China Brokers’ Profit Seen at Risk From Government Action Bloomberg Business

Post on: 8 Июнь, 2015 No Comment

Employees work inside a branch of Haitong Securities Co. in Beijing, China. Haitong Securities said Dec. 21 it’s planning a private share sale in Hong Kong to raise HK$29.9 billion ($3.9 billion), about 60 percent of which will be used to develop its short-selling and margin-financing business. Photographer: Nelson Ching/Bloomberg

(Bloomberg) — China’s surging stock market is raising the prospect of government action to prevent an equities bubble, a potential threat to brokerage earnings that are projected to hit a seven-year high this year.

UBS Group AG says regulators could limit the use of credit in buying stocks. In 2007, authorities raised a trading tax after a sixfold increase in the Shanghai Composite Index over two years. Some brokers have boosted minimum-asset requirements for margin trading and short selling, the 21st Century Business Herald said today, citing unidentified employees.

Potential government action puts at risk the trading volumes and record margin lending that have placed the nation’s 19 publicly traded brokerages on course for a 62 percent profit gain this year, data compiled by Bloomberg show. The firms’ shares fell an average 6.4 percent today, paring 2014 gains to 134 percent. The Shanghai index jumped 40 percent this year, the second-biggest gain among 93 benchmarks tracked by Bloomberg.

“While the stock market is extremely hot now, the question remains if such strong trading volumes will continue into next year,” said Tang Yayun, a Shanghai-based analyst at Northeast Securities Co. “This is a risk that we need to watch out for securities companies. The explosive growth in securities lending and margin financing isn’t sustainable.”

Leveraged Bets

The securities regulator this month cautioned investors on buying shares and started inspecting some brokerages’ margin finance businesses. Shares of Citic Securities Co. and Haitong Securities Co. China’s top two brokerages by market value, lost more than 9 percent at the close of Shanghai trading.

Shanghai’s average daily trading volumes this year are 50 percent higher than the 2013 mean. The prospect of higher trading-related fees drove the market value of Citic Securities to $55 billion as of Dec. 19, replacing Credit Suisse Group AG as the world’s fourth-biggest securities firm, data compiled by Bloomberg show.

Increased appetite for risk has made investors more willing to take on debt to finance equity purchases. The amount of credit extended to investors to buy stocks climbed to 1 trillion yuan ($161 billion) as of Dec. 19, nearly triple the 344 billion yuan at the end of 2013, China Securities Finance Corp. data show.

Advertisements are luring the Chinese public to leveraged investing. Customers with Huatai Securities Co. trading accounts that are at least six months’ old can be approved for margin-finance accounts in “minutes” through its smartphone application, according to the brokerage’s website. “Big bets” are possible at a low cost, Huatai said.

Chinese Dream

One investor who is thinking about using borrowed money to amplify his bets on equities is Zhang Jun, a 40-year-old real-estate researcher in Beijing. If President Xi Jinping “wants to realize the Chinese dream, he has to boost the stock market, which makes us ordinary people happy,” Zhang said in an interview this month.

Increasing use of credit means margin finance and securities lending may contribute about 20 percent of brokerages’ revenue this year, according to a UBS report dated Nov. 10. That compares with about 12 percent in 2013, Securities Association of China data show.

The 19 brokerages’ combined net income may grow to 39 billion yuan this year, the most since 2007, from last year’s 24.1 billion yuan, data compiled by Bloomberg show.

Irrational Exuberance

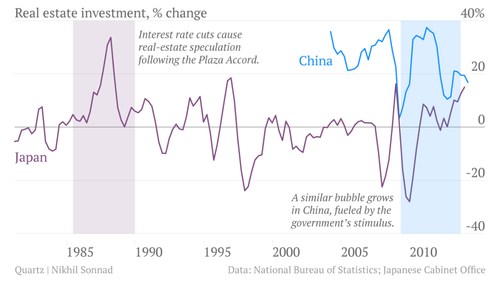

Those earnings — and the underlying stock rally — may be in question in an economy projected to grow 7 percent in 2015, down from this year’s estimated 7.4 percent, according to a Bloomberg survey of 51 analysts. Slumping home sales and a credit crunch are among risks faced by the world’s second-largest economy, according to economists surveyed by Bloomberg.

In a note today, Bank of Communications Co. strategist Hao Hong likened China’s stock surge to the U.S. market volatility documented in Robert Shiller’s 2000 book “Irrational Exuberance,” which was written in the wake of the bubble in Internet stocks.

“It is like deja-vu –- in a foreign place and a different language,” Hong wrote, in reference to China’s rally.

Some Chinese brokerages seem to be more optimistic. Haitong Securities said Dec. 21 it’s planning a private share sale in Hong Kong to raise HK$29.9 billion ($3.9 billion), about 60 percent of which will be used to develop its short-selling and margin-financing business.

Regulatory Inspections

“We believe 2015 will see more brokers conducting equity financing,” China International Capital Corp. analysts Du Lijuan and Mao Junhua wrote in a Dec. 22 note. “Enhanced capital will give brokers more room to develop capital-intensive business.”

Concern that the China Securities Regulatory Commission may step in to quell the stock market’s surge has risen as the authority said Dec. 12 it would conduct on-site inspections of some brokerages’ margin finance and securities lending businesses. Credit had played an “enormous role” in the rally the official Xinhua News Agency said in a Dec. 8 commentary.

The CSRC said last week it’s probing the suspected market manipulation of 18 stocks, causing the ChiNext index of smaller companies to slide on Dec. 22 by the most in more than a year. The regulator didn’t immediately respond to phone and faxed requests today for comment.

Tougher Policies

After the Shanghai Composite Index surged more than sixfold from 2005 to its peak of 6,092.06 in October 2007, policy makers took steps including tripling the stamp duty on equity trading to curb speculation.

The gauge slumped 65 percent the following year, while Citic and Haitong tumbled at least 60 percent. The two brokerages traded at an average price-book ratio of 2 since the end of 2008, data compiled by Bloomberg show. After the recent rally, they’re valued at a mean of as high as 3.7 times.

“We expect the regulator to introduce tougher policy in the near future to ease the risk brought about by the influx of leveraged funds,” Pan Hongwen, a Shanghai-based UBS analyst, wrote in a Dec. 16 note. “Taking into account the increased regulatory risk and a relatively high industry valuation, we are turning cautious on brokerages over the short term.”

To contact Bloomberg News staff for this story: Aipeng Soo in Beijing at asoo4@bloomberg.net

To contact the editors responsible for this story: Paul Panckhurst at ppanckhurst@bloomberg.net Darren Boey