Closing of unloved ETFs could start a trend

Post on: 5 Апрель, 2015 No Comment

Investors in exchange-traded funds are learning that you’d rather be in what sticks than what falls by the wayside.

Invesco PowerShares Capital Management announced recently that it would close 19 ETFs on May 18, the single biggest mass killing of ETFs in the history of the business and the continuation of a small trend that started in 2008, involving the liquidation of tiny funds that can’t attract any market share.

After carefully evaluating numerous factors including shareholder considerations, length of time on the market, asset levels and the potential for future growth, we proposed closing certain portfolios that have not gained sufficient acceptance with investors, Bruce Bond. president and chief executive of Invesco PowerShares, said in a statement. We remain fully committed to the ETF industry and expect to offer new, exciting products in the months ahead.

And therein lies part of the problem: The ETF business is currently in the rapid-growth phase, where every idea, no matter how scatterbrained, gets a tryout. Fund companies are so anxious for market share that they’re throwing every concept at the wall to see what sticks.

In the PowerShares case, the funds that have fallen are a rogue’s gallery of the uninspired and unloved. While the 19 funds represent nearly 15 percent of the PowerShares lineup, their $122 million amounted to less than 0.5 percent of the company’s assets under management.

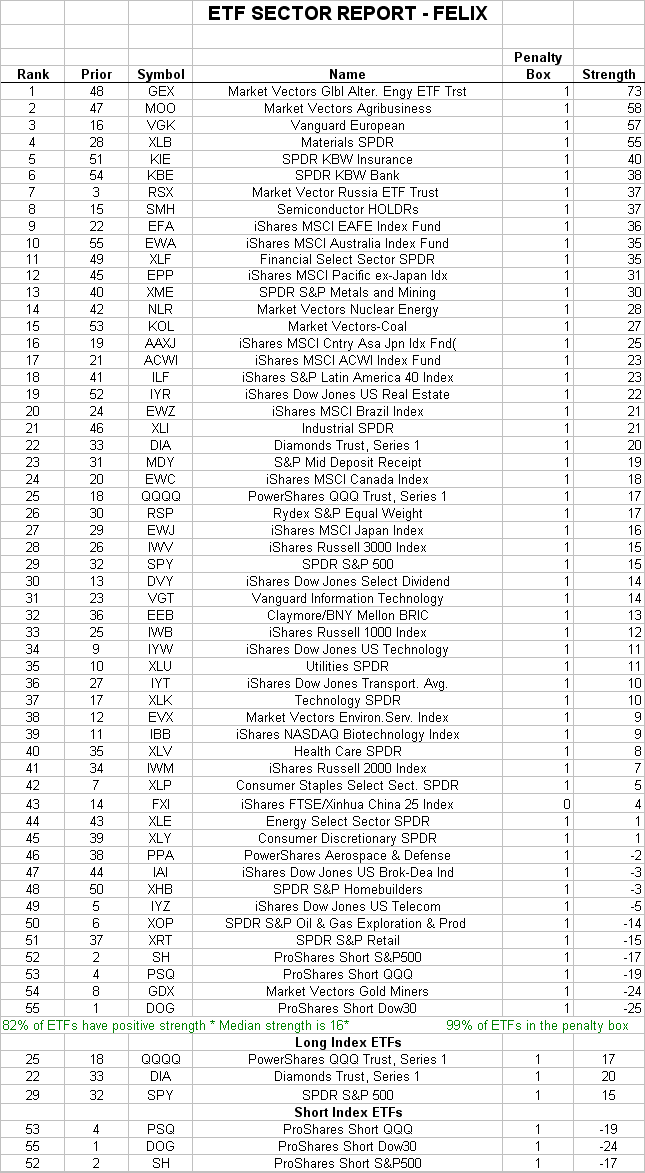

Whether the move will be the launching pad for a spate of fund closings is an open question. Last year, the Claymore funds liquidated 11 issues, and experts thought it might be the start of an industry-wide wave. That never materialized; in fact, several firms with small issues said the low cost of running an ETF would keep funds open indefinitely. Ironically, one of those companies, XShares, wound up closing its entire line of HealthShares ETFs before the end of the year and put several of its new ideas on hold.

And yet, because many investors are still new to ETFs — and because the new-fund machine is starting to crank out actively managed ETFs that may never get much traction — it’s important to know how to respond if your fund is on the chopping block.

ETFs typically are built like an index mutual fund but trade like a stock. Under most conditions, they track the price of an index closely but tracking error tends to rise when a fund is small or when management starts to sell holdings as part of the liquidation process.

For example, when the last four HealthShares funds bit the dust in 2008, they all traded at market prices below their net asset value. HealthShares Drug Discovery Tools, for example, was trading at $21.44 on Nov. 26, when its net asset value was nearly $1 per share higher. An investor who held the fund before liquidation was announced, therefore, could have taken a loss of nearly 5 percent simply because the fund was going through the process of shutting down.

The more illiquid the securities in a fund, the bigger the difference is likely to get; in funds invested in large-cap stocks or big indexes, the discount to net asset value could stay small.

While there are traders who might try to take advantage of that gap, the typical investor has a different decision to make, namely if they get out at a price that may be discounted to net asset value or if ride all the way to the fund’s final trade, which may include a bounce-back that minimizes any pricing discrepancy.

The advantage to selling is that you get your money back right away and can put it to work in something else, said Tom Lydon. editor of the ETF Trends newsletter. But there’s not some big downside risk to staying in the fund until the bitter end, when they will send you a check.

In either case, if you hold the ETF in a taxable account, the fund’s liquidation will give you either a taxable gain or a realized loss.

You may be able to avoid the hassle entirely by sticking with funds that have at least $25 million in assets, where the investment premise has attracted some interest and earned the fund the right to live.

A lot of ETFs could go away, because they’re based on ideas that just haven’t caught on with investors, Lydon said. No one has really bought these funds, so no one will miss them.