Core dividend stock portfolio

Post on: 16 Март, 2015 No Comment

ETF-only portfolio are perfectly suitable for any kind of investor. This said, there are sound investing strategies that rely on rigorous stock selection processes based on tested principles. As it is relevant to diversify not only your holdings but also the investing strategies you use in your portfolio, we want to detail here a strategy that it a good complement to our global tactical asset allocation ETF strategies. The strategy outlined below aims at building a core portfolio of strong dividend stocks.

Step 1 — Stock screening

Here is the step-by-step approach we use to create a stock screening whose purpose is to provide a list of stocks that could form a solid core portfolio of dividend paying stocks with good prospects. This list of stocks serves as a starting point for further investigation before actually adding the picks to the core stock portfolio.

The starting universe is the list of dividend paying stocks available on the DRIP website . The list is broken down into three categories:

- Dividend Champions: stocks with 25+ straight years of higher dividends

- Dividend Contenders: stocks with 10 to 24 straight years of higher dividends

- Dividend Challengers: stocks with 5 to 9 straight years of higher dividends

The screen is based on tested stock investing principles:

- High-Yield Low-Payout stocks tend to outperform the market over time. Read paper .

- High-Yield High Dividend-Growth Rate stocks tend to outperform over time. Read paper .

Following these principles, and after cleaning the DRIP list, we establish every month a list of stocks meet all the criteria below:

- Yield is higher than average.

- Dividend-Growth Rate is higher than average.

- Payout ratio is lower than average.

- The company has increased its dividend for at least 8 years.

The cleaning involves a few steps such as removing stocks with negative earnings, excessive payout in excess of earnings, or stocks with a lack of data for dividend growth rate.

Step 2 — Choosing the stocks to add to the portfolio

Every time we run the screen, we will assess whether stocks on the list deserve to be included in the portfolio. Decision will be based on whether we see the stocks as currently having attractive valuations .

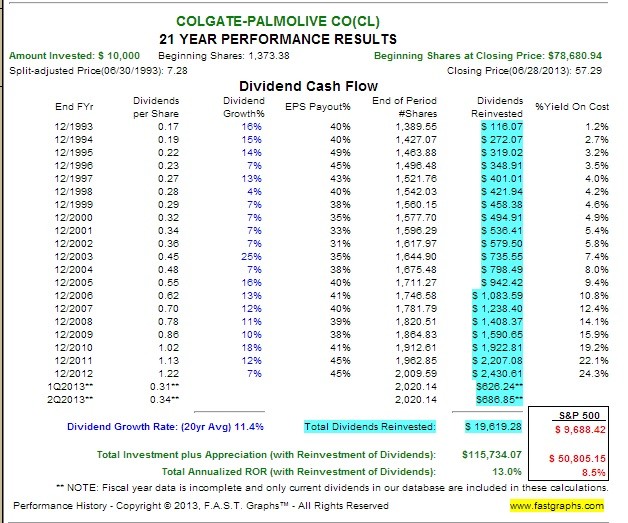

This step is essentially based on earnings history and consistency, future expected earnings growth and current and future Price-to-earnings ratios (PER). In the long run, earnings dictate a stock performance. They always have and always will. Investing in great companies that are significantly overvalued can be extremely costly, even if companies continue to grow earnings at a solid pace. Several tech giants perfectly illustrate this point: for instance, an investment in Intel in 2000 did not return much if anything to shareholders although the company has consistently growed earnings ever since.

Step 3 — Portfolio construction and management

We will gradually add new positions to the portfolio as our stock screen and valuation assessments signal new candidates. Positions will be held as long as the company prospects, earnings and valuation suggest to do so.

We will build and manage the portfolio to ensure a balanced exposition to different sectors and market capitalization segments. We expect to end up with a portfolio comprised of 20 to 50 stocks maximum.

The portfolio will be benchmarked against the SPY (S&P 500).

We started this model portfolio with a hypothetical $100,000 balance on January 6, 2012.

Starting in January 2012, we will regularly post the results of the above screen, how we use it to add to the portfolio, and how the portfolio performs. The posts will be readable here .