Consumer Staples Part II

Post on: 27 Апрель, 2015 No Comment

“We see change as the enemy of investments. so we look for the absence of change. We don’t like to lose money. Capitalism is pretty brutal. We look for mundane products that everybody needs.” Warren Buffett

In Consumer Staples, Part I, I explored the unique nature of consumer staples stocks and their impressive historical returns. In this part, I’ll explore how to find the best individual consumer staples stocks.

Some aspects of security analysis require a heavy touch. For example, evaluating the value of a brand, or the sustainability of a “business moat” requires hands on work and deep knowledge of each company. My approach is, instead, quantitative. In this sector series, I’ll highlight “factors” that can be quickly calculated and compared across a wide universe of stocks. I’ll cluster these stock selection factors into several key categories: valuation, profitability, momentum, and quality. I’ll also include some factors that do not add value historically, despite their appeal.

As we will see, the secret to success in the consumer staples sector is similar to the secret to success in the broad market: focus on high quality, cheap stocks. Value has been the most successful factor for choosing consumer staples stocks, but the value strategy can be enhanced by insisting on strong profitability and a shareholder orientation.

What Matters for Stock Selection

There aren’t that many consumer staples stocks. Today, there are just 108 U.S. stocks in the sector with a market cap greater than $200MM. If you include international stocks listed on a U.S. exchange (usually as an American depository receipt (ADR)), there are 161 stocks.

Because there are so few, my analysis of factors separates the universe into quintiles (buckets that represent 20% of the market sorted by a factor, or roughly 32 stocks each today) rather than deciles (which I normally use in a bigger universe). I’ve tried to include as many factors as possible that are available at free screening services like www.finviz.com, but I’ve also included some factors that are not available from the free screening services.

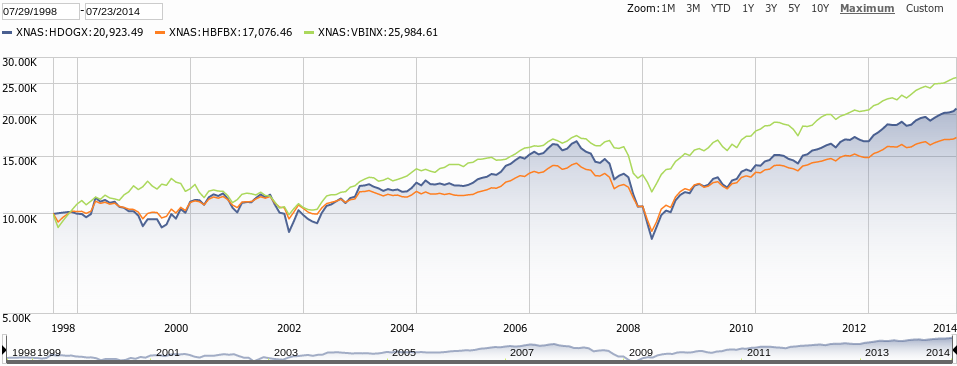

Given that consumer staples stocks have had such high returns on their equity for so long, it is curious that they are have been, on average, the second cheapest sector after utilities over the past 50 years [i] . And their valuations have been steady. Look at the thick black line in the chart below. Measured against all stocks, consumer staples are almost always cheaper (i.e. their average valuation percentile is less than 50). In this chart, 1 means cheapest and 100 means most expensive.