Computerized Investing_1

Post on: 29 Август, 2015 No Comment

by CI Staff

Volatility in the markets has seemingly been on the rise the last couple of years. As a result, many traders and investors are looking for methods of gauging the volatility in securities.

One popular tool is Bollinger bands, developed by John Bollinger in the late 1970s and early 1980s. Bollinger bands are volatility bands placed above and below a moving average of closing prices. The bands use standard deviation as the measure of volatilitythe bands automatically widen when volatility increases and narrow when volatility decreases. Bollinger chose standard deviation because of its sensitivity to extreme price deviations.

In this installment of Technically Speaking, we discuss the basics of Bollinger bands and some ways investors can use them in their analysis.

Construction

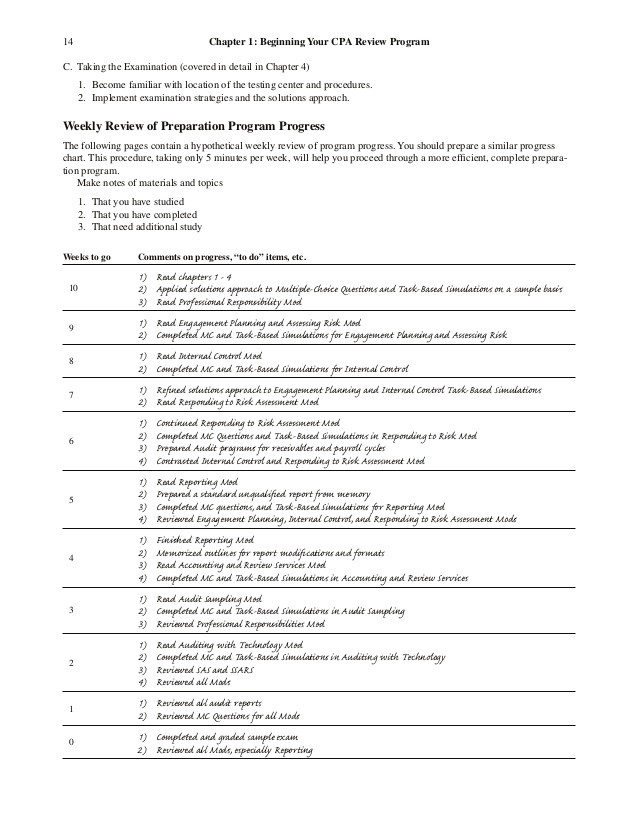

Bollinger bands consist of a middle band and two outer bands. The middle band is a simple moving average (SMA) of closing prices, usually over the last 20 periods to capture the intermediate-term trend. A simple moving average is used because a simple average is also used in the standard deviation formula for the two outer bands. Furthermore, the look-back period used for the standard deviation calculation is the same as the one used for the moving average middle band. The outer bands are usually set two standard deviations above and below the middle simple moving average band. In effect, Bollinger bands use moving standard deviations to plot bands around a moving average.

For our discussion here, we will be using closing prices in our simple moving average and standard deviation calculations. However, Bollinger points out that you can use typical price [(high + low + close) 3] or weighted close [(high + low + close + close) 4]. In addition, he feels that a 20-period look back is optimal for the overall stock market and individual stocks. Ideally, however, the look-back period you use should generate bands that provide support more often than they are broken, and they should contain roughly 90% of prices. If you find that the closing prices of the security or market you are tracking are frequently outside the outer bands, it is a good idea to increase the look-back period to further smooth the bands.

Bollinger bands are adjustable, allowing you to change the settings to match the characteristics of a particular security or to match your trading style. For example, you can change the number of periods used for the simple moving average. This, in turn, affects the number of periods used to calculate the standard deviation of prices for the outer bands. Therefore, Bollinger points out that only small adjustments are required to the standard deviation multiplierthe number of standard deviations above and below the moving average that the outer bands are plotted. If you increase the number of moving average periods, this increases the number of standard deviation periods, which in turn requires an upward adjustment in the standard deviation multiplier. Bollinger suggests the following settings:

- A 20-period moving average/standard deviation has a standard deviation multiplier of 2.0;

- A 50-period moving average/standard deviation has a standard deviation multiplier of 2.1; and

- A 10-period moving average/standard deviation has a standard deviation multiplier of 1.9.

Signals: Tops & Bottoms

As mentioned earlier, Bollinger bands can be used to identify tops and bottoms in price movements.

When looking for topping patterns, Bollinger bands can be used to identify W-Bottoms, which form when prices form successive lows, with the second low below the first. The important feature of the W-Bottom is that the second low fails to dip below the lower Bollinger band. A W-Bottom forms in four steps:

- The security forms a low, which is usually (but not always) below the lower Bollinger band;

- The price rebounds toward the middle moving average band;

- The price reaches a new low that is above the lower Bollinger band; and

- The W-Bottom pattern is confirmed when prices move off the second low and break through previous resistance.

If the price fails to dip below the lower Bollinger band when forming the new low, this is an indication that the downward price momentum is weakening.

Figure 1 shows a W-Bottom pattern that formed with Norfolk Southern Corp. (NSC) in SeptemberOctober 2011. Since Bollinger bands are constructed using closing prices, we opted to use a line chart of closing prices for identifying signals. If we had used a bar or candlestick chart, we would not be interested in intraday violations of the upper or lower bands; closing prices above or below the upper or lower Bollinger bands are what we are looking for.

As indicated by the first blue arrow, the price formed an intermediate reaction low in late September that was below the lower Bollinger band (lower solid red line). The price then rebounded toward the middle band, only to fall back below the previous low in early October. However, the price held above the lower band in a new lower reaction low. Finally, the price broke above the highs of late September and continued an upward march for the next few weeks.

Another way to use Bollinger bands is for identifying M-Tops. These patterns are similar to double tops, but the highs are not always equalthe second high may be higher or lower than the first high. Bollinger looks for signs of non-confirmation as a security is reaching new highs. According to Bollinger, the non-confirmation plays out in three phases:

- The security forms a high above the upper band;

- The price pulls back toward the middle moving average band; and

- The price moves back above the prior high but fails to reach the upper band.

The failure of prices to once again pierce the upper band is a warning sign that momentum is waning and a possible trend reversal is upcoming.

Figure 2 is an example of the M-Top pattern that developed with GrafTech International Ltd. (GTI) in July 2011. In late June, GTI moved above the upper Bollinger band (upper red line), only to pull back below the upper band in early July, finding support around $20.50. The price rebounded to near $22 in late July, flirting with the upper band but never closing above it. The M-Top pattern was confirmed when GTI broke below resistance at $20.50; additional confirmation came from the MACD (moving average convergence/divergence line; black line in lower section of chart), which moved below the signal line at almost the same time.