Change in PE ratio

Post on: 10 Июнь, 2015 No Comment

Dont be a stockpicking monkey

Greg Hoffman

March 21, 2011 12:06PM

Monkeys are great stockpickers. Had your common-or-garden variety primate randomly selected five stocks in March 2009, chances are it would now be sitting on huge capital gains, contemplating reinvesting them in bananas by the truckload.

Its easy enough for us to see that our monkey, who now sees himself as a future fund manager, is mistaking skill for luck. Whats harder for us to see is how we might be making the same mistake ourselves.

If examining your portfolios returns over the past few years engenders in you a feeling of self-satisfaction, youre running that risk. With the sharemarket falling recently now is the time to educate yourself. Consider what follows a lesson in fire safety.

Value investing is theoretically simple: buy assets for less than theyre worth and sell when they