Consumer Staple ETFs Hitting Highs

Post on: 28 Апрель, 2015 No Comment

Summary

- With the Dow trading at an all-time high, it creates a fear in investors that another bubble is forming.

- The two largest consumer staples ETFs hit new all-time highs this week as investors prepare for a pullback.

- The SPDR Select Sector Consumer Staples ETF (XLP) tracks 42 publicly-traded consumer staple companies, most of which are large cap.

By Matthew McCall

A number of consumer staple ETFs have been on the move lately as investors shift to a defensive stance and look for lower volatility and higher yields. With the Dow trading at an all-time high, it creates a fear in investors that another bubble is forming. This forces investors to consider less risky sectors such as consumer staples.

Historically when the stock market is rallying, the consumer staples would lag because money would be flowing into riskier sectors. That has not been the case this time around, as money has been making its way into both high-risk and low-risk sectors.

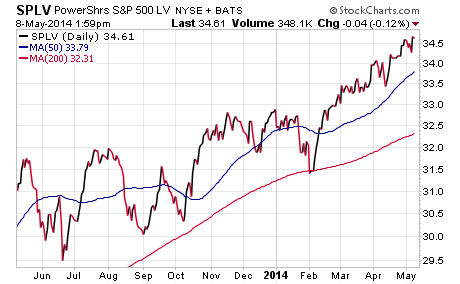

The two largest consumer staples ETFs hit new all-time highs this week as investors prepare for a pullback, but at the same time keep money in equities.

The SPDR Select Sector Consumer Staples ETF (NYSEARCA:XLP ) tracks 42 publicly-traded consumer staple companies, most of which are large cap. The companies are spread out among six sectors within the industry. The food and staples sector makes up about one-quarter of the portfolio, followed by household products at 20 percent. The top three individual companies that make up ETF are The Procter & Gamble Company (NYSE:PG ), The Coca-Cola Company (NYSE:KO ) and Philip Morris International Inc. (NYSE:PM )

The ETF is up 10 percent over the last 12 months and 6.4 percent over the last six months. An expense ratio of 0.16 percent is very low and puts it in line with its competitors.

The Vanguard Consumer Staples ETF (NYSEARCA:VDC ) tracks companies that provide consumers with products considered to be non-discretionary. It is comprised of 102 companies with the top 10 holdings making up 58 percent of the total portfolio. VDC has a similar composition to XLP.

VDC has slightly outperformed XLP, up 11 percent over the last 12 months and 7.8 percent over the last six months. VDC has an expense ratio of 0.14 percent.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Disclaimer: Neither Benzinga nor its staff recommend that you buy, sell, or hold any security. We do not offer investment advice, personalized or otherwise. Benzinga recommends that you conduct your own due diligence and consult a certified financial professional for personalized advice about your financial situation.