Consumer Price Index Real Inflation How Do We Hedge

Post on: 18 Сентябрь, 2015 No Comment

What is Inflation?

Before we discuss the CPI and government economic data, we much first fully understand the concept of inflation. Inflation, in the most general terms, is a rise in price levels of goods and services measured over a period of time. When price levels rise, each unit of currency buys fewer goods and services. Inflation also measures the erosion in purchasing power of money, the loss of real value in the medium of exchange. Inflation impacts everyone in society, rich or poor, young or old, working or unemployed. Anyone that has to buy food, goods, and services, pay bills, or transact in the economy is directly affected by inflation.

The CPI — official measure of inflation

The government’s key measurement for inflation is known as the CPI (Consumer Price Index). It has been around since 1913 and traditionally measured a basket of goods, which consumers would purchase. Then the price of the basket of goods was compared on a year-over-year basis.

For instance you price a steak, a loaf of bread, a gallon of milk, etc. The following year you price the same products, look at the price change, and you are able to determine the rate of inflation. How much have items increased in price. That is (was) the purpose of the CPI, the rate of change on a fixed basket of goods (with a modicum of replacements when a product is no longer serving its core use, such a computer for a typewriter).

The CPI is a very important data point for a couple of key reasons:

- Used to adjust Social Security benefits.

- The Federal Reserve uses it as their key measure of inflation to adjust monetary policy.

Obviously a lower CPI would be beneficial for both those key reasons.

The Cost of Living?

When the CPI came about it was used to strictly measure inflation, as described above. It did so for 70 years without any major changes. More recently in the last few decades, the model used for calculating the CPI has changed drastically. In fact, it no longer measures inflation, but rather the cost of living.

The cost of living measures the choices a consumer has made based on price changes. In fact inflation directly impacts those choices. Many of the changes that have been made to the CPI over recent years have been argued based on the cost of living and the freedom of choice. It would seem a sound argument if we forget the purpose of the CPI to measure inflation.

The Cost of Living is not synonymous with inflation, yet politicians and the media frequently use the words inflation and cost of living interchangeably.

The philosophy behind the changes

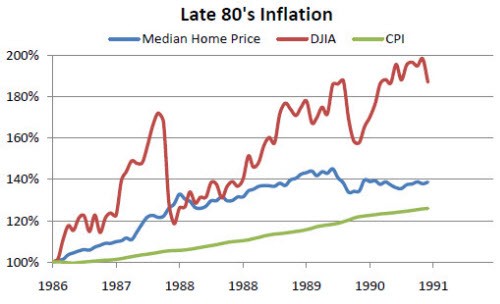

The first big change was made in the mid 1980s, it removed housing from the CPI and replaced it with a rental equivalent. It was argued that not everyone buys a house and some that do buy also rent homes, thus we should measure the inflation of rent rather than the inflation of home prices. This made a significant and measurable change to the CPI and lowered the results.

However, it was the Cost of Living argument in the 1990s that brought forth the largest changes. A powerful argument based on measuring the Cost of Living and freedom of choice. The belief was the CPI was not reflective of consumer choices, that consumers would make changes in their purchasing to meet a standard of living. In order to measure this Cost of Living, we must make significant changes to the method and make some adjustments.

These major changes fell into three distinct areas:

- Substitution

- Hedonics

- Geometric Weighting

These three changes to the CPI model radically changed the results. For the first time in almost 80 years we were no longer measuring inflation, but instead measuring the Cost of Living.

Substitution Method

The first big change made to the CPI model was the Substitution Method.

In the 90s it was argued by Boskin (brief bio: Dr. Michael Boskin, chairman of the Council of Economic Advisors 89-93, was the chairman of the Commission on the Consumer Price Index, whose report transformed the way the government measured inflation, GDP and productivity ) that CPI was overstating inflation and a method he had been working on would give a more accurate measure of inflation. His argument was, We should allow for substitution here because people can buy hamburger instead of steak, when the price of steak goes up. While it correctly points out people’s freedom of choice, it clearly does not measure inflation. The consumer purchasing hamburger doesn’t change the fact that steak has increased in price. Clearly the substitution method hides or masks the actual impact of inflation.

The term Cost of Living was best defined, perhaps by accident, by Boskin, who was trying to phrase the substitution changes, but realized that it impacted the standard of living. The model he used had been known as the utility of living (or Utility Efficiency), this is defined as the cost of meeting the essentials regardless of the standards. By the definition, the utility of living is met by purchasing hamburger instead of steak, since they both offer protein. However, it is clear that the standard of living has declined significantly, even though the utility of living has met its burden.

The Cost of Living soon became the standard term used with the CPI, however I think most people missed the real definition and mistakenly assumed it meant the same thing as inflation.

For those not familiar with the substitution methodology, I have included some text from the Bureau of Labor and Statistic (BLS) website used as an example of this methodology. It clearly sheds light on the fact that while a certain level of utility of living is met, the standards of living could be significantly lowered. Yet, most importantly, the substitutions mask the real impact of inflation.

The CPI is constructed as an aggregation of basic indexes computed for approximately 200 item categories, such as ice cream and related products, in each of 38 geographic areas. Within each of these index components, or strata, prices for specific items in a sample of outlets (stores) are combined to produce a basic index. Consequently, the use of the formula will address only the issue of consumer substitution within strata.

Substitution can take several forms corresponding to the types of item- and outlet-specific prices used to construct the basic indexes:

- Substitution among brands of products, for example, between brands of ice cream;

- Substitution among product sizes, for example, between pint and quart packages of ice cream;

- Substitution among outlets, for example, between a brand of ice cream sold at two different stores;

- Substitution across time, for example, between purchasing ice cream during the first or second week of the month;

- Substitution among types of items within the category, for example, between ice cream and frozen yogurt;

- Substitution among specific items in different index categories, for example, between ice cream and cupcakes.

Hedonics

The CPI additionally receives an adjustment to the cost of a product based on the product’s Ease of Use or Lifestyle Benefit. The idea is that technology has benefited our lives, so the cost that the consumer pays for the product would be artificially reduced by its ease of use when calculating the CPI. This is known as Hedonics and reduces the cost of the goods in the substituted basket.

Example: My new smartphone cost is artificially lowered in the basket of goods because it allows me to access my email, thus saving me time and a lifestyle benefit.

How you actually measure Hedonics and determine the reduction in the calculation even leaves some economists scratching their heads. Not only is it subjective, the mathematical impact further reduces the CPI data.

I understand that our lifestyles through the increase of technology have benefited, but to tell people that we are going to artificially reduce the cost of the product when calculating CPI because she/he received a lifestyle benefit is silly. Why, because the consumer did not receive a discount when they bought it.

Geometric Weighting

Geometric weighting works hand-in-hand with the substitution method and determines the weighting of an item in the basket of goods based on price changes.

If the price of an item that is measured increases, they lower the weight of that item to reduce the impact of the price increase.

The argument is that if the price goes up you will buy less of it and theoretically that makes sense. However, you still need to eat, pay for gas, pay your bills, etc.

If the price impact is too much then they substitute the product out for something else, again making the assumption that the consumer will buy something different because the item cost too much.

There is nothing wrong with this approach if and only if you want to measure the cost of living based on a certain income and how inflation impacts people’s purchasing decision.

However, and this is very important, this approach is not measuring inflation but rather how real inflation is impacting consumer spending habits.

Simple Example

Let’s say that milk makes up 10% of the food basket of items in the CPI. Milk prices rise 20% this month.

You would assume that because the price goes up by 20% the weighting of Milk should also increase, if we are to assume that you purchase the same amount of milk .

However, the Geometric Weighting system lowers the amount of milk weighting in the basket because it is making the assumption you are buying less of it because it is more expensive. Theoretically this is true to a certain extent. However, we still need to eat, buy gas, etc.

The fact is the price of milk increased by 20%, regardless of the consumers decision to purchase it or something else, or less of it.

Semantics

While all these changes directly impact the CPI, the broader problem is that the Federal Government and Federal Reserve report this as the official measure of inflation and use the words cost of living and inflation synonymously. The problem is clearly one of semantics. We are told the government is measuring inflation, when clearly they are measuring something different.

It’s a semantics problem that the International Labor Organization (ILO) has clearly addressed when this question was posed to them about measuring inflation:

Which of the two types of index (i.e. a fixed basket index CPI and cost of living index COLI) is preferable as a means of measuring inflation?

There are two diametrically opposed views. One view is that a clear distinction needs to be made between a fixed basket index and a COLI and that a fixed basket is preferred as a means for measuring inflation. A second view is that a COLI does provide precisely that information which is required of an inflation measure. The arguments for the first view are as follows: The fixed basket approach adheres to the principle of a straightforward comparison of prices, therefore only indicating a change in prices, whereas a cost-of-living index provides information about how, given price changes and the substitution processes, expenditure would have to change to maintain the original Standard of Living or level of utility. A fixed basket is therefore a pure price index, while a cost-of-living index is an index which may show change even when all prices stay at the same level. As such, the latter cannot be considered as an appropriate measure of inflation. The argument for the second view is as follows: the COLI is a price index whose weights change to reflect changes in consumer preferences. It is intended to measure the change in the cost of maintaining a given Standard of Living and takes into account substitutions in response to changes in relative prices. However, it can also be interpreted as measuring the change in the value of a fixed basket of goods and services where the fixed basket is a particular blend of the baskets in the two periods compared (Hill, 1997). A COLI is preferred because in practice fixed basket indices may be biased estimates of inflation (especially in the indices with weights that are updated infrequently) and therefore are measuring changes in the value of a basket of goods and services that is no longer representative.

It is interesting that the ILO simply relates the different opposing views and does not say that one is correct or the other is wrong, just different. Furthermore it is clear that you can’t replace one with the other, as you are measuring two different things, price changes vs. effect of those prices changes to the cost of living.

I spoke with the ILO about the CPI vs. COLI subject. They stated you can not replace one with the other, they measure two different things. One measures inflation based on price changes, the other measures the cost of living based on utility efficiency. When asked about the U.S. CPI method, the ILO stated it is a consumer cost of living that is now being used as the current method of measuring inflation, not the traditional fixed basket of goods. I asked which is better; they said depends on what you want to measure. However, you cannot say one is the other, because they are not.

It’s interesting to note that measuring the Consumer Cost of Living (COLI method) is impacted by inflation effects from the fixed basket of goods, as consumer substitutions must change to avoid price increases, the definition of substitution.

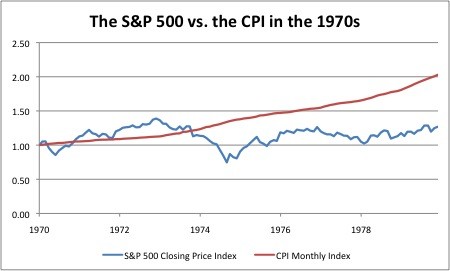

Comparing: CPI original model (inflation) vs. CPI current model (Cost of Living)

The official CPI (currently used) is reporting inflation as of 2012 at 2.07%

If we remove the 1990s changes that converted the model from a Cost of Living back to the original inflation method, the CPI reads as of 2012 at 9.68%.

That is a 367% difference.

However, even using the current official CPI method for reporting inflation at a artificially low 2.07%, you will still lose money purchasing a 10 year treasury that yields 1.8%.

Currently the Obama Administration is considering another change to the CPI to the new C-CPI-U model, which further lowers the CPI results by 50 basis points. It is been explained by government officials that it is even more accurate.

Other measures of Inflation

As investors or even everyday citizens we know that inflation is real. We experience it at the gas pumps, buying food, health costs, and all sorts of costs and prices we are subjected to on a regular basis. It is certainly hard to ascertain the accuracy of the CPI, EPI, or other models to our own real world experience.

Accepting that the CPI is not a measure of inflation, but rather a cost of living, how do we get a more accurate measure? There are several resources that may be of help.

We can use the original CPI model, which is still tracked at Shadow Statistics, found here .

Additionally the Everyday Price Index (EPI) measures only the prices of goods and services that the average consumer purchases once a month, but draws from the same survey data that the CPI uses. The methodology is weighted and it is still subjected to CPI data (which may not be the best source). As of 2012 the EPI was 2.5%. Information on the EPI can be found here .

How do we hedge against inflation?

If we accept that inflation is real and impacting us, we want to own or purchase assets that are tangible, limited in supply, and hold intrinsic value.

Three areas of investment include:

- Property

- Precious Metals

- Equities

The equities market is an excellent place to hedge against inflation risk for a couple of reasons, it’s liquid, there are an array of choices, and options allow to hedge investments as well as generate additional income.

Property — REITS are an excellent investment vehicle for taking a position in property, if one can’t do it directly. However, before rushing out and buying any REITS, it is important to understand the holdings and make-up of the particular REIT. The housing market collapse has certainly driven a lot of trepidation into the REIT and real-estate market. However, while property values have dropped, income properties generate dividends. One should look at REIT income relative to the REIT price, which will help determined yield. Check out the ETF IShares Real Estate Index IYR .

Precious Metals — Gold and Silver are frequently sighted as the go-to place against inflation. GLD and SLV are very liquid and offer options trading. While this is considered paper gold and silver, it is certainly a great and low cost entry/transaction to add to your portfolio.

Equities — We live in a global market and many multi-nationals are no longer beholden to the U.S. economy. There is huge growth in the emerging markets and will continue to be for a very long time as billions of new customers come online every day. When looking at equities as an inflation hedge, we must consider their balance sheet and currency exposure. We are looking for companies with cash on the balance sheet and over 50% revenue generated outside of the U.S. dollar market. Also the majority of growth must come from the emerging market. These companies will continue to thrive, even if the U.S. dollar begins to devalue. Examples: Caterpillar (NYSE:CAT ), McDonald’s (NYSE:MCD ), and Rio Tinto (NYSE:RIO ).

Inflation Hedging Philosophy

The philosophy in inflation hedging is not investing, but thinking of it as an alternative savings account. I personally buy physical gold and silver every month (coins and bars). I have set aside a certain amount to purchase every month and I purchase that amount every month regardless of price. I store the gold and silver, expecting never to use it and thinking of it as a saving account. I hope someday to give it all to my son.

Strategy

The same philosophy is used when purchasing the REITs, Equities, and Precious Metal ETFs and Stocks. I sell a few Out-of-the-Money (OTM) put options at a price I am willing to own the asset for every month. This is never a leveraged position, only sell the amount of puts that you are actually willing to buy that amount of share for, putting aside a fix amount ready to purchase every month, quarter, or year. The put selling strategy is excellent for this type of inflation hedging, because if you are not put (delivered) the asset on or before expiration, you have collected premium. This premium can be compounded to increase you future asset accumulation. I personally withdraw the profits on expired worthless puts and use it to purchase actual physical gold and/or silver.

Disclosure: I am long GLD. SLV. CAT. RIO. IYR. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.