Clouds Over Solar Energy ETFs May Soon Pass TAN KWT QCLN TSLA

Post on: 27 Март, 2015 No Comment

After a banner year in 2013, smoking-hot solar energy ETFs seem to have lost some sizzle.

But the downdrift this year is relative and the outlook for the alternative energy sector remains bright, analysts who spoke to IBD said.

Valuations have become more rich, but with solid growth prospects ahead, the industry still continues to do well, said J.J. Feldman, portfolio manager with Miracle Mile Advisors in Los Angeles.

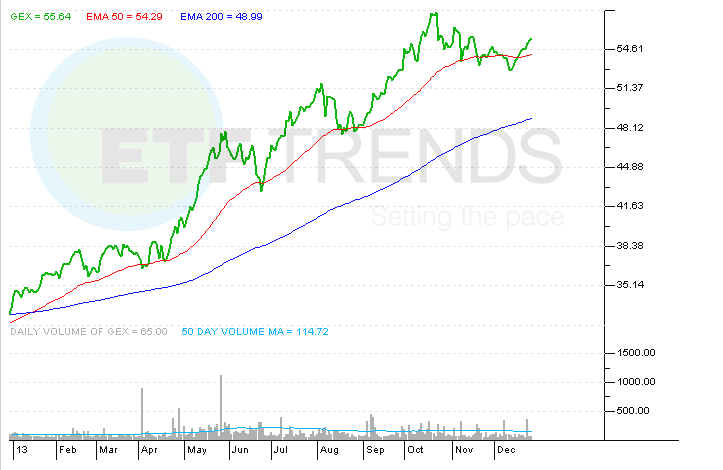

Guggenheim Solar (ARCA:TAN )and Market Vectors Solar Energy (ARCA:KWT )rose to 2-year highs on March 6, but they hit turbulence soon after.

They tumbled after investors grew wary about tepid growth in the U.S. and Chinese economies.

With the momentum stock meltdown in March/April, solar stocks definitely got hit, Feldman said.

Further complicating matters, the Commerce Department in June slapped a stiff 19% to 35% tax on Chinese solar panels in response to what were deemed unfair government subsidies to manufacturers. TAN and KWT’s sizable exposure to Chinese solar companies was duly noted by investment experts.

As a result of the trade dispute, U.S. solar stocks such as SolarCity (NASDAQ:SCTY ) and SunPower (NASDAQ:SPWR ) should benefit in the short term at least, said Barry Fennell, a senior research analyst with Lipper. He added that their medium-term outlook is bright as well if they control costs and offer attractive contracts to customers.

Cloudy Skies?

The 2013 banner year for solar ETFs was attributed to favorable green trends and President Obama’s climate change plan.

While investors have collected impressive 20% and 14% gains in the stock market from TAN and KWT so far this year, those numbers are well below their respective 128% and 105% returns in 2013.

Describing last year’s numbers as truly extraordinary, Feldman said: so the returns this year are still very strong and would be considered to be in an upward trend.

By comparison, iShares Russell 2000 Index (ARCA:IWM ), which tracks small-cap U.S. stocks, is up 0.42% year-to-date, following a 39% climb last year. SPDR S&P 500 (ARCA:SPY ) is up 7% this year after gaining 32% in 2013.

TAN’s $456 million in assets makes it the largest ETF in the alternative energy space. KWT has $29 million.

The top holdings of both funds show considerable overlap with eight of their top 10 held in common and neck-to-neck concentrations in equities grouped by sector and market capitalization. While KWT costs slightly less than TAN 0.66% vs. 0.70% returns for both have been very close most years since their 2008 launch. Feldman described TAN’s better performance in 2013 as an outlier.

Also, both ETFs are forming potential bases and testing support at their 10-week moving averages.

Outlook For Alternatives

More broadly, in the alternative energy sector, an offering such as First Trust Nasdaq Clean Edge U.S. Liquid Series (NASDAQ:QCLN ) has outperformed both TAN and KWT over the three- and five-year periods.

This ETF is more diversified and not nearly as focused on solar, said Feldman, noting that it holds Tesla (NASDAQ:TSLA ), Cree (NASDAQ:CREE )and Linear Tech (NASDAQ:LLTC ). QCLN has returned 10% to investors so far in 2014, vs. 94% last year.

Future growth in solar and alternative energy ETFs will likely be driven by fossil fuel constraints, as well as investors who believe in the principles of ethical investing, Fennel said.