Consumer Sentiment and Stock Market Returns CXO Advisory

Post on: 8 Июнь, 2015 No Comment

The business media and expert commentators sometimes cite the monthly University of Michigan Consumer Sentiment Index as an indicator of U.S. economic and stock market health, generally interpreting a jump (drop) in sentiment as good (bad) for future consumption and stocks. The release schedule for this indicator is mid-month for a preliminary reading on the current month and end-of-month for a final reading. Is this indicator in fact predictive of U.S. stock market behavior in subsequent months? Using monthly final Consumer Sentiment Index data from the Federal Reserve Bank of St. Louis, augmented by more recent data from Bloomberg and contemporaneous monthly levels of the S&P 500 Index during January 1978 through October 2014 (442 monthly sentiment readings), we find that:

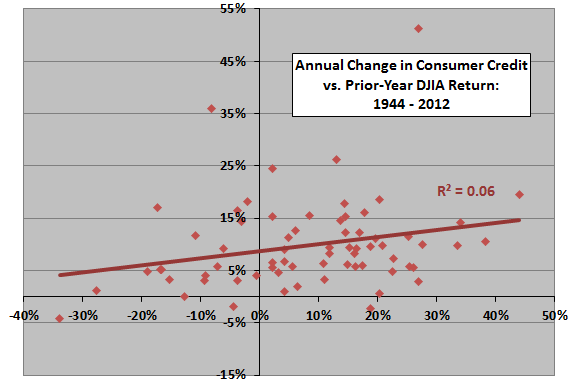

The following chart compares the behavior of the Consumer Sentiment Index and the S&P 500 Index (on a logarithmic scale) based on monthly data over the entire sample period. Visual inspection suggests that the two series mostly move together, but casual inspection is insufficient to determine whether consumer sentiment systematically leads or lags the stock market.

For a closer look, we relate monthly change in consumer sentiment to next-month stock market return.

The following scatter plot relates next-month S&P 500 Index return to monthly change in the Consumer Sentiment Index over the entire sample period. The Pearson correlation for the two series is -0.01 and the R-squared statistic 0.000, indicating that changes in consumer sentiment have no predictive power for next-month stock market returns.

Is this correlation stable over time?

The next chart tracks the rolling 36-month Pearson correlation between next-month S&P 500 Index return and monthly change in the Consumer Sentiment Index over the sample period. Results indicate that, while the average correlation is near zero, it drifts higher and lower over short subperiods.

Might consumer sentiment changes predict future stock market behavior beyond the next month?

The next chart summarizes Pearson correlations for various lead-lag relationships between monthly S&P 500 Index return and monthly change in the Consumer Sentiment Index over the sample periods, ranging from stock market return leads change in consumer sentiment by six months (-6) to change in consumer sentiment leads stock market return by six months (6). Results suggest that:

- A stock market advance (decline) indicates an increase (decrease) in the Consumer Sentiment Index one to two months later.

- Consumer sentiment and the stock market move together contemporaneously.

- A change in the Consumer Sentiment Index does not predict stock market return at horizons up to six months.

In case there is a material non-linearity in the relationship, we calculate average stock market return by range of changes in consumer sentiment.

The final chart summarizes average next-month S&P 500 Index and Russell 2000 Index returns by ranked fifth (quintile) of monthly changes in the Consumer Sentiment Index for the overall sample period and two equal subperiods. There are 88 (44) observations per quintile for the overall sample period (subperiods). Progressions of average returns across quintiles are not systematic and results for subperiods are very different, indicating no reliably exploitable non-linearities.

In summary, evidence from simple tests offers no support for a belief that monthly changes in the University of Michigan Consumer Sentiment Index predict stock market returns at horizons of one to six months.

Cautions regarding findings include:

- Most of the above analyses are in-sample. As illustrated by the rolling correlation analysis, an investor operating in real time with inception-to-date data may develop different, dynamic beliefs.

- The above analyses do not address preliminary consumer sentiment readings.

- This analysis does not rule out the possibility that surprises in the Consumer Sentiment Index, relative to some measurable expectation, usefully forecast stock market returns.

- The returns used above ignore any effects of dividends.

Why not subscribe to our premium content?

It costs less than a single trading commission. Learn more here.