Corporate Bond Risk Encyclopedia

Post on: 27 Апрель, 2015 No Comment

Corporations secure long-term financing primarily through the issuance of stocks and bonds. Stock represents permanent capital whereas bonds are long-term debt. A recurring question relates to the fraction of a corporations financing that should be equity or debt. Modigliani-Miller theory states that the relative allocation between the two is irrelevant to existing shareholders interests. However, that theory is based on strong simplifying assumptions, including an assumption of no taxes. While tax law varies from one jurisdiction to another, the interest a corporation pays on its bonds is generally deductible as a business expense. Dividends paid to stockholders are not. For this and other reasons, the question of how corporations should allocate their financing between debt and equity recurs in practice.

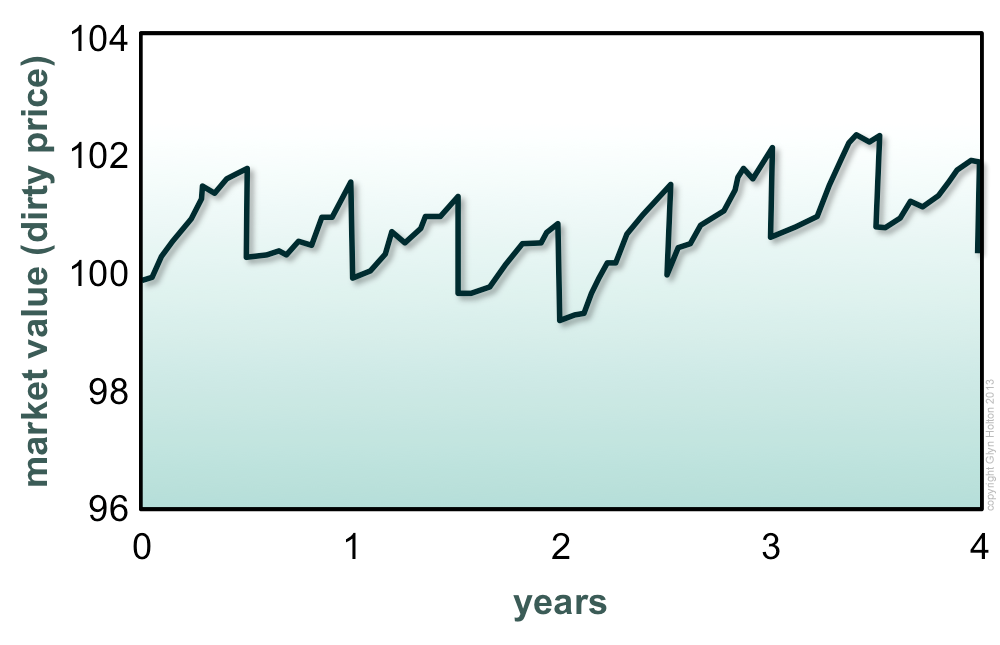

Corporate bonds typically have terms between 12 and 30 years, but there have been issues with terms of 50 and even 100 years. Shorter term bonds are also issued, but these may be called notes. While structures vary, corporate bonds are typically issued at a price close to their par value and pay a fixed semi-annual coupon. Their nominal yield is specified as a semi-annual interest rate. For example, if a bond has a par value of USD 100 and a nominal yield of 7.0%, it pays a coupon of USD 3.5 every six months until maturity, at which time a final coupon and the par value are paid to investors.

Corporations may issue bonds as private placements. or they may engage an investment bank to conduct a public offering. In the latter case, the bank may act as principal, purchasing bonds from the corporation either with a firm commitment or standby agreement. It may also act as agent, selling bonds to the public under a best efforts commitment. Once issued, some publicly-offered bonds trade on exchanges such as the New York Stock Exchange, but most trade over the counter (OTC). If a bond trades OTC, the bank that handled the public offering usually acts as a market maker.

Bond indentures can include a variety of provisions. A call provision grants the issuer an option to redeem bonds early. Some bonds have a sinking fund provision that requires the issuer to set aside funds to retire a specified amount of bonds each year.

Corporate bonds entail credit risk. and indentures include provisions to mitigate this or clarify the rights of bondholders in the event of a default. Bonds may have some form of credit enhancement such as a third-party guarantee. Bonds can be secured or unsecured. Secured bonds are collateralized by specific assets of the corporation. Unsecured bonds, called debentures. are general obligations of the issuer. They are not secured by any specific collateral, so investors claims are backed only by the corporations general assets. A corporation may issue senior and subordinated debentures. In a liquidation, the claims of senior debentures must be satisfied in full before anything can be paid to holders of subordinate debentures.

In a reorganization, a troubled company may offer income bonds to investors in exchange for bonds they already hold. These are unsecured bonds that require the issuer to make scheduled coupon payments only if it has the income to do so. Failure to pay coupons cannot drive the issuer into bankruptcy. Missed coupons may accumulate or they may not. If they do accumulate, they may do so with interest. Income bond indentures vary considerably, but they are likely to prohibit the paying of dividends to stockholders unless obligations to the bondholders are met. In many respects, income bonds resemble preferred stock .

There are various forms of secured bonds. Mortgage bonds are collateralized by assets such as power plants or factories. Should the corporation be liquidated, the bondholders have a direct claim on those assets. A mortgage bond can be open-ended or closed-ended. An open-ended mortgage bond allows the corporation to issue more bonds backed by the same collateral and of equal seniority. This means the bondholders claim on the collateral can be diluted. With a closed-end mortgage bond. the corporation may issue more bonds backed by the same collateral, but bonds are divided into classes according to the order in which they were issued. The classes are called the first mortgage , second mortgage. etc. Earlier classes have higher seniority than later classes. In a liquidation, claims are satisfied in the order of seniority. First mortgage claims must be paid in full before subordinate claims can be paid.

The protection that collateral affords holders of mortgage bonds is limited. Bankruptcy proceedings can be lengthy, expensive and unpredictable processes. If they result in a reorganization instead of a liquidation, holders of mortgage bonds may lose their seniority to new investors. In such a case, the new investors receive what are called prior lien bonds. These are treated as first mortgages, and previously issued bonds have subordinate claims. If, on the other hand, bankruptcy results in liquidation, the relative seniority of bondholders is generally honored, but collateral may have insufficient liquidation value to satisfy all claims. Due to shortcomings such as these, mortgage bonds are falling out of use. Most are issued by utilities.

More popular are equipment trust certificates. These are a form of structured finance backed by collateral such as railroad cars, airliners or trucks. A corporation might contribute 20% of the purchase price of the assets with the balance coming from purchasers of the certificates. The assets are held by a trust, which leases them to the corporation. Lease payments to the trust are passed, minus expenses, to investors as interest on the certificates. Both the nature of the collateral, and the fact that it is held in a trust, makes it easy to liquidate in the event of default. Certificates generally have staggered maturities or a sinking fund provision that allows the debt to be retired more rapidly than the collateral is depreciated. Deals are generally structured to maximize depreciation and/or leasing tax benefits for the issuing corporation. Once all the debt is retired, the collateral is transferred to the corporation.