Chart Formation – Continuation Patterns (Part I)

Post on: 27 Апрель, 2015 No Comment

This article presents a classic case study on continuation patterns for two stocks listed on the Singapore stock exchange. Do note that the example is for educational purposes only and does not reflect the most current prices of the two stocks.

For this article, we will touch on another form of price patterns known as “The Triangles” or continuation patterns where the price is expected to break out after a consolidation phase. They are also widely known as intermediate or near-term patterns. Although they are essentially continuation patterns, they sometimes act as reversal patterns as well. Let us begin our discussion with an introduction to the ascending triangle.

The ascending triangle has a flat resistance and a series of higher lows, hence forming a right-angled triangle. Though prices are facing resistance at one particular price level, it must be observed that buyers are accumulating as dips from resistance start to form at higher prices. A breakout happens when the resistance finally gives way. An ascending triangle breakout is biased towards the upside and one should note where the breakout occurs. The best breakout of triangles happens away from the apex of the triangle and further supports the bullish pattern.

Figure 1: Ascending triangle example – Tat Hong Holdings

As shown in Figure 1, the price chart of Tat Hong Holdings shows a resistance near the $0.93 price level. For the three months from January to March 2012, it was unable to convincingly break out of this resistance. However, it must be noted that the price retracements from the resistance level achieved were characterised by a series of higher lows. This is a very bullish sign as it meant that investors were keen to accumulate and buying pressure was strong as the price was unable to fall back to original lows. During mid-April, the price broke out of the resistance and went on to new highs. Do note that the breakout is away from the apex of the triangle.

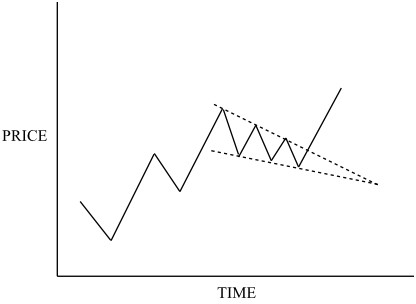

In contrast, the descending triangle is a bearish pattern that indicates further downtrend. As the name suggests, this price pattern depicts a downward sloping triangle. Instead of a flat resistance as in the case of an ascending triangle, we will be looking out for a flat support instead. The price levels will appear to have found support at a particular price and that will give investors the impression that the prices seem to be holding strong at this level. Oblivious to untrained eyes, every rally is actually forming at a lower price than the previous levels. In this scenario, a breakout to the downside usually catches investors off guard, leaving them reeling from the subsequent price slumps.

Figure 3: Descending triangle example – COSCO Corporation (S)

As shown in Figure 3, the price chart of COSCO Corporation (S) shows a flat support around the $1.685 price level. For nearly two months, this support level gave a false sense of security to investors because while support was holding well, every price rally was ending at a lower level. It had indicated strong selling at every rebound, with profit-taking correcting previous highs. Investors should be cautious of such a characteristic. This is a very bearish sign where investors are very keen to sell and the selling pressure is strong as prices are subsequently unable to trade higher. At the start of August 2011, the price broke out of the support level and went on to make new lows. Do note that it happened away from the apex of the triangle as well.

Having gone through the ascending and descending triangle formations, are you interested to know more? Then stay tuned to Issue 442 and find out about another continuation pattern which has an even bias to a breakout on either the upside or the downside. We will also discuss about the essential factors that investors should take into consideration when trading on triangle patterns.

Please visit CHARTNEXUS for more information on our complimentary training and seminar dates.

ChartNexus provides financial solutions to the investing community. The company engages in the business development and commercialization of intuitive and cutting-edge financial charting solutions.