Citigroup CCAR Further Stress Or Sigh Of Relief Citigroup Inc (NYSE C)

Post on: 17 Июнь, 2015 No Comment

Summary

- The Fed will release CCAR results at 4.30 p.m. on Wednesday.

- This is the business end of the CCAR process where the Fed will approve or reject Banks’ capital actions plans.

- The release of the stress test results last Thursday were widely viewed as a negative for Citigroup, reflecting a rather tight margin on several key capital ratios.

- The Fed’s stress test perhaps suggesting that a modest capital return is on the cards, primarily due to quantitative constraint.

- This article analyses the numbers behind CCAR in great detail.

The 2015 Citigroup (NYSE:C ) CCAR outcome was always going to be a pivotal moment for the firm. Management has repeatedly reiterated their commitment to remedy past failures and design an industrial strength CCAR process. Against this background and much publicized 2014 CCAR failure — a qualitative or quantitative failure will likely be a catalyst for the departure of Citi’s current leadership (CEO, CFO and CRO).

Stress tests results (stage 1)

The Fed published the Dodd-Frank stress test results last Thursday — Citigroup’s results are shown below:

The minimum capital requirements for each capital ratio are illustrated below :

As can be seen from above, under the Fed’s stress test results Citigroup does not seem to have much of a buffer, when it comes to certain capital ratios. Specifically, the Tier 1 capital ratio minimum requirement is 6.0% whereas under the Fed’s results, Citi’s ratio declines to a low of 6.8%. Similarly, the Tier 1 leverage minimum requirement is 4.0% whereas under the Fed’s test, Citi’s ratio declines to a low of 4.6%.

The overriding concern is that, all else being equal, Citigroup has limited quantitative buffer to request substantial capital returns in the form of buybacks and dividends (but more on that later).

Citi’s disclosure of its internally calculated stress test

Under the Fed’s rules, Citi is required to disclose its own calculations under the same severely adverse scenario as the Fed’s:

As can be seen from above, Citigroup’s projections of its capital ratios are somewhat higher than the Fed’s. There are a couple of major reasons for the difference:

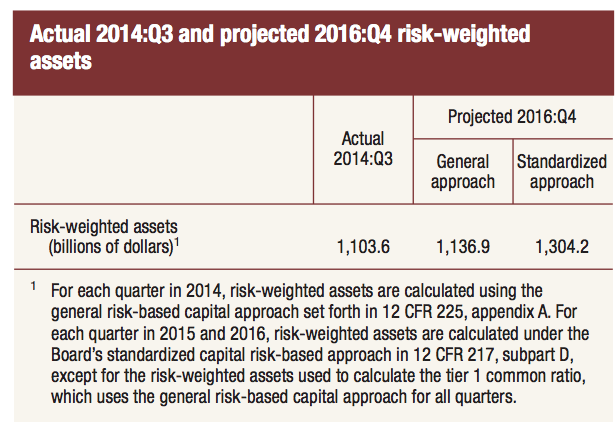

- The Fed assumes that Citigroup’s RWA increases to 1.3T (as opposed to 1.2T assumed by Citi’s projections)

- The Fed assumes significantly higher ($48.3 billion) loan losses than Citi’s projections ($37.7 billion)

Should you believe the Fed or Citi’s projections?

Do I believe Citi’s RWA will increase by $200 billion in a severe recession under the standardized method of calculating RWAs?

Absolutely not — I think it is a ridiculous proposition to assume that Citi will grow its book to that extent (let alone there would be such loan demand, in such a severely stressed environment).

Do I believe that the Fed’s loan loss models are more accurate than Citigroup?

Not really — I don’t believe so, as the Fed is using standardized models and most likely not taking into account collateral and other credit mitigation strategies (such as credit insurance, hedging, covenants etc.) that Citi would likely be employing.

Does it really matter what Citigroup’s management (or investors) believe?

Clearly not — one cannot fight the fed, so best to take it on the chin and just move on.

Citigroup planned capital actions

The above discussion, though, strictly pertains to Dodd-Frank stress tests that do not take into account Citigroup’s planned capital actions — specifically, Citigroup’s planned issuance of additional preferred stock.

Citigroup’s CFO, in its most recent fixed income call noted the following:

We issued approximately $4 billion of preferred stock, consistent with 2013 issuance levels, bringing our Additional Tier 1 capital to approximately 90 basis points of risk-weighted assets. We expect to issue approximately $4 billion of preferred stock again in 2015 as we continue to prepare for full implementation of capital requirements in 2019.

In other words, Citigroup plans to raise an additional $1 billion of preferred stocks per quarter for the next two years or so (approximately $8 billion of additional preferred stock is expected).

The impact of issuing preferred is immediately accretive to both CET1 ratio and total tier 1. In other words, the planned preferred stock issuances should substantially increase Citi’s quantitative capacity for its 2015 CCAR capital ask.

The impact on Citi’s capital ratio can be clearly seen by comparing Q3’2014 (starting point for 2015 CCAR) and Q4’2014 capital calculations:

And after issuance of additional preferred stock during Q4’2014, the deduction from Tier 1 capital is reduced by the issued amount:

By the numbers: what is Citigroup’s quantitative capacity?

I have calculated, what I believe, is Citigroup’s capacity under the quantitative constraint of CCAR (including planned capital issuances of preferred stock):

As can be seen from above, Citigroup’s capacity under the Fed’s stress test scenario (including preferred issuance) is

19 billion.

Under Citigroup’s projections, it is significantly higher at

35 billion.

Please note, that these are my calculations based on the assumptions stated above and my interpretation of the capital rules — these may vary materially from actual outcomes — as such readers should not rely on these, especially when making investment decisions, without independent verification.

Conclusion

It appears that the concern over Citi’s quantitative limitation is somewhat exaggerated — especially if one takes into account planned issuances of preferred stocks. Based on Citi’s own projection of a large buffer, I would guess that the original capital ask was around $10-$12 billion (perhaps $10 billion buyback and an increase in dividends to 10 cents per quarter). That would have been a reasonably conservative ask at around 30% of projected buffer.

Citigroup can still maintain this capital ask at around $10 billion even under the Fed’s stricter projections (including planned capital issuances). However, given the gap between the Fed and its own projections, Citi’s management may choose to revise request to a more conservative number (say $5-$10 billion).

Final Thoughts

All of the above is of course premised on Citi passing the qualitative test as well — I would not even want to imagine the ramifications (to all involved), if the Fed fails Citi on a qualitative basis.

It is also interesting to see whether the sale of OneMain is timed for qualitative or quantitative reasons. If it is the latter, then the capital ask (albeit contingent on closure of transaction) may significantly surprise on the upside.

Disclosure: The author is long C. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.