Commodities Funds

Post on: 25 Апрель, 2015 No Comment

Investors come in all flavors. Some are bold, whether they have the capital to lose or not. Some are cautious and regard capital preservation, with the hope of some small return over a long period, as the paramount value. Somewhere in between, but closer to the latter probably, is the territory for most fund investors.

Mutual funds — the perfect solution?

Serious, regular investing is the province of individuals who have the resources and can dedicate the time to turn trades over often. Most traders don’t have the time, the expertise, nor the risk capital to be in and out of the market so regularly. For such people, funds — in particular, mutual funds — are the perfect solution.

But stocks, bonds and other purely financial instruments aren’t the only items worth investing in. True enough, over long periods, the stock market performs better, on average, than most other investments. Somewhere in the range of 12% annual return, depending on the period chosen. But there are shorter periods, extending for several years sometimes, where other investments outperform the substantially. In recent years, that has been commodities. As a result, commodities funds have risen in popularity.

Commodities boom time

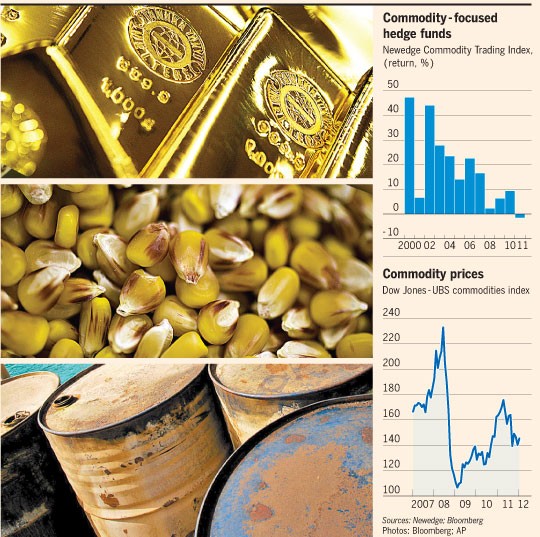

Since early 2000 commodities have risen substantially. Gold has increased over 25% and oil has nearly doubled. During this same period commodity funds have seen double-digit returns.

Pimco, for example, has over $12 billion under management in their commodity fund and from mid-2004 to mid-2005 garnered a return of 14.5%. Their next nearest competitor, Oppenheimer, with around $1.77 billion under management earned 19.5% during the same period.

Normally stocks and commodities tend in opposite directions. That was true for the period from 1974-2000, when the Dow Jones Industrial Average rose, while the DJ AIG Commodity index fell. But the last few years has seen a reversal of that historical trend.

No one can predict how long it will last. As financial advisers always say: ‘past performance is no predictor of future gains’. But during the last year the S&P 500 fell 0.5%, while the Dow Commodity Index rose 6.5%. Over the longer period from May 2000, the AIG Commodity index rose 47% vs. a 15% decline for Standard & Poor’s 500-stock index, assuming reinvested dividends.

It could end anytime, but given the pressure on oil and other energy source prices — which affects the price of everything else — it doesn’t seem likely to happen soon. Experts seem to agree, since most commodity funds are not selling short. Selling short would imply that speculators are betting on a decline in prices.

However, one has to look under the covers a little bit. Commodity funds often have substantial investments in items you might not normally consider a commodity — like U.S. Treasury securities. Pimco, for example, has over 90% of its assets in T’s.

But, technically, even financial instruments act like commodities in some markets, since they trade in the form of futures contracts on some of the exchanges. Not only do the instruments themselves sell as futures, but the indexes that tract the instruments do too.

So a commodity fund may have investments in commodities directly, or the futures contracts that cover them, or even indexes that track them. The latter may be three steps removed from something you can see and touch, but the profits are real.

The verdict on these commodity funds is.

Investing in them is one excellent way to diversify your portfolio and not depend solely on stocks or bonds.