Climate Change And Your Portfolio

Post on: 14 Июль, 2015 No Comment

According to the consensus of scientists around the world, the evidence for climate change has now become undeniable. As weather patterns grow more extreme, so may the ramifications for one’s portfolio. Although storms, droughts, floods, and public policy changes are hard to predict, that shouldn’t stop investors from preparing for such events well ahead of time.

(Source:NASA .gov)

Energy

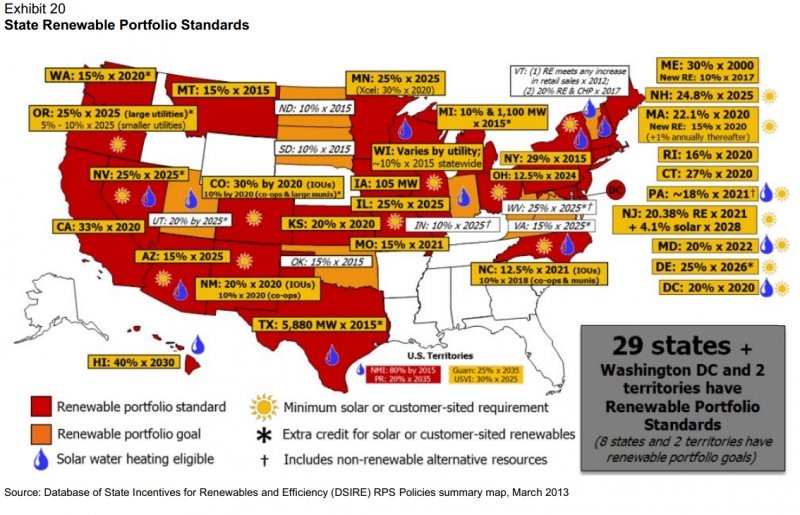

The primary concern for energy investors right now should be sustainability. Renewable resources such as solar energy and biofuels may be better for our environment, but have generally made poor investments at this early stage in their technological development. Non-renewables, such as oil and natural gas, have been great investments for the last century, but must be viewed with caution as petroleum production has likely already peaked .

Still, the lack of growth in oil production doesn’t necessarily spell doom for companies like Exxon Mobil (NYSE:XOM ), BP (NYSE:BP ), Royal Dutch Shell (NYSE:RDS.A ) and Chevron (NYSE:CVX ). A tighter supply, or even perception thereof, should lead to higher prices and greater profits for many oil giants in the coming years.

(Source:OregonEconomicAnalysis.com )

Don’t expect their biofuel projects to come to the rescue anytime soon. BP and Shell may still need government help to support their efforts to make ethanol from cheap Brazilian sugar cane; Exxon keeps trying but it still hasn’t figured out how to grow algae effectively ; and Chevron has essentially abandoned its Catchlight biofuel project .

Natural gas prices look to remain cheap for the coming decade. and public policy should reinforce this likelihood, as climate change concerns have led to its perception as being a clean energy source. Natural gas producers may end up scoring new government subsidies to ensure low prices, but that sort of possibility can’t be relied upon. Until then, investors should make the weighting of oil to natural gas an important point during their consideration process. A large dividend, rapid dividend growth, and other share-holder friendly measures should also be present, due to the potential collapse of fossil fuels in the distant future, as well as the continual risk of massive oil spills. Because of these concerns, I would not suggest using a DRIP for any oil or gas investments, but to reinvest those dividends elsewhere instead.

Renewable energy companies likely already hold a place in the portfolio of every investor who has been preparing for climate change. With their technologies still relatively new and unproven, competition and volatility should remain intense for green companies in the near future, which is why I’d suggest the more cautious approach of ETFs. The NASDAQ Clean Edge Green Energy Index Fund (NASDAQ:QCLN ) is heavily weighted with over 16% of its value in Tesla (NASDAQ:TSLA ), and the Guggenheim Solar ETF (NYSEARCA:TAN ) is almost 10% First Solar (NASDAQ:FSLR ). As an investor who appreciates diversification, I prefer funds like PowerShares WilderHill Clean Energy Portfolio (NYSEARCA:PBW ) or PowerShares Cleantech Portfolio (NYSEARCA:PZD ), where the largest holdings are at around 3% currently.

