China ETFs v Stock Market What You Need to Know

Post on: 17 Июль, 2015 No Comment

Recent Posts:

China ETFs vs. the Chinese Stock Market: What You Need to Know

The past few weeks have brought an abundance of news regarding the ongoing collapse in China’s stock market. The Shanghai Composite Index, which traded near 2,500 in May, dropped under the 2,000 level and touched a low at 1,959 last week a 21% plunge from peak to trough.

For investors in China exchange-traded funds, this must be an unmitigated disaster, right?

Not exactly.

On Wednesday, the largest China ETF iShares Trust FTSE China 25 Index Fund (NYSE:FXI ) closed 18.5% above its early-September low and just 3% away from 52-week high. The second-largest, SPDR S&P China ETF (NYSE:GXC ), has gained 16.5% since Sept. 5, while Guggenheim China Small Cap ETF (NYSE:HAO ) is ahead 23.2%.

At first glance, this type of divergence seems to be a head-scratcher. However, a closer look shows that there is a substantial difference between the investments held in the ETFs and the “Chinese stock market” discussed in the media.

The main issue is that the Shanghai Composite (SSEC) tracks the “A” share market, which can only be accessed by local investors. This market has a number of unique features, including lower liquidity and a substantial weighting in smaller companies. Even more important, trading is dictated more by local issues such as politics and government reforms than it is by broader, global trends. The A-share market is closed to foreigners, which means that U.S. investors don’t have a way to gain direct exposure to the Shanghai Composite.

Not that anybodys complaining:

In contrast, U.S.-based ETFs such as FXI invest in the “H” share market, which is open to foreign investors and is dominated by large-cap firms such as oil interest CNOOC (NYSE:CEO ) that are much more heavily influenced by global factors. This is the market U.S. investors access via ETFs, and as the performance discrepancy would indicate it has provided much better returns than the SSEC in recent weeks.

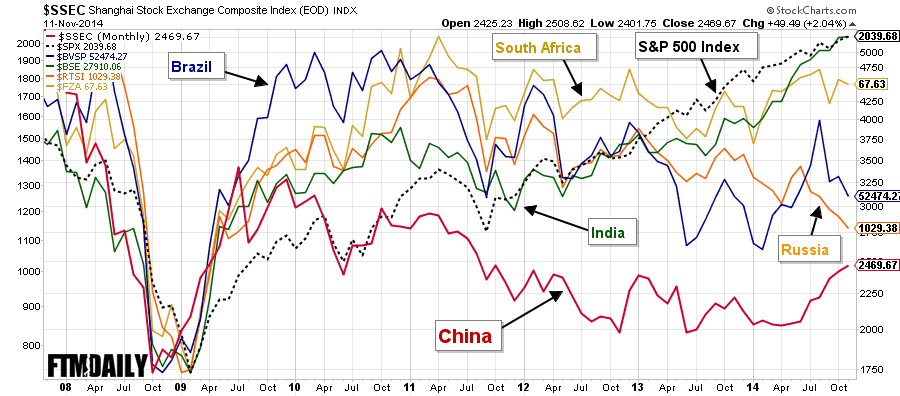

Reasons for the shortfall in A shares include local investors’ disappointment with the reform process and growing concerns with valuations given the murky outlook for 2013. Measured by the A-share market, in fact, China is the worst-performing country in the world so far in 2012.

Investors in China ETFs therefore need to take news reports about the Chinese stock market with a grain of salt, since trends in the Shanghai Composite don’t necessarily translate to the performance of the H-share market. This has been particularly true in the past month, during which the major China ETFs have moved exactly opposite the SSEC.

Divergence Among the ETFs

This leads to the question of which ETF is the best way to play China.

It’s an issue many investors are considering right now, since the country’s economic data appears to be turning the corner. and China is one of the few regions likely to deliver decent growth in the year ahead.

Between the two largest ETFs FXI and GXC FXI garners more attention, and it also has more than six times the assets. Still, GXC actually might be the better bet of the two. FXI is much more concentrated than GXC, with only 25 holdings total and 61.8% of its assets in its top 10 holdings, including weightings of more than 9% in both China Mobile (NYSE:CHL ) and China Construction Bank. In contrast, the SPDR S&P China ETF holds 210 positions and has a weighting of 45.6% in its top 10.

The most striking difference between the two funds is in their sector weightings: FXI holds a full 58% of its assets in financial stocks, well above the sector’s 33.7% weighting in GXC, which means that FXI investors are making a huge bet on China’s property market. One benefit of the higher weighting in financials is that FXI offers a higher dividend, 2.9% versus 2.1%. However, GXC makes up for a portion of this shortfall through a slightly lower expense ratio: 0.59% versus 0.74%.

Another key difference is performance. GXC has outpaced the iShares fund in all trailing time periods since its inception in March 2007: