Conservative investing

Post on: 1 Июнь, 2015 No Comment

Conservative investing

Your investing style isn?t a blue-jeans-versus-three-piece-suit debate. It refers to your approach to stock investing. Do you want to be conservative or aggressive? Would you rather be the tortoise or the hare? Your investment personality greatly depends on your purpose and the term over which you?re planning to invest. The following sections outline the two most general investment styles. Conservative investing

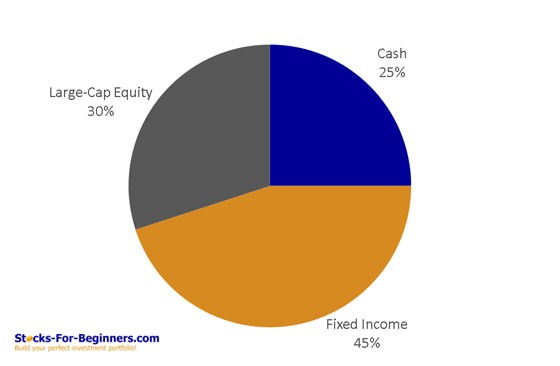

Conservative investing means that you put your money in something proven, tried, and true. You invest your money in safe and secure places, such as banks and government-backed securities. But how does that apply to stocks?

Conservative stock investors want to place their money in companies that have exhibited some of the following qualities:

- Proven performance: You want companies that have shown increasing sales and earnings year after year. You don?t demand anything spectacular, just a strong and steady performance.

- Market size: Companies should be large-cap (short for large capitalization). In other words, they should have a market value exceeding $10 billion. Conservative investors surmise that bigger is safer.

- Market leadership: Companies should be leaders in their industries.

- Perceived staying power: You want companies with the financial clout and market position to weather uncertain market and economic conditions. It shouldn?t matter what happens in the economy or who gets elected.

As a conservative investor, you don?t mind if the companies? share prices jump (who would?), but you?re more concerned with steady growth over the long term. Aggressive investing

Aggressive investors can plan long term or look only over the intermediate term, but in any case, they want stocks that resemble jack rabbits they show the potential to break out of the pack.

Aggressive stock investors want to invest their money in companies that have exhibited some of the following qualities:

- Great potential: The company must have superior goods, services, ideas, or ways of doing business compared to the competition.

- Capital gains possibility: You don?t even consider dividends. If anything, you dislike dividends. You feel that the money that would?ve been dispensed in dividend form is better reinvested in the company. This, in turn, can spur greater growth.

- Innovation: Companies should have technologies, ideas, or innovative methods that make them stand apart from other companies.

www.2stocktrading.com.

Author Description :