Combining The CAPE Ratio With The PEG Ratio To Find The Cheapest S&P 500 Stocks

Post on: 3 Июнь, 2015 No Comment

Summary

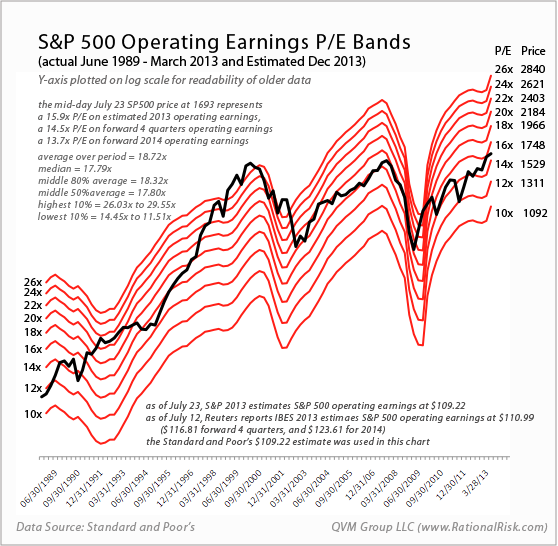

- The CAPE Ratio is often used to measure the value proposition of overall markets, but very rarely for individual stock selection.

- In the studies and research where individual stocks were selected utilizing the CAPE Ratio, positive returns were seen.

- But the use of CAPE Ratio for individual stocks has been criticized as being biased against stocks with high earnings growth.

- We are therefore presenting the CAPEG which is a modified PEG utilizing the CAPE for the P/E component and 10 years of EPS growth for the denominator.

- We have used this metric to rank the entire S&P 500 as of Friday’s closing price — here we provide a list of the cheapest 15 stocks per CAPEG.

Utilizing the CAPE Ratio as a tool for investing and for crafting a portfolio allocation strategy has generally been done through three separate approaches.

A) Applying a sector based approach as Shiller has done with his ETN (NYSEARCA:CAPE ). You can read more about this here .

B) Applying it globally on a per market basis as Meb Faber has done with his ETF (NYSEARCA:GVAL ). You can read more about that strategy here and then also here. Or, you can read his book on Global Value. Meb Faber also put together a nice library of links for understanding all about the CAPE Ratio if this is new to you.

C) In the final approach, one can utilize the CAPE Ratio in order to craft a portfolio of individual stocks. I discuss this approach in this article here and show that it has some success and even the potential for doubling the S&P 500’s rate of return. Another study on utilizing the CAPE Ratio for individual stock selection was conducted by Wes Gray and Jack Vogel where they backtested the method and found it to be useful (although not the most optimal cyclically adjusted metric).

In analyzing these three approaches, one must consider what one is attempting to discover by utilizing the CAPE Ratio. The sector-based approach is attempting to capture value based on currently undervalued segments and then rebalancing and realizing the gains. The global value approach is attempting to find rock bottom economies, buy them cheaply and turn them over for a profit. Possibly the riskiest method is the individual stock approach, which attempts to find the most discounted stocks in the entire market in an effort to realize value.

But a real problem emerges with respect to utilizing a modified version of the P/E for individual stock evaluation. Often we see the same trouble with respect to the normal TTM P/E. A P/E can easily be quite high, while an investor intuitively knows that it makes sense to invest in the stock anyhow because the growth rate is also very high. Naturally this is the definition of the PEG ratio .

About two weeks ago I presented a list of stocks utilizing a modified version of the PEG which I named the CAPEG. People had written to me prior to that point indicating that growth should be considered with respect to the stocks selected utilizing the CAPE. This thought process was reiterated by some other commentators on the subject. But the trouble with the list I presented was that it consisted of the lowest S&P 500 stocks sorted by CAPE with their CAPEG listed alongside it as a secondary consideration. Additionally the CAPEG was utilizing only one year of growth in the denominator whereas probably it would have been better to use ten years of growth.

It is much more complicated than it sounds from a data manipulation standpoint, but in summary the formula runs along these lines:

This is essentially the usual PEG except that it looks more complicated simply because of the various adjustments for the 10 years of earnings, inflation, etc. But it is ultimately only the usual CAPE divided by the average Annual Growth for 10 Years.

I ran the above stated formula against the entire S&P 500 (SPY ) (obviously doesn’t work for a few stocks because they don’t have ten years of earnings), and created the list of Cheapest 15 stocks on the index as ranked by CAPEG.

So here is the list:

Will this work for a portfolio approach? I’m not sure just yet. But it seems to make sense from a theoretical standpoint, right?

One thing you’ll notice right away is how awkward these stocks look standing together on the same list. Based purely on CAPE, and even other value investor metrics, Apple (NASDAQ:AAPL ) seldom shows up. However based on the average annual earnings growth over the last ten years, it qualifies as a member of this list. Apple shows up right alongside Transocean (NYSE:RIG ), the dog of the market at the moment.

In theory, PEG ought to be adjusted with respect to dividends as well. I haven’t done that for the CAPEG list as this would need to be done across 10 years which becomes rather cumbersome.

We will need to further explore the CAPEG through backtesting and possibly tweak this metric more. It would seem however, that this presents a logical approach to harness the power of the CAPE in a way that eliminates its bias against high growth stocks. While this theoretical and intuitively reasonable approach might not work, it certainly seems like a good method to explore further.

I appreciate any feedback on the potential utilization and improvement of the CAPEG.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.