Common Stock v Stock and Stock Classes

Post on: 13 Июль, 2015 No Comment

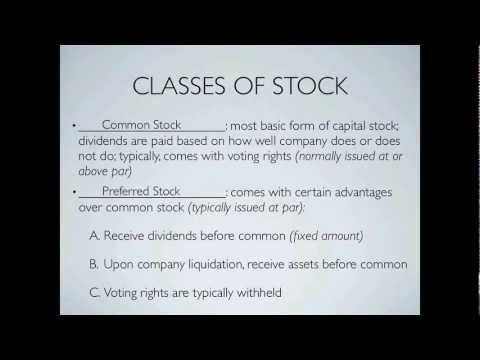

Stocks can be classified into many different categories. The two most fundamental categories of stock are common stock and preferred stock, which differ in the rights that they confer upon their owners.

Common Stock versus Preferred Stock

Common Stock

Most shares of stock are called common shares. If you own a share of common stock. then you are a partial owner of the company. You are also entitled to certain voting rights regarding company matters.

Typically, common stock shareholders receive one vote per share to elect the companys board of directors (although the number of votes is not always directly proportional to the number of shares owned). The board of directors is the group of individuals that represents the owners of the corporation and oversees major decisions for the company. Common stock shareholders also receive voting rights regarding other company matters such as stock splits and company objectives.

In addition to voting rights, common shareholders sometimes enjoy what are called preemptive rights. Preemptive rights allow common shareholders to maintain their proportional ownership in the company in the event that the company issues another offering of stock. This means that common shareholders with preemptive rights have the right but not the obligation to purchase as many new shares of the stock as it would take to maintain their proportional ownership in the company.

Although common stock entitles its holders to a number of different rights and privileges, it does have one major drawback: common stock shareholders are the last in line to receive the companys assets. This means that common stock shareholders receive dividend payments only after all preferred shareholders have received their dividend payments. It also means that if the company goes bankrupt, the common stock shareholders receive whatever assets are left over only after all creditors, bondholders, and preferred shareholders have been paid in full.

Preferred Stock

The other fundamental category of stock is preferred stock. Like common stock, preferred stock represents partial ownership in a company, although preferred stock shareholders do not enjoy any of the voting rights of common stockholders. Also unlike common stock, preferred stock pays a fixed dividend that does not fluctuate, although the company does not have to pay this dividend if it lacks the financial ability to do so. The main benefit to owning preferred stock is that you have a greater claim on the companys assets than common stockholders. Preferred shareholders always receive their dividends first and, in the event the company goes bankrupt, preferred shareholders are paid off before common stockholders.

In general, there are four different types of preferred stock:

- Cumulative: These shares give their owners the right to accumulate dividend payments that were skipped due to financial problems; if the company later resumes paying dividends, cumulative shareholders receive their missed payments first.

- Non-Cumulative: These shares do not give their owners back payments for skipped dividends.

- Participating: These shares may receive higher than normal dividend payments if the company turns a larger than expected profit.

- Convertible: These shares may be converted into a specified number of shares of common stock.

Since preferred shares carry fixed dividend payments, they tend to fluctuate in price far less than common shares. This means that the opportunity for both large capital gains and large capital losses is limited. Because preferred stock, like bonds, has fixed payments and small price fluctuations, it is sometimes referred to as a hybrid security .

Stock Classes

Although common stock usually entitles you to one vote for every share that you own, this is not always the case. Some companies have different classes of common stock that vary based on how many votes are attached to them. So, for example, one share of Class A stock in a certain company might give you 10 votes per share, while one share of Class B stock in the same company might only give you one vote per share. And sometimes it is the case that a certain class of common stock will have no voting rights attached to it at all.

So why would some companies choose to do this?

Because its an easy way for the primary owners of the company (e.g. the founders) to retain a great deal of control over the business. The company will typically issue the class of shares with the fewest number of votes attached to it to the public, while reserving the class with the largest number of votes for the owners. Of course, this isnt always the best arrangement for the common shareholder, so if voting rights are important to you, you should probably think carefully before buying stock that is split into different classes.