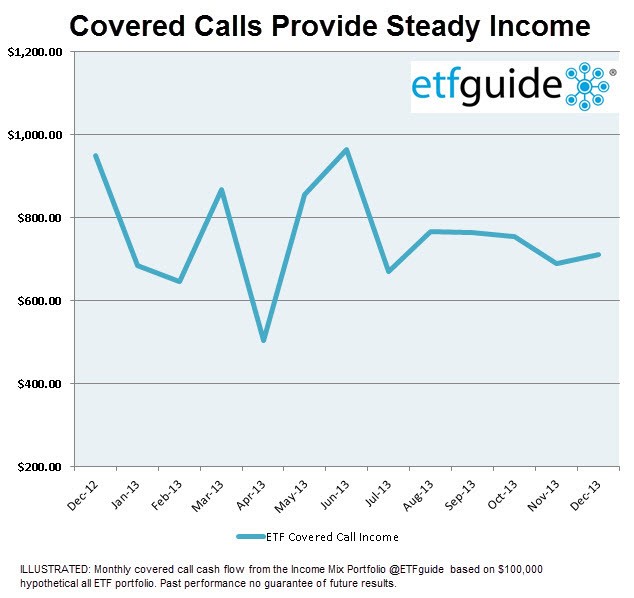

Covered Call ETFs

Post on: 16 Март, 2015 No Comment

There are two main types of options: calls and puts. The investor can either buy or sell the option. The person who purchases the option has the right to either buy (call option) or sell (put option) a specific stock or index at a specified price and a specified number of shares before the option’s expiration date. The option purchaser can exercise the option at anytime prior to the market’s close on the third Friday of a month. The longer the time (days, weeks, or months) until the option expires, the more the purchaser (option buyer) will pay.

There are three main reasons investors deal in options: [1] to hedge a position (buy put options so a position does not have to be sold), [2] to speculative, or [3] to generate current income (writing options and selling them to option buyers). Most individual investors either use options as a speculative tool or to generate current income by using covered calls (“covered” because investor owns underlying security). A speculative example is shown in the next paragraph.

For example. if Apple is selling for $600 a share and the stock increases $60 a share during the next four months, the Apple stock owner will see a 10% gain. If a different investor buys one Apple contract (note. each contract represents 100 shares) with a striking (exercise) price of $600, for, say $20, a $60 increase means the option investor will make at least 200% because the option will be worth at least $60 (more if there weeks or months remaining before the option expires).

The idea behind speculative option plays is straightforward: put up $1 to control something worth $10-$20 dollars for a short period of time, generally weeks or months. As you can see from this simplistic example, the leverage is frequently 10-or-20-to-1. The downside is

70% of all options expire worthless. When you buy a put option or call option, time is always working against you. When you sell a put or call, time works for you. The more volatile the underlying security, the more the option is worth.

In general, options on individual stocks are more expensive than index options. This makes perfect sense because price volatility for indexes is usually lower than it is for an individual stock. A fairly popular strategy used to generate current income is covered call writing. “Covered” because you own the underlying security; “call writing’’ because you are giving someone the right to “call away” X number of shares at price Y within a specified period.

For example. Tom owns 1,000 shares of SPY (a popular ETF that mimics the S&P 500). SPY shares currently sell for $180 a share. Tom thinks most of the short-term price appreciation in the S&P 500 has already occurred; Tom also wants to generate some short-term income. Tom decides to sell 10 SPY contracts, thereby giving someone the right to buy 1,000 SPY shares from him for $185 a share anytime between now and the third Friday in February 2014. SPY February $185 call options sell for $4.00 each.

Tom sells 10 contracts and pockets $4,000 ($4 x 1,000 shares). In return, Tom is obligated to sell his 1,000 SPY shares for $185 between now and the third Friday in February—regardless of the price of SPY shares. If SPY shares go up to, say $220 a share, Tom must sell them for $185 a share—assuming the option is exercised. If SPY shares drop to, say, $184 (or lower), no SPY option buyer is going to pay $185 for something that can be bought for $184.

Tom gets to keep the option money whether or not the options he sold are ever exercised. Once the option expires, Tom is no longer obligated to anyone regarding his SPY shares. He can then write (sell) new options or pursue some other strategy that may or may not involve his SPY shares.

Conceptually, a covered call writing strategy would appear to be more conservative than simply buying and holding a stock or ETF index. You own the stock (or shares of an index) but your downside risk is partially or fully offset by the income generated from selling the call option.

Some studies show covered call writing may not do any better than buy-and-hold in the long run. This is because the person who sells call options is always limiting his/her upside potential (once the index or underlying stock appreciates by X, it is called away). Moreover, downside risk protection is limited to whatever option money is received by the option writer.

According to Optionize.net founder Derek Tomczyk, an S&P 500 covered call strategy (using SPY) should outperform a buy-and-hold strategy 75-90% of the time. However, 10-25% of the time, the potential lost appreciation can be great, thereby favoring the buy-and-hold investor.

For example. the table below compares the total return of the PowerShares S&P 500 BuyWrite (PBP) to the S&P 500 ETF (SPY).

PowerShares S&P 500 BuyWrite (PBP) vs. S&P 500 ETF (SPY)

All periods ending 12/10/2013