Choosing the right mutual fund

Post on: 3 Июль, 2015 No Comment

How do you choose which mutual fund to invest in? With more than 6,800 distinct funds available, according to Morningstar, that can be a daunting question.

The book is a tome on the mutual fund industry. But in one chapter he offers a handy, bullet-point guide for what to look for when reading up on a fund before you invest in it.

Start with the prospectus

Every mutual fund must provide shareholders with a document known as the prospectus, which outlines material information about a fund, including the investment strategy, risks and fees.

The prospectus, readily available on fund company websites (or which can be mailed to you upon request), can be intimidating. So Pozen offers some tips.

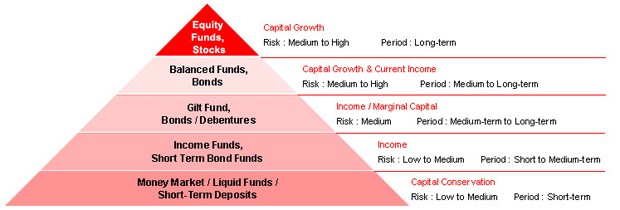

First, focus on the description of the fund’s investment objective and strategy. Normally, this will be toward the beginning of the prospectus, so it should be easy to spot. Consider whether it matches your own goals by, say, investing in blue-chip stocks that deliver steady growth.

Next, see how risky the fund is. An easy way to do this is to look at the bar graph of the fund’s annual returns included in the prospectus, Pozen said. If the fund has had big swings in performance, up one year and down another, then it (and its investors) likely endure a fair share of volatility. If the fund is new, see how much space is dedicated to discussing its risks.

Finally, check out the list of expenses. Will you be billed an upfront sales charge? And what annual fees will you have to pay?

Read the shareholder reports

Mutual funds also provide shareholders with annual and semiannual reports.

They include commentary from the fund’s management team about how the fund has performed recently.

The manager’s discussion is one of the most important things to focus on, Pozen said in an interview with journalists.

The discussion gives you a sense of the manager’s thinking and whether the fund has met stated goals.

Veteran portfolio managers Larry Pitkowsky and Keith Trauner, who launched the GoodHaven fund this year, say the annual and semiannual reports are worth paying attention to.

Trauner suggests that investors look back two or three years.

What did we say then, and have we behaved consistently with what we said? he said. That’s a much better judge of whether a manager is walking the walk.

Email Carolyn Bigda at yourmoney@tribune.com

Shareholder reports

You can find the most recent shareholder reports on a fund company’s website. For past reports, go to sec.gov/edgar.shtml. Click on Search for Company Filings and have the fund’s ticker symbol handy.