Cleantech Group Green investing sees uptick

Post on: 16 Март, 2015 No Comment

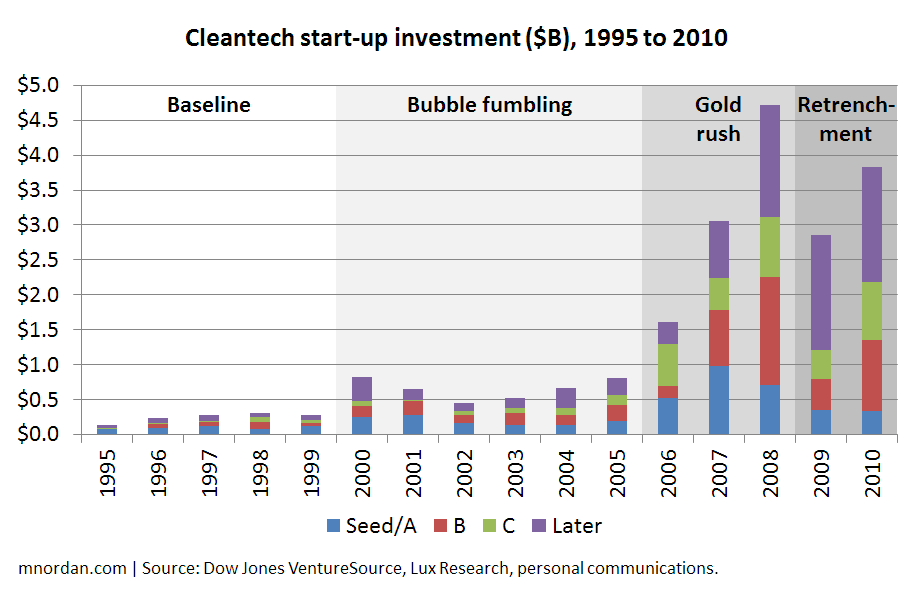

Clean-technology investing could be seeing a rebound.

Cleantech Group, a research firm backed by Deloitte, released a preliminary report on Thursday showing a slight uptick in clean-tech funding during the second quarter of 2009 in North America, Europe, China, and India.

After two quarterly declines, the increase is good news, but the Cleantech Group noted that the quarter-to-quarter comparison for the same period a year ago is still down.

The (second-quarter) total is up 12 percent from the previous quarter, although down 44 percent from the same period a year ago. The average round size in (the quarter) was $12.9 million, up from $12.3 million (the previous quarter), the report stated.

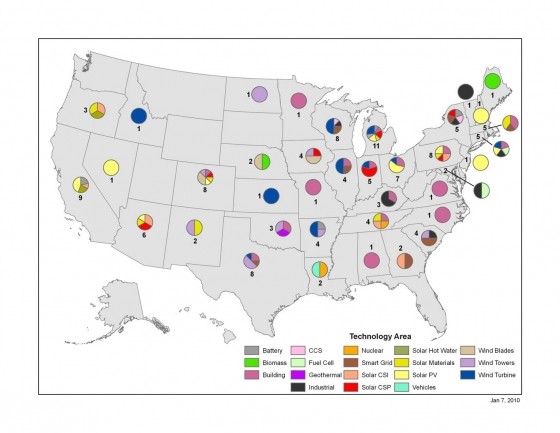

Silicon Valley venture capital funds remained the top clean-tech investors in the second quarter. Cleantech Group

Cleantech Group said that while solar investments are still down, clean-tech investments in the utility and automotive sectors have risen. In fact, automotive firms saw the biggest influx of clean-tech investments, which Cleantech attributes largely to the government’s stimulus package for the automotive industry.

North America was the biggest investor in clean technology, making up about 66 percent. Europe and Israel were the second biggest investors, at 21 percent. India and China were less invested in clean technology, making up only 11 percent and 1 percent of the total investments in clean tech for the quarter, respectively.

The Cleantech Group also pointed to some big automotive deals completed during the quarter:

- Kleiner Perkins and T. Boone Pickens together invested $100 million in San Diego start-up V-Vehicle .

- Fisker Automotive. which plans to make a plug-in electric luxury sedan, raised $85 million from Kleiner Perkins and Eco-Drive Partners.

- Think Global, a Norwegian company that specializes in electric cars. raised $39 million.

- Israel-based ETV Motors received $12 million from Quercus Trust.

Battery companies also saw the love. Lithium ion battery maker A123 Systems raised $100 million from General Electric. and Deeya Energy, working on a redox flow battery, raised $30 million from Technology Partners.

The Cleantech Group also listed the venture capital firms that invested the most in clean technology for 2Q09. Not surprisingly, Kleiner Perkins Caufield & Byers topped this list of green-tech investors, with Khosla Ventures, Braemer Energy Ventures, Robeco Alternative Investments, Draper Fisher Jurvetson, VantagePoint, and Venture Partners following.