Closedend funds

Post on: 7 Июль, 2015 No Comment

Keep your eyes open for a good closed-end fund

By Laura A. Bruce • Bankrate.com

Do you work for a company that allows you to buy company stock at a discount to the market price? Obviously you should show a better profit than someone who pays market price for the same stock.

There’s a way to do that with mutual funds, too, and it’s not a corporate perk. Anyone can do it.

There are two basic types of mutual funds. Open-end funds, or OEFs, comprise the vast majority of mutual funds offered to investors. These are what are usually meant by the term mutual funds.

Closed-end funds, or CEFs, are rarely referred to as mutual funds. They’re simply called closed-end funds. There are about 500 CEFs. They make up a tiny portion, some estimate 2 percent, of the mutual fund market. Don’t confuse CEFs with closed funds (mutual funds that are no longer accepting new investment dollars).

Closed-end characteristics

The closed-end aspect of CEFs means the fund is a closed pool of assets, according to Jack Perry, a financial adviser with Raymond James and Associates in Indianapolis.

When a fund is created, there’s an initial public offering and the NAV (net asset value) is established. The NAV is determined by subtracting the fund’s liabilities from its assets and dividing that number by the number of outstanding shares. The number of shares in the fund is fixed and after it’s set up, no money is added to or withdrawn from the fund.

- advertisement -

The money they’ve got is what they’ve got. It’s fixed. They can make it grow just based on their investment expertise, says Perry. The portfolio manager doesn’t have to deal with the cash flow problems of redemptions and new deposits that the open end manager does.

CEFs are traded just like a regular stock. If you want 100 shares of a particular fund, you contact a broker who finds someone who has 100 shares they want to sell. That’s different from the standard mutual fund where the fund issues new shares whenever an investor wants to buy and also ponies up the cash (by possibly selling fund assets at a loss) whenever an investor wants to redeem his or her shares.

If you want to buy or sell a standard mutual fund, you pay, or receive, the NAV. While CEFs have a NAV, they also have a market price because they trade on the exchanges — mainly the New York Stock Exchange, a few on the American. If you wanted to buy or sell a CEF, you’d pay, or receive, the market price.

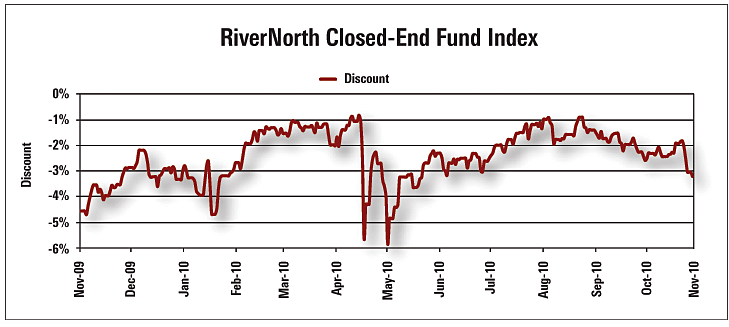

This is where the biggest benefit — or biggest drawback — comes in. The difference between the NAV and the market price is called the discount or the premium. The fund is trading at a discount if the market price is less than the NAV; it’s trading at a premium if the market price is higher than the NAV.

It’s this two-tiered pricing system that allows the discount — or premium — to exist. The discount is the key reason people buy closed-end funds.

For instance, Blue Chip Value Fund has a NAV of $7.84 as of this writing. Its market price is $7.40. That means you can buy it at a 5.6 percent discount. On the other hand, MFS Special Value Fund has a NAV of $10.27 but its market price is $14.95 — that’s a premium of 45.6 percent.

Cashing in on closed-end funds

Historically, CEFs trade at a discount. Brian Smith of the Kansas City, Mo. -based Closed-end Fund Association, says, on average, funds that specialize in U.S. stocks are currently selling at about an 8- to 11-percent discount. You wouldn’t necessarily have to wait for those funds to trade at a premium to make money. If you buy a fund at an 11-percent discount and you sell when it’s at a 5-percent discount, you’d still make a profit.

The CEF market is one of the few places in the investment world where you can buy a dollar’s worth of assets for less than a dollar. That is huge, says Jack Perry.

Most investors probably wouldn’t want to buy a fund at a premium, especially one as high as 45 percent. But if you’ve done plenty of research, perhaps you agree with whatever bullish investor sentiment has driven up the price of that particular fund and perhaps you believe it will go even higher.

CEFs can often be used as a hedge against market downturns.

Brian Smith says the average U.S. stock CEF returned 11.2 percent last year at a time when the S&P was down 9.1 percent.

CEFs are often more value-oriented, says Smith. It’s not an absolute, but a general statement. Clearly, investments have cycles. CEFs aren’t immune to that.

When the creation of the tech bubble was dominating, there wasn’t much interest in CEFs. That led to widening discounts. Smart investors realized that’s often an opportunity. It was at this time last year that investors were returning to value investments. CEFs generated strong returns in terrible market conditions.

CEFs can also increase the value of a dividend. Dividends are set based on the NAV. An investor who buys the fund at a discount essentially increases the dividend’s yield, according to Smith.

Dividends reinvested at a discount have the potential for accelerated growth for the return. And if the fund moves toward a deeper discount they aren’t concerned because they’re reinvesting at lower and lower levels.

While many stock investors scramble to invest in IPOs (initial public offerings), it’s probably safer to stay away from the IPO when it comes to closed-end funds. Unlike stocks, CEF share prices almost always drop after the IPO.

Not only could it be safer to wait and buy the fund at a discount, but an underwriting charge is built into the IPO. Morningstar, the Chicago-based company that provides stock and mutual fund information, says the underwriting charge can be as much as 7 percent. Brian Smith disputes that and says it’s closer to 3.5 percent to 5 percent.

Just as with stock purchases and sales, you’ll pay a commission to a broker when you trade a CEF. And, just as with a mutual fund, you’ll take periodic taxable distributions, unless the fund is held in a tax-deferred account.

What you’re buying into

CEFs cover a variety of sectors including general equity, specialized equity, income and preferred stock, foreign and bond funds. In fact, the majority of CEFs are bond funds. One reason is CEFs can invest in some areas that are out of bounds to standard mutual funds.

The bond funds have been very popular, according to Brian Smith. They’re universally recognized as being better products than the open-end bond funds because of the opportunity to leverage a portion of their assets into less quality, but potentially higher yielding bonds.

Junk bonds form a small portion, maybe 5 percent. They’re for someone who really understands what they’re investing in and how it will enhance their portfolio.

Gregg Wolper, senior analyst at Morningstar, says knowledgeable investors may want to explore this area of CEFs but others should be very careful.

If I borrow money at 4.5 percent and invest in more bonds at 7 percent, that spread goes into the fund and raises the yield. Open-end funds can’t do that; it’s against the guidelines. They can only borrow up to half their assets, and they don’t really know what their assets will be from day to day because of withdrawals.

A CEF has no withdrawals, so many CEFs use this technique. But there’s a risk. If the market goes down, a leveraged fund goes down further.

Wolper says there are good investment opportunities with CEFs, especially because of the leverage and discount features. Nevertheless, he’s not a fan of new investors getting involved with CEFs.

A regular mutual fund is easier to understand. You buy at a certain price and sell at the price of the portfolio. A CEF has two levels of prices, and it can be a little hard to correlate those for a new investor. Even for a more sophisticated investor to know the better times to buy and sell a CEF can be complicated.

Selecting a fund

At least three national publications, The New York Times. The Wall Street Journal and Barron’s. publish separate listings of closed-end funds once a week. The listings will show the NAV, market price and the amount of the premium or discount.

For more detailed information visit the Closed-end Fund Association Web site and Morningstar. Individual financial services firms such as Raymond James or Fidelity may also have information on closed-end funds.

Brian Smith says the typical investor should first focus on whether the fund meets their asset allocation criteria.

Is there a good offering in the sector — small cap, aggressive growth? From there look at the performance history of the fund. Look at the NAV both short and long term and look at the performance of the fund in the given market conditions, says Smith.

At that point, Smith advises looking at the fund manager’s track record with the fund.

If you have a good feeling, then the premium/discount becomes an interesting play. Look at it in its historical context, too. If it’s trading at an 8-percent discount, that shouldn’t necessarily be a concern if the historic discount is in the 6-percent to 10-percent range. When it falls outside that normal range, then you need to know why.

The silent treatment

One reason many people aren’t familiar with CEFs is they’re rarely advertised. The nature of the fund is that it has a fixed capital base. Generally speaking, the fund can only grow through the expertise, or good luck, of the manager. That also means there isn’t much money for advertising the fund. Jack Perry of Raymond James says that makes CEFs a good bargain for investors.

Stop paying retail! Clients buy mutual funds because of marketing.

Perry also says many financial advisers opt not to sell CEFs because the commissions are usually smaller than with open-ended funds. In fact, Perry, who’s based in Indianapolis, says investors may have to do a little searching to find an adviser who’s well versed in CEFs.

It’s a niche. A couple months ago, for the five states surrounding Indiana, there were about 10 or 11 financial advisers listed on the Closed-end Fund Association Web site.

If you have a balanced portfolio of mutual funds, stocks, bonds and cash, you may want to consider adding closed-end funds to the mix. As always, do plenty of homework and talk to a professional who understands your goals and risk tolerance.

— Posted: April 27, 2001