Corporate Takeover Defense A Shareholder s Perspective

Post on: 16 Март, 2015 No Comment

Much has been written, often in dramatic and ominous language, about hostile takeovers and the various steps companies take to prevent them. While most articles and books view such events from the perspective of investment bankers and corporate officers, little has been written about the impact of hostile takeovers on shareholders of target companies. Yet these shareholders can experience significant financial consequences when the target company’s board activates a defense or signals its intention to do so by adding defensive strategies to the corporate charter after the news of an impending takeover breaks.

To assess the ramifications of a takeover, shareholders need to identify and understand the various defensive strategies companies employ to avoid one. These shark repellent tactics, named for the well-known circling predator, can be both effective in repelling a takeover and detrimental to shareholder value. This article will discuss the effects of some typical shark-repellent and poison pill strategies.

Shareholders Rights Plan

The most common form of takeover defense is the shareholders’ rights plans, which activates at the moment a potential acquirer announces its intentions. Under such plans, shareholders can purchase additional company stock at an attractively discounted price, making it far more difficult for the corporate raider to take control.

But today, more than ever, there are steep consequences to the poison pill reaction. While it can indeed complicate matters for the acquirer, it is often enacted to protect the interests of the elite upper echelon of corporate executives, rather than the company or its investors. It can also discourage the average, well-intentioned investor and drag down share prices. This destructive scenario played out the day after Yahoo! (Nasdaq:YHOO ) announced it had added a poison pill clause to the company charter in 2000 and its shares plummeted 94%, from a high of $118.75 to $6.78.

While the poison pill defense may help ward off unwanted suitors, it also makes it more difficult for shareholders to profit from the announcement of a takeover. Rights issued to existing shareholders can effectively thwart a takeover by diluting the acquirer’s ownership percentage, making a takeover more expensive and preventing or delaying control of the board and the company. But shareholders are often punished when their stock drops after a company adds a poison pill clause to its charter and they are unable to reap profits from a successful takeover.

Voting Rights Plans

Targeted companies may also implement a voting-rights plan, which separates certain shareholders from their full voting powers at a predetermined point. For instance, shareholders who already own 20% of a company may lose their ability to vote on such issues as the acceptance or rejection of a takeover bid.

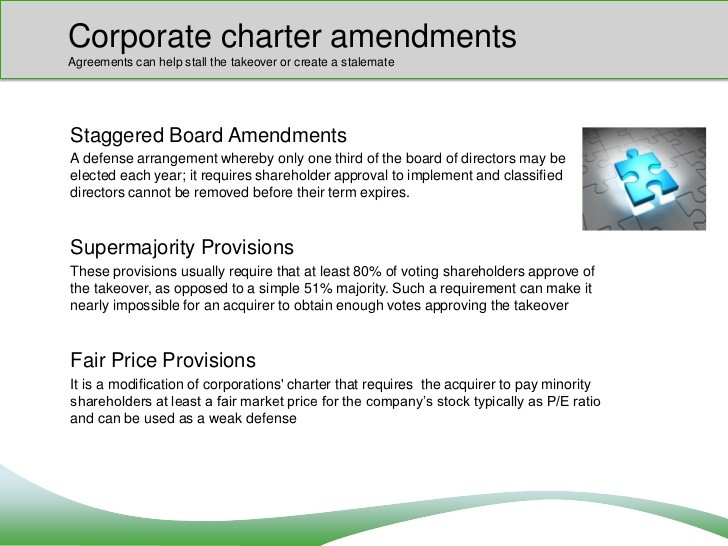

The presence of corporate predators may also trigger super-majority voting, which requires that a full 80% of shareholders approve a merger, rather than a simple 51% majority. This requirement can make it difficult — if not impossible — for a raider to gain control of a company. It is very difficult for management to convince shareholders that voter-rights clauses benefit them, and the addition of such clauses to the corporate charter is often followed by a drop in stock price. (For related reading, see Proxy Voting Gives Fund Shareholders A Say .)

Staggered Board of Directors

Clauses involving shareholders are not the only escape routes available to targeted companies. A staggered board of directors (B of D), in which groups of directors are elected at different times for multiyear terms, can challenge the prospective raider. The raider now has to win multiple proxy fights over time and deal with successive shareholder meetings in order to successfully take over the company. It’s important to note, however, that such a plan holds no direct shareholder benefit. (For more insight, read What is a staggered board? )