Concept of Elliott Wave Theory Explained with Examples – Wave’s Cycle Sweeglu Elliott Wave

Post on: 7 Май, 2015 No Comment

Elliott Wave theory explained with examples – Wave’s Cycle, is a part of very first chapter of my book “Practical Application of Elliott’s Wave Principles by Deepak Kumar ”. Many of my followers and blog readers requested me to explain Elliott wave’s cycles in details so that they can understand better.

So, I am just copying very first chapter “Wave’s Cycle and Principles of Elliott’s Wave Theory” of my book in this Article/Lesson. And I hope this article will be enough to make you understand everything about Elliott’s Wave Cycles.

This chapter covers only basics of EWT that you need keep in your mind before going forward. These are just simple wave’s rules but applicable in every pattern and in every conditions. I am not adding any real time chart in first chapter as it may confuse you in the start and tried to explain these simple rules with imaginary graphs and figure to make you understand easily. Don’t try to think hard and compare these imaginary figures with real time chart but, just try to understand the concept. Everything will be explained in later chapters with lots of examples on real time charts. So let’s start from simple end.

Learn Elliott Wave Analysis! Know The Future of Stock Market

Elliott observed that every financial market, stocks or financial instrument moves in zigzag formation and called it wave’s cycles. And that zigzag formation consists of a set of 5 waves in the direction of Primary/Main/Bigger trend followed by a set of 3 waves opposite to direction of main trend.

Note: - If we see the history of market from start, the main/primary trend is always up as the market cannot go below zero. In this book, most of the examples I covered with uptrend (bullish trend) as main trend and down trend (bearish trend) as corrections. But the rules are applicable same on both bullish and bearish market.

- The set of 5 waves in the direction of main trend he called “Impulsive” or “Impulse”.

- And the set of 3 waves opposite to the direction of main trend he called “Corrective” of “Correction”

In this Article,

- All the inner/lower degree waves of “Impulsive” (set of 5 waves) will be marked as 1,2,3,4 and 5.

- All the inner/lower degree waves of “Corrective” (set of 3 waves) will be marked as A, B and C.

Let me show you the imaginary figure to make you understand visually: -

Just see the image (1.1) given below, it is just a simple imaginary representation of movement of market based on Elliot Waves Theory. Just read the points and try to identify it on image.

Five waves move (impulsive) started from point “0” and completed at point “5” were’

- Inner wave 1 started from points “0” and completed at point “1”

- Inner wave 2 started from points “1” and completed at point “2”

- Inner wave 3 started from points “2” and completed at point “3”

- Inner wave 4 started from points “3” and completed at point “4”

- Inner wave 5 started from points “4” and completed at point “5”

Elliott Wave Theory Explained (Image 1.1)

Thus, a whole impulsive is completed from point 0 to 5. Now, after completion of Impulsive;

Three waves move (corrective) started from point “5” (end of impulsive) and completed at point “C” were: -

- Inner wave A started from points “5” (end of impulsive) and completed at point “A”

- Inner wave B started from points “A” and completed at point “B”

- Inner wave C started from points “B” and completed at point “C”

Now, I assume that points of “Impulsive” and “Corrective” is clear to you and now we can go little deeper to understand it better.

As you learned above, Impulsive is consisting of Five Waves 1,2,3,4 and 5 in the direction of main trend and corrective consist of Three Waves A, B and C opposite to the direction of main trend.

But if you see deeply within Impulsive (set of 5 waves up move marked as 1,2,3,4 and 5), Inner/lower degree wave 1, 3 and 5 are in the direction of main trend but wave 2 and 4 are opposite to the direction of main trend.

Here you need to learn.

Every inner wave 1, 3 and 5 of is also small/inner impulsive of lower degree. Means, inner wave 1, 3 and 5 that are in the direction of main trend are also consist of 5 smaller waves.

And wave 2 and 4 of are corrective waves of lower degree. Means, inner waves 2 and 4 that are opposite to the direction of main trend are consist of 3 smaller waves (a,b and c).

Thus, a combination of 3 Impulsive and 2 corrective forms a Bigger impulsive.

And Within Correctives,

Inner/Lower Degree wave A and C are impulsive of lowest degree which consists of 5 inner waves whereas B is corrective of smallest degree and consist of 3 inner waves (abc).

Just see the image (1.2) and try to identify Impulsives and correctives.

Concept of Elliott Wave Theory Explained (Image 1.2)

In this image, I just broke down bigger waves into smaller/lower degree wave. Here bigger wave are marked as big characters 12345 and ABC whereas lower degree/inner waves are marked as small characters (I, ii, iii, iv and v) and (a, b and c).

Just read the image carefully and try to identify how I represented waves 1, 3, 5, A and C as impulsive (5 waves moves) and wave 2, 4 and B as corrective (3 waves move).

