Corporate Bond ETFs

Post on: 11 Июль, 2015 No Comment

What You Need to Know About Corporate Bond ETFs

You can opt-out at any time.

Please refer to our privacy policy for contact information.

Before we discuss corporate bond ETFs, it might be beneficial to understand the mechanics of a corporate bond itself.

What is a Corporate Bond?

Companies need money to operate and sometimes that money can’t come from earnings right away. Therefore a firm can issue a debt instrument like a corporate bond using future earnings or its assets as collateral. The corporate bonds are usually issued in lots of $1,000, also known as par value, and a company must have potential for future earnings in order for the debt security to be approved.

How Do Corporate Bonds Work?

A corporate bond will have a standard pay rate known as a coupon, which is one of most appealing features of bonds. However, because a company can go out of business at any time, corporate bonds can be risky. But with risk comes reward and corporate bonds tend to have higher rates than other bonds like treasury or municipal bonds. The coupon rate and ability to even issue a debt instrument in the first place is based upon the company’s credit rating; a credit quality measurement.

What are Corporate Bond ETFs?

A corporate bond exchange traded fund is basically an ETF that consists of corporate bonds. You receive all the benefits of ETFs. while at the same time you still get the revenue streams created by the bonds.

How Do Corporate Bond ETFs Work?

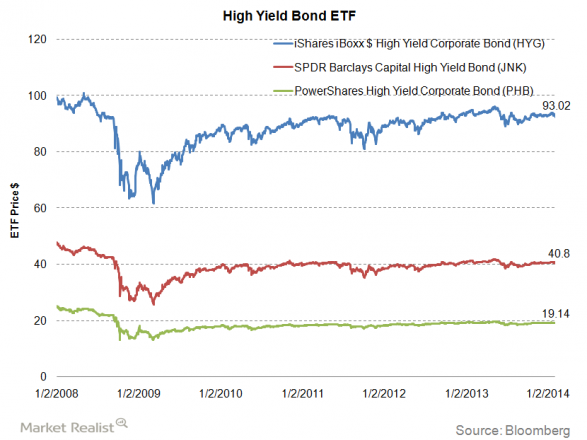

Like the many types of bond ETFs. there are different types of corporate bond ETFs as well. Corporate bond ETFs can consist of certain bonds categorized by duration, investment grade, or even yield. And some are even categorized by other factors like PXR – PowerShares Emerging Markets Infrastructure Bond ETF, which is chock full of emerging market bond ETFs .

Why Should I Include Corporate Bond ETFs in My Portfolio?

There are many different ways to utilize corporate bond ETFs in your investment strategy .

How do I Include Corporate Bond ETFs in My Portfolio?

The simple answer is to call your broker or use your online brokerage account. However, I highly suggest conducting thorough research before dabbling in these types of investments. To help you with that, I’ve compiled a special list of corporate bond ETFs to help you with your research. From there, it’s just a matter of getting started with ETFs .