Cost Of Capital And Financial Leverage On Profits Finance Essay

Post on: 15 Апрель, 2015 No Comment

In order to carry out its normal business activities, every industrial organization must have adequate amount of capital at its disposal. As the capital is regarded as the lifeblood of an organization and are available in a limited quantity, an industrial organization must acquire and spend the same in a planned and systematic manner. In general, the potential sources of capital are owner’s equity, retained earnings, undistributed profit and borrowed money. For most large business operations, borrowed money from banks and other specialized financial Institutions are used. The very policy of supplementing owner’s equity with borrowed money can only be supported when the Return on Investment (ROI) is sufficiently large and a bigger margin of income is available after meeting all fixed charges including Cost of Capital. It has been observed that a large number of industrial organizations have a propensity of making a lavish use of borrowed money without considering its earning potential. Such a policy can spell disaster for the enterprise leading to failure and bankruptcy in the long run. This paper examines the implications of cost of capital and financial leverage on profits and financial position of the selected firms

Keywords

Owner’s equity, Retained earnings, undistributed profits and Borrowed money.

Introduction

Policy often adopted by industrial undertakings is the unplanned and indiscriminate use of borrowed money and other modes of financing which totally distorts its capital structure. The ultimate implications of such policies on the financial position of an industrial organization can be very unsatisfactory both in the short-run and long-run prospective. Thus it is very much imperative that every successful industrial organization must pay adequate consideration to the vital question of financial Leverage and Cost of Capital.

Review of Literature

Survey of the literature shows that a large number of researchers have carried out extensive researchers have carried out extensive research in the field of Capital Structure and Cost of Capital. Notable among them are David Durand, Ezra Solomon Barnes Baumol et. Scott, Haley and Schell, J.V. Elliott and they came up with the important findings. However, these studies were mostly based on data available in the advanced countries likes U.K. U.S.A, et. The foregoing resume of research work shows that no systematic study has yet been made to test the validity of these important concepts in the context of the industrial undertakings operating in developing countries. So far as Bangladesh is concerned, no study in this area was conducted and thus the present paper seeks to make a humble beginning in this respect. A short review of the theory of Financial Leverage, Cost of Capital and Capital Structure, may be discussed as follows:

Objectives of the Study

To suggest a suitable composition of fixed and variable capital for maximizing the earning per share.

Hypothesis of the Study

Ho There is only two sources for financing the funds of the firms.

Ho Fixed cost capital is used to enhance the earning per share

Research Methodology

For this study, the necessary data have been collected from the concerned companies’ actual field investigation. These data have been used in computing certain specific ratios mentioned in the accounting literature. These ratios would help in evaluating the financial position of the selected companies the throw ample light on their respective financial policies. In this study, a small sample of three companies – two cigarette manufacturing and ceramic manufacturing industrial units have been selected. The identity of the company has been kept anonymous as per the request of the suppliers of the data. Based on the data contained in their Balance Sheet and Profit and Loss Account of the sample companies for a period of three years. In total six categories of ratios via; Trading on Equity, under-or overtrading, under-or over capitalization, Financial Leverage; Debt Paying Capacity and Cost of Capital has been calculated. The detailed calculation and results has been shown in three schedules namely A, B and C for three companies X, Y and Z respectively.

Financial Leverage

Schell and Haley define Financial Leverage as, “the effect of debt financing on shareholder’s income or financing the firm’s development projects with outside debt.” It also refers to a case where fixed income securities such as Preference Share Capital and Debt Capital are used as a means of financing, Financial Leverage may also be defined, as “the ability of a firm to use fixed financial charge to magnify the effect of EBIT on the firm’s earning per share.” In other word, financial leverage involves the use of funds obtained at a fixed cost in the hope of maximizing shareholder’s return.”Charles Ellis observes that a favourable financial leverage occurs when a firm earns more by investing than the fixed charges paid for their use. In case of unfavorable financial leverage, it is not worthwhile for a firm to borrow. This policy of financing is often termed as “trading on the equity”. Likewise, and unfavorable financial leverage takes place when a firm earns less or equal to the cost required to be paid for the use of the borrowed fund or where the ROI is less than the limited cost fund. In such a case, borrowing is not justified. Thus it is evident that the use of borrowed fund if used judiciously increases ROI without requirement of additional fund from the equity stockholders. However when earnings are low during economic recession, the use of borrowed fund reduces the earning of the common shareholders.” Many financial managers argue that the financial leverage is the most important among the leverage concepts. It is particularly applicable in the capital structure management. A firm’s capital structure is the relation between debt and equity capital that makes up the firm’s financing of the assets. A firm using no debt capital is said to have all equity capital structure. Since most firms have a capital structure. Since most firms have a capital structure comprising of both debt and equity, the firm’s have a capital structure comprising of both debt and equity, the firm’s financial manager is highly concerned with the right choice of debt and equity. It determines the relationship that should exist between debt and equity capital at a given point of time. A firm which makes no use of mixed charge securities have a purely equity capital structure and thus have no financial leverage at all.

