Choosing the Right Investment Benchmark

Post on: 17 Апрель, 2015 No Comment

By: Investor Solutions

By: The Financial Planning Association

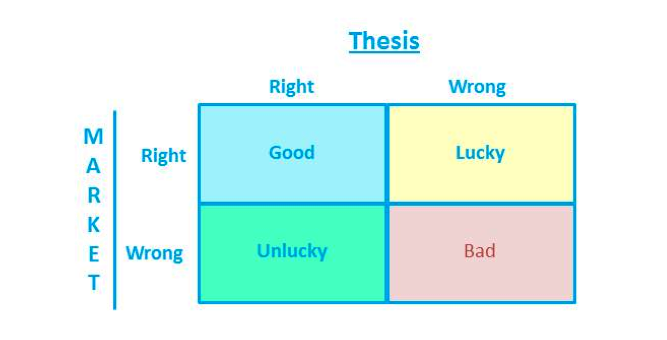

Whether the stock market is going down, or up, most investors compare the performance of their portfolio and the individual components of their portfolio against one of the major market indexes. Typically, the index of choice is the Dow Jones Industrial Average or the S&P 500. Some investors pick the current hot index, such as the Nasdaq was in 1998 and 1999. But this use of a single market index usually equates to comparing apples to oranges, say many Certified Financial Planner professionals.

Isnt using a single benchmark against which to compare your entire portfolio and the individual components of the portfolio such as domestic stocks and bonds, mutual funds, real estate investment trusts, foreign stocks and certificates of deposit the simplest method? Simplest, yes, but it tells a false story. Heres why.

By design, a well-diversified portfolio is made up of different types of assets that dont correlate strongly to each other. Large-cap stocks may boom, as they did in 19951999, while U.S. Treasury bonds didnt do nearly as well. But in 2000 and 2001, when large caps slumped, Treasuries did well.

The same goes for different types of stocks. Small cap didnt do as well as large cap in 19951999, but, like Treasuries, they outperformed large cap in 2000 and 2001. Mixing these uncorrelated types of assets in a single portfolio theoretically reduces risk and, argue some, actually enhances total return over time versus investing in a single type of asset.

Consequently, theres little value in measuring this years performance of a bond mutual fund in your portfolio against the return of the large-cap S&P 500 Index, or comparing the returns of your foreign stock mutual funds against the Nasdaq. As for comparing the return of your overall portfolio against a specific benchmark, planners suggest that you really should compare it against the return benchmark you established as part of your investment plan. Perhaps you want the portfolio to return ten percent a year in order to accomplish your financial goals. Then the portfolios return should be compared against that ten percent benchmark, not what the Dow does for the year. (And remember, the return of your portfolio will inevitably go above or below your personal benchmark in any given year; it is whether you are accumulating enough dollars over time that counts.)

The real value of market indexes is for comparing how well related investments in your portfolio are doing. For example, is your large-cap mutual fund performing well against a large-cap index such as the Dow or the S&P 500? If its doing much worse, why?

Here, are some of the benchmarks to keep in mind and what they measure.

The Dow. The godfather of stock market indexes and still the most watched by individual investors. Some critics complain, however, that it is too narrow because it follows only 30 large-cap stocks.

S&P 500. More popular among investment experts because it follows a much larger number of stocks, it too has its critics. One complaint is that because the index is cap weighted, the returns of a relatively small number of the largest stocks in the index account for most of the indexs performance. And it still follows only 500 of the roughly 7,000 publicly traded stocks in the United States. Some experts think the Russell 1000, which follows the 1,000 largest companies, is a better index.

Nasdaq Composite. A value-weighted listing of the nearly 5,000 stocks listed on the Nasdaq. Critics complain that the huge technology stocks that dominate the index skew the weighted index.

Russell 2000. This tracks 2,000 smaller company stocks.

Wilshire 5000. This tracks all publicly traded stocks in the country around 7,000 though the largest stocks in the index still dominate the indexs total return.

Lehman Government/Corporate Bond Index. Made up of government and investment-grade corporate bonds with maturities of one to ten years. This is what you should compare most of your bonds and bond funds against, not the S&P 500.

MSCI-EAFE. The Morgan Stanley Capital International-Europe, Australia Far East Index follows around 1,000 of the largest stocks in Europe and Pacific Basin markets.

Solomon Brothers World Bond Index. This tracks fixed-income investments, mostly in Europe.

In addition, there are numerous other specialized indexes such as value, growth and mid-cap stocks, and municipal bonds.

This column is produced by the Financial Planning Association, the membership organization for the financial planning community, and is provided by Frank Armstrong, a local member in good standing of the FPA.