Closedend Funds Are Attractive

Post on: 20 Июль, 2015 No Comment

Error.

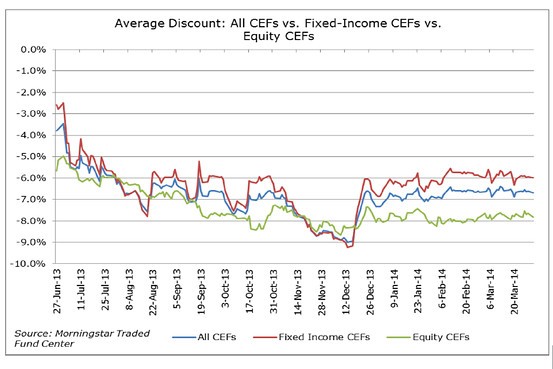

With the fixed-income markets last week scrambling to adjust to the prospect—however distant—of tighter Federal Reserve policy, investors might want to think about income-generating alternatives. Some closed-end funds fit the bill.

Unlike standard mutual funds, closed-ends issue a set number of shares and trade like stocks and exchange-traded funds. CEFs, however, can and do change hands at prices above (at a premium to) or below (at a discount to) their net asset value. ETFs, in contrast, rarely stray from their NAVs, and open-end mutual funds continually issue and redeem shares at their net asset value. Most closed-end vehicles are created to generate steady cash flows for investors, which is what makes them attractive right now.

As critics point out, they do have shortcomings: CEFs can be illiquid, and it isn’t possible to write options on them. Many ETFs do have options available, which can be used to leverage a position.

CEFS ARE ACTIVELY managed, while ETFs are usually based on a broad market index or specific sector. CEF expense ratios, on average, are higher than the 1% or so that most open-ended mutual funds charge. One advantage that CEF managers have over their open-end counterparts is that they don’t have to worry about shareholder redemptions when the market goes south because there are only a finite number of shares available. That makes them more suitable for relatively illiquid asset classes, such as foreign securities and certain fixed-income strategies. However, you might want to be cautious about funds with long-term bonds at the moment.

I’ve been using a half dozen or so CEFs to generate income for two relatives who’ve handed me their portfolios. (I am not a certified financial planner, but three decades tracking financial technology has helped me develop certain skills.) My introduction to CEFs came at Barron’s. I would sort through our lists searching for those trading at a discount (because I like a bargain). The Barron’s list these days also can be found online under Market Data by clicking on the Stock and Fund Tables menu choice. You can choose the weekly Closed End Fund report, or the quarterly table. Unfortunately, these tables are not sortable—I used to go through the printed versions with a highlighter and a notepad. But searching for suitable CEFs online is much easier.

One site that I always visit when re-evaluating the list of CEFs that I track and trade is run by the Closed-End Fund Association (cefa.com ). Under the Learn tab, you’ll find an overview of CEF basics, which is a short read but well worth perusing. Down the left-hand side of the page you’ll find Managed Distributions, which is a unique tool comparing different types of CEF payouts, allowing you to determine whether a fund is making promised payouts from income or from return of capital. Most tables show the distribution yield of a fund, which some investors may assume is from the income generated. But it actually include a return of capital, which means the fund is giving investors their own money back.

Another site I like is CEF Connect (CEFconnect.com ), which bills itself as the authority on closed-end funds. Its screener lets you search for tax-free income by state, among other criteria. It can also sort by discount, premium, yield, and return. CEF Connect provides a link to a fund’s Website, which usually provides even more detail. It also lists fund expenses. A closed-end fund has little incentive to minimize expenses, since it’s not looking to market more shares, like a regular mutual fund. A high expense ratio may account for a closed-end fund’s discount, in which case it’s no bargain.

You can use the site without registering, but there are more tools for registered users, including fund alerts and a portfolio tracker. There is no fee for registering. The site is sponsored by Nuveen Closed-End Funds, but the sponsorship is not terribly intrusive.