Another term is more frequently used in connection with financial leverage is “over trading”. Gupta is of the view that overtrading is a curse for business. It squeezes the vitality of the business and brings it on the verge of insolvency. It arises from maximization of sales. When the management pursues such a policy, it is compelled to make more credit purchase and hire people to carry on wok in the factory in order to meet supply commitments. It requires a long time to convert the finished goods into cash and as a result, huge stocks of goods are kept blocked in the pipeline. On the other hand, necessity for cash arises to pay the routine business expenses such as rates, interest, salary and wages and payment to the supplier of goods. In such a case, the firm is caught in a vicious trap. Under a severe financial pressure, the company may be compelled to adopt a policy of selling goods at less than the cost price just to meet its financial obligations. On the other hand, under trading implies that a business entity is compelled to undertake low volume of business, as its capital base is inadequate. This occurs mainly due to underdevelopment of the assets of the firm, leading to drop in sales volume, which leads to financial crisis. This means that the business is unable to meet its financial obligations and ultimately lead to forced liquidation. Overcapitalization refers to a case where the earnings of a company are not sufficient to justify a fair return on the amount of share capital and debt that has been used. It is also said to be overcapitalized when the total of owned and borrowed capital exceeds the fixed and current assets i.e. when it shows accumulated loss on the right side of the balance sheet. Such a situation may be remedied by reducing capital to such a level, which helps in achieving desirable balance between proprietor’s fund and net profit. If over-capitalization is the result of overvaluation of the assets, this should be remedied by scaling down the value of the assets to its proper value. Undercapitalization implies that the owned capital is less than the total borrowed capital; it is a definite case of undercapitalization. It indicates that the owned capital of the business is inadequate is comparison with the scale of operation and thus very much dependent upon borrowed capital and trade creditors. Undercapitalization is usually caused by under trading.

Cost of Capital

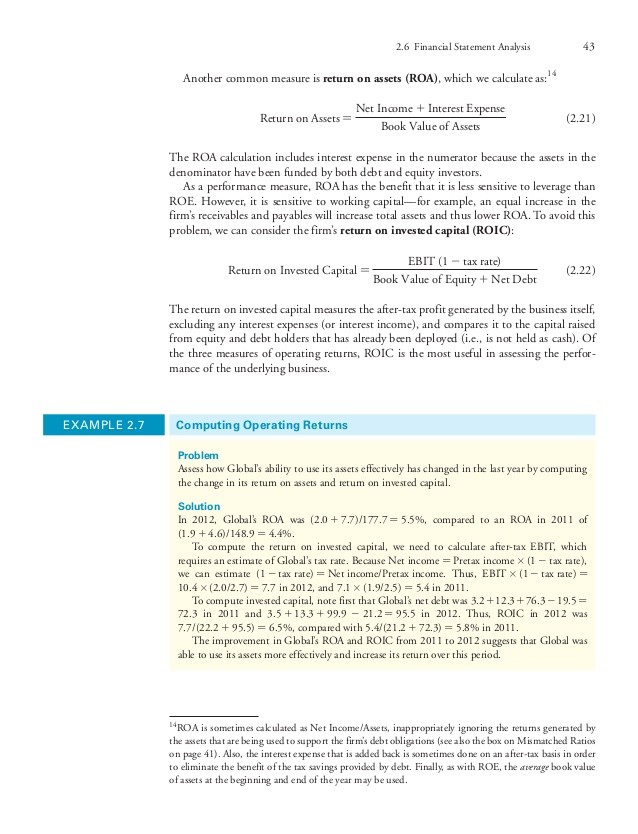

Whenever some amount of capital is invested in a business operation, it is generated into cost and the ultimate recovery of the capital through recouping the cost involves delay or time lag. Here the actual owner of the capital id deprived of its possession and the user of the capital derives the benefit. Therefore the user/borrower must pay a certain amount of money to the owner of the capital, which may be termed as “cost of capital”. It may also be termed as “time cost of capital”. The term “cost of capital” includes such item of cost as dividend paid to equity and preferences shareholders, interest paid on loan and such other charges. In operational terms, cost of capital refers to the discount rate that will be used in determining the present value of the estimated future cash proceeds and eventually deciding whether the project is worth undertaking or net. In essence, it is defined as the minimum or required rate of return that the firm must earn on the investment for the market value of the firm to remain unchanged. In economic theory, the required rate of return should be equal to the company’s cost of capital. This is the cost of debt capital plus equity capital weighted by respective amount of each type in the company’s financial structure. Let us assume that a company in which the debt capital i.e. bond has cost of 7%. The cost of equity capital i.e. common share is 18 per cent and in which 40 per cent of the total capital is debt and the remaining 60% is equity, them the cost of capital may be calculated as follows:-

=Debt proportion x Debt rate + Equity proportion x equity rate.

=0.4 x 7% plus 0.6 x 18% = 13.6%.