In the same way,

Completion of smaller set of 5 waves move is a completion of bigger Impulsive and the start of bigger correction that will correct that full bigger impulsive and the cycle goes on. Let me show you on image (1.3).

Concept of Elliott Wave Theory Explained (Image 1.3)

And market moves in this formation only, Completing bigger impulsive followed by bigger correction. The up move till the bigger impulsive is Bull Market and later correction is Bear Market followed by the start of new Bull Phase that goes well above previous high again. And the cycle goes on.

Example: - The completion of bigger impulsive in 2008, most of the world’s market completed bigger Bull cycle in 2008 followed by bigger correction that fell almost 60-70-% of total upside of history followed by start of new bull trend for new cycle. See the chart (1.4) below.

Basics of Elliott Wave Theory Explained (Chart 1.4)

I hope you are familiar with basic cycles of Elliott Wave Theory now, which says every impulsive is consist of a set of 5 waves followed by a correction which is a set of 3 waves.

- Wave 1 is impulsive which a set of 5 inner waves.

- Wave 2 is corrective for wave 1 that corrects wave 1 which is a set of 3 inner waves

- Wave 3 is again impulsive after completion of wave 2 which a set of 5 inner waves.

- Wave 4 is corrective for wave 3 that corrects only wave 3 which is a set of 3 inner waves.

- Wave 5 is again impulsive after completion of wave 4 which a set of 5 inner waves.

Completion of a set of 5 waves forms a bigger wave 1 and there is a start of bigger corrective wave 2 which is again a set of 3 waves “ABC” that corrects whole set of 5 waves (bigger wave 1). Where:

- Wave A is impulsive which a set of 5 inner waves.

- Wave B is corrective for wave A that corrects wave A which is a set of 3 inner waves

- Wave C is again impulsive after completion of wave B which a set of 5 inner waves.

Turn back and read once more if you are not clear of the concept and the step forward to next topic of “Basic Rules of Elliott Wave Theory”. And proceed on next lesson:

Learn Elliott Wave Theory! Know the Reality of Stock Market Behavior

You already learned about the wave’s cycles of EWT and now, it’s the time to know 3 basic rules applicable on waves. I am not explaining every rule and condition here in this topic but just stating three basic principles to remember that are the back bone of EWT. All the predictions, calculations of entry levels, stoploss and targets are based on these 3 primary rules only. These are: -

- Wave 2 can never correct more than 100% of wave 1, i.e. Wave 2 can never go below the start of wave 1.

- Wave 3 can never be the shortest wave in full 5 wave’s cycle. Means, wave 3 can never be shorter than both 1 and 5.

- Wave 4 cannot overlap wave 2, i.e wave 4 cannot go below the end of wave 1 or start of wave 2. There are exceptions in this rule that will be explained later.

Isn’t it easy to remember?

Though these three rules are not everything about Elliott Wave’s Theory but these three simple rules will help you a lot in identifying patterns, predicting levels and taking low risk entries in market for high profit. And I will explain everything in next chapters how to use these rules for profitable trading. For now, just remember these 3 rules.

This is the wave’s cycle that every financial Instrument including Stocks, Indexes, Commodities, and Currencies follows. Not only long term but every single move even a 5 minutes move have same wave’s cycle in its internal structure. It is a natural law, a path on which the stock market moves.

But this is just the start or you can say beginning or concept of Elliott wave theory. Though every financial instrument follows the same pattern but you will not see it clearly on real time charts as I shown in imaginary figures. Every wave of this Elliott’s Wave Cycle has separate personality, separate calculation and separate internal structure in different conditions.

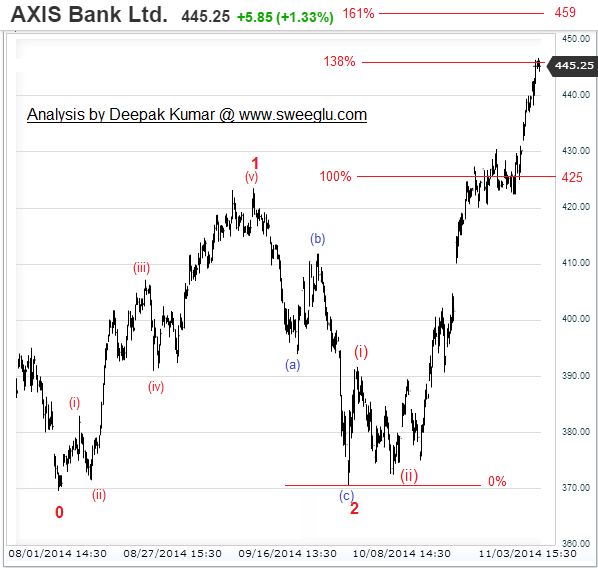

There are some real charts given below where I applied Elliott Wave Principles in real life and also traded on that. See every chart and read till the end.

Basics of Elliott Wave Theory Explained on chart