Closedend Funds Bonds and Stocks

Post on: 20 Июль, 2015 No Comment

Closed-end funds (CEFs), also know as closed-end companies, are one of three basic type of investment companies:

3 Forms of Investment Companies:

Closed-end Funds

Mutual Funds

Unit Investment Trusts (UITs)

Closed-end Funds

Closed-end funds are a popular type of investment whose shares are listed on a public stock exchange or traded on the over-the-counter market. Like other publicly traded securities, their value fluctuates and is determined by supply and demand.

Unique Characteristics of Closed-end Funds :

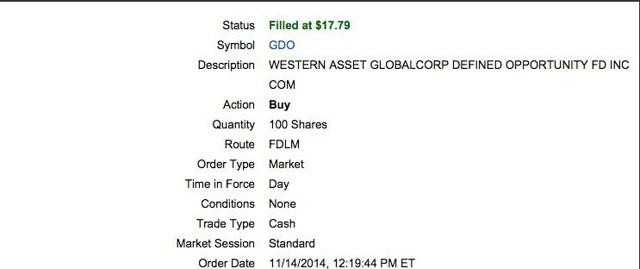

A). Closed-end funds sell a fixed number of shares in an Initial Public Offering (IPO). After the IPO, shares are traded on a secondary market, such as the New York Stock Exchange (NYSE) and Nasdaq Stock Market (NASDAQ).

B). Closed-end funds trading on a secondary market may be priced above or below the shares Net Asset Value (NAV).

C). Shares of closed-end funds are not redeemable and the fund is not required to buy back its shares from investors..

D). Closed-end funds are permitted to invest in more illiquid securities than mutual funds. For this reason, funds that invest in illiquid markets are generally organized as closed-end.

E). Closed-end funds are managed by professional investment advisors registered with the Security and Exchange Commission (SEC) and subject to numerous requirements under the Investment Company Act of 1940. the Securities Act of 1933 and the Securities Exchange Act of 1934.

Investors, both large and small, can purchase shares in these funds like in ordinary open-end funds (best known as mutual funds). They are managed by a team of professionals according to the fund’s unique investment philosophy, objectives and policies. Fund managers can invest in stocks, bonds or a combination of both. Unlike open-end funds they have a fixed number of shares outstanding and once they have an initial public offering they will be traded much like a stock.

Closed-end Funds vs. Traditional Mutual Funds (open-end funds):

1. After it begins operating, Closed-end Funds are closed to new funds and new shares are rarely issued after the fund is launched. Shares are not redeemable for cash until the fund liquidates.

2. Shares in a closed-end fund are available for purchase by buying on the secondary market or stock exchanges. They are available from brokers, market makers and investors; while the typical Open-end Fund has all transaction eventually involving the fund company creating the new shares.

3. Unlike open-end funds, which are traded only at the closing price at the end of the day, closed-end fund shares are traded like stocks continuously throughout the market day at whatever price the market will support at that moment. Some investors like that limit orders and stop orders can be used with closed-end funds as well. Open-end funds only trade at the close of each business day and do so at the calculated Net Asset Value or NAV. Since the value of the NAV changes throughout the day, buyers and sellers place orders in advance of the calculation and some funds require that orders be place hours, even days in advance of the transaction.

4. The price at which shares of a closed-end fund are sold is usually at a premium or discount to the value of their holdings. For long-term holders buying a fund at a discount can substantially improve returns — a feature many investors like. For short-term traders, being able to buy when discounts are deeper and sell when they are less is also an advantage for many.

5. Open-end funds sell at the Net Asset Value, abbreviated NAV. Calculating mutual fund net asset values is fairly easy — you simply take the market value of the fund’s net assets and divide by the number of shares outstanding. Example: if a fund had net assets of $60 million and there are one million shares of the fund, then the price per share or NAV would be $60.00.

6. Leverage, often called gearing, is used to enhance returns. Like any use of leverage, gearing increase returns when the market is going up, and likewise reduces returns when the market is heading lower.

7. Closed- end funds trade like stocks and investors pay commissions in the same way. With open-funds, commissions typically vary based upon the share class, method used to purchase and annual fees.

8. CEFs usually have fees that are much lower than mutual funds because they don’t have the expense of creating and redeeming shares. Additionally, they tend to keep far less cash in their portfolios. Because of their structure, a closed-end fund may snap up bargains if prices become irrationally low, while open-ended funds might be forced to sell too early because of redemptions.

9. In order to be a part of the exchanges, Closed-end Funds must obey certain rules, such as filing reports with the listing authority and holding annual stockholder meetings. These requirements provide stockholders with more information about their fund and support shareholder activism, such as protests against poor management.

Closed-end Funds vs. Exchange Traded Funds (ETFs):

Closed-end funds trade on exchanges so they may seem much like Exchange Traded Funds or ETFs. However, there are several important differences between the two

1. The price of a closed-end fund is determined entirely by the valuation of the market at any moment. This price of tern diverges substantially from the NAV of the fund’s holdings. Closed-end funds can sell at a premium or discount sometimes has high as twenty percent. By comparison, ETFs trade in an extremely close range to its NAV, typically less than one-fifth of one percent.

2. Closed-end funds have a limited number of shares.

3. Like Closed-end Funds, ETFs are made up of a basket of stocks or bonds and trade freely on an exchange; however, unlike CEFs, they usually track an index and are not actively managed like Closed-end Funds.

4. Many feel that ETFs tend to be more tax efficient since they do not distribute capital gains to the same extent as actively managed funds.

Also, if there is a market panic, investors may sell en masse. Faced with a wave of sell orders and needing to raise money for redemptions, the manager of an open-ended fund may be forced to sell stocks he’d rather keep, and keep stocks he’d rather sell, due to liquidity concerns (selling too much of any one stock causes the price to drop disproportionately). Thus all it may have left are the dud stocks that no one wants to buy. But an investor pulling out of a closed-end fund must sell it on the market to another buyer, so the manager need not sell any of the underlying stock. The CEF’s price will likely drop more than the market does (severely punishing those who sell during the panic), but it is more likely to make a recovery when the intrinsically sound stocks rebound.

Any securities or investments mentioned within this web site are for illustrative and informational purposes only. They should not be regarded as an offer to sell or as a solicitation of an offer to buy any security. Past performance is no guarantee of future results- investors can and do lose money. Closed-end.com does not sell, offer or provide any investment advice. We provide no opinion regarding the value, suitability or profitability of any particular security, portfolio of securities or investment strategy. Your investment decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance, and liquidity needs. Always consult with your own personal financial advisor, attorney, CPA or other qualified professional.