The cost of capital is a basic input into capital investment decision. In the present Value Method of Discounted Cash Flow Techniques, the Cost of Capital is used as the discount rate to calculate the NPV or Net present Value. The profitability index or Benefit-Cost Ratio is similarly employed to determine the present value of future cash flow. When the Internal Rate of Return method is used, the computed IRR is compared with the Cost of Capital. The concept of cost of capital thus constitutes integral part of the investment decision.

Capital Structure

The term “Capital Structure” essentially refers to the combination of firm’s financing strategy and denotes to the proportion of long-term debt, preference share and common equity in relation to the total capital exhibited in the Balance Sheet. It may also be defined as a mixture of debt and equity that comprises the financing of the assets of a company. Some of the authors prefer to exclude short-term fund from the capital structure. But Hampton argues that the short-term fund may become an integral part of the capital structure if it is used as a permanent source of financing for a reasonably long period of time. The capital structure should be a balanced one and suitable to the company’s business operation. It is a very delicate phenomenon and should be handled with care. An unplanned capital structure may often lead to failure and bankruptcy of a Company.

Result and Interpretation

The details of the ratios calculated have been shown in schedule. A concerning company under investigation is engaged in manufacturing and sale of ceramic were. The capital gearing ratio shows that even if the company has reduced the proportion of debt from 67% to 51%, still it is about half of the total capital employed in the business. As far as under-or overtrading is concerned, ratio number 1 to 3 showed a gradual improvement but there has been a sizable increase in the volume of sundry creditors and stock. This means that the company is engaged in overtrading. The ratios under-capitalization group shows that inspire of some improvement in ROI, and Current Ratio, the other two ratios namely proprietary ratio and Current Ratio has not registered any tangible progress. The results derived under financial leverage existence of some amount of leverage but there was hardly any improvement in EFS and FE ratio even though there was some improvement in ROL. A Close examination of the debt paying capacity ratios shows that the Debt Coverage Ratio and Debt Equity Ratio have remained basically constant with a very marginal increase in CFC ratios it may be added here that the cost of capital could not be calculated due to tack of necessary information.

Schedule B shows the results of the ratios calculated for the Company Y. this company is a leading cigarette manufacturer of the country and has recently entered into the export market. Here the Capital Gearing Ratio shows that the company has reduced the proportion of outside debt in its Capital Structure to a minimum of 5% from 24%. So far as under-or overtrading is concerned, the rising trend in Sundry creditor and Inventory volume gives an indication of definite Overtrading. Here the ratio of sales to net worth has increased but this is more than offset by poor or low turnover and negative working capital. Under capitalization group of ratios, the results provide a gloomy picture of the company’s financial position. The proprietary and Return on Equity Ratio shows a downward trend and the current ratio is below the standard level of 2:1. Therefore, the company suffered from serious financial crisis. The results derived under the financial leverage group provides further evidence that inspire of limited use of outside debt, all the ratios are on the decline indicating an worsening trend in its financial position. In completes conjunction with the foregoing finding, the debt paying capacity also indicated a downward trend and hence the company would not be able to meet its debt and other financial obligations. Here also, the cost of capital could not be calculated due to lack of necessary information.

The results displayed in schedule C relate to company Z, which is a cigarette manufacturer of relatively large size. It is a Multinational Company engaged in manufacturing and sale of quality brand cigarettes. The capital-gearing ratio shows that the company has totally reduced its dependence on outside debt. And hence has no gearing or leverage. As far as under-or overtrading is concerned, ratio number 1 to 3 has registered quite sizable increase with declining volume of inventory. The overall indication is one of overall indication is one of overtrading. The result under the capitalization group of ratios makes it apparent that the proprietary and current ratios are more or less static and is below prescribed standard level. The only silver line from the equity shareholder’s point of view is the high rate of return on equity. This would no doubt maximize the shareholders income. From the results under the financial leverage group, it appears that the degree of financial leverage has been reduced to a minimum.

It may be further added here that despite some increase in the Return on Investment, the Earning per Share is far from satisfactory keeping in view the large volume of capital invested. The Price Earnings Ratio could not be calculated due to lack of necessary data. The evaluation of the debt paying capacity revealed that the company has reduced its burden of outside debt totally. The margin of debt coverage is very small and a slight drop in assets owned by the company may cause serious financial difficulty. The only hope of improvement is the high rate of CFC Ratio. Here also the cost of capital could not be calculated due to lack of necessary information.

Conclusion

For the purpose of establishing financial discipline every, successful industrial organization must pay paper attention to the vital question of Cost of Capital and financial leverage. The Cost of Capital in relation to a company must be carefully defined and determined. As a general rule, no investment project should be accepted where the rate of return is less than the Cost of Capital. As far as Financial Leverage is concerned, it should be applied with great care and caution. During the periods of uncertainty, risk or recession, financial leverage should hardly be used as a means of financing. Whenever financial leverage is used, the management should make a determined effort to increase Return on Investment, which should be sufficient enough to cover the Cost of Capital and leave a comfortable margin of income. The goal of higher earning can only be achieved through increasing the profit margin and the rate of assets turnover. It can be safely inferred here that a pragmatic decision in respect of Cost of Capital and Financial Leverage is a prerequisite for achieving optimal Capital Structure.