Nuclear power deserves its own consideration, due to its enormous potential and unique problems. Modern nuclear plants are far less dangerous than previous generations, but the American public has remained unconvinced that more plants should be built ever since the Three Mile Island accident. Keeping that in mind, Market Vectors Uranium+Nuclear Energy ETF (NYSEARCA:NLR ) is weighted 83% toward international stocks and 12.7% American stocks, and its holdings are fairly balanced between utility, industrial, and basic material companies. In contrast, iShares S&P Global Nuclear Energy Index Fund (NASDAQ:NUCL ) and PowerShares Global Nuclear Energy Portfolio ETF (NYSEARCA:PKN ) are both weighted with about 39% American stocks, and the majority of their holdings are utility companies.

The only place in the energy sector where I wouldn’t invest at any valuation is coal, with the EPA and public perception being the two primary reasons. Clean coal is a myth. or at least economically untenable. and coal can be quite the immoral industry as well. The world is increasingly aware as to what the air looks like in Shanghai. and I believe strict air pollution legislation is as certain to come as climate change itself.

Insurance

Property and casualty insurance companies face some of the largest risks from climate change. With the rate of natural disasters increasing, companies like Allstate (NYSE:ALL ), Travelers (NYSE:TRV ), and American International Group (NYSE:AIG ) will have to walk a fine line between increasing the cost of coverage and maintaining enrollment.

(Source: Munich Re )

However, the threat of increasing catastrophes shouldn’t scare investors away from this sector. The insurance industry has been modeling the likely effects of climate change on its own, and should remain capable of pricing its products appropriately in different regions. This type of preparation combined with reinsurance coverage ought to mitigate their risks significantly, while a growing fear of climate events should help provide a continual flow of new and eager customers.

Finally, consider customer satisfaction surveys. which may give some indication as to these companies’ hidden growth potential. An honest insurance company may have worse margins today, but even more customers tomorrow, as good and bad reviews alike spread quickly in the digital age.

Agribusiness

Agricultural businesses like Archer Daniels Midland Co. (NYSE:ADM ), Monsanto Co. (NYSE:MON ), and Bunge Ltd. (NYSE:BG ) will have to endure an increasing variety of threats from climate change, though they will also be amongst those providing the answers to these global problems.

As climates shift by just a few degrees, the variety of crops that can grow in a region change as well. Pests from neighboring lands and the diseases they carry will challenge new ecosystems. Water shortages could cripple the agricultural output in certain areas. as farming becomes either economically or politically unfeasible. In many other places, too much water will be the problem, as rising sea-levels, flooding, and the associated salinisation of the soil renders the land unusable.

(Source:Nature.com )

Agribusinesses have been preparing for these threats, and many should be able to adapt and thrive in the face of climate change. Cargill has been investing in facilities in Canada and the northern parts of the United States. as it expects expanded agricultural activity to come with warmer weather in those regions. DuPont (NYSE:DD ) has been developing pest and weather resistant seeds and supporting the commercialization of the cellulosic ethanol industry. With smart long-term planning and innovations such as these on the horizon, a keen investor should still be able to find growth opportunities in this sector.

For investors who desire diversification, Market Vectors Agribusiness ETF (NYSEARCA:MOO ) would be my preference. In comparison, PowerShares Global Agriculture Portfolio (NASDAQ:PAGG ) has a higher expense ratio (0.75% vs 0.53%), and iShares MSCI Global Agriculture Producers ETF (NYSEARCA:VEGI ) is too concentrated, with almost 14% of its holdings in Monsanto.

Conclusion

The many perils of climate change are real, but its effect on your portfolio may be negligible. Industry leaders that take this threat seriously and invest wisely should be rewarded over the coming decades, but don’t expect outlandish returns from their still-developing green technologies in the immediate future.

There are three key things long-term investors can do to prepare their portfolio for climate change. First, ensure that your holdings are recognizing and preparing for the coming challenges; don’t be afraid to sell a company cheap if its business model is unsustainable. Second, analyze which of your companies may be good to hold and collect dividends from, but are too risky to keep reinvesting into. Finally, it will be more important than ever to stay well-diversified, so as to mitigate the unpredictable risks of both mother nature and human nature.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.