 shares of stock you own.

Why do a covered call? A covered call can work with you to enhance profitability of stock ownership and to provide limited downside protection against adverse stock movement.

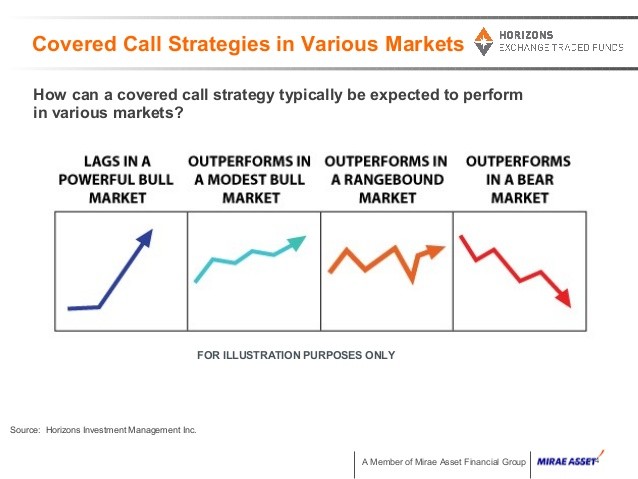

Trading Bias When you are neutral to slightly bullish on a stock, the covered call is an excellent choice.

When to Use the Covered Call Strategy When you feel the stock will trade up slightly or in a tight range for a period of time and you plan on holding the stock for longer term.

How can you profit with a covered call option strategy? If the stock rises, profit will be enhanced by premium received. If stock stagnates, you will profit from premium received from call sale.

How can you lose when writing a covered call? If the stock trades lower than the point defined by your purchase price minus the premium received from the sale of the call, you will lose dollar for dollar. Call premium received will act as an offset to the loss in the stock.

Key Concepts If stock trades up aggressively, you will only profit up to a stock price defined by the strike price plus option price. If the stock continues higher above that point (breakeven), you will incur lost opportunity. Further, if stock closes above strike price, stock will be called away unless necessary adjustment is made. Philosophically identical to the Sell — Write position except in opposite direction. Time decay helps the position.

To summarize what a covered call writing will entail:

If you currently own stocks. or if you day trade or swing trade. then you would be interested in the covered call writing strategy.

It works like this:

1. Buy a stock that is trending flat or increasing in value.

2. Sell a call option on the stock you own and collect a premium.

3a. If you are called out, you liquidate your position and keep the profit.

3b. If you’re not called out, you keep your premium and repeat the process next month.

Pretty simple, right? But get this: If you master the art of covered call writing, you can. MAKE 3% TO 15% EVERY MONTH !

Many investors are ecstatic if they make 20% ROI in a year. Imagine if you could make that much in just one month. And imagine if you could continue compounding your profits, making anywhere from 3% to 15% (or more) every single month. Because it’s entirely possible writing covered calls.

THE STRATEGY REVEALED

Option trading coach and expert A.J. Brown (who has made well over $1 million by trading options) has created a brand new SYSTEM that makes writing covered calls easy. In fact, he’s just created a series of videos showing you exactly how he writes covered calls for profit.

And you can watch the videos for free — click here.

VIDEOS OF A REAL LIFE TRADE

These videos show how A.J. picks a stock to purchase. how he sells the call option and collects the premium. and how he unwinds the trade.

The best part: This process is so simple that just about anybody can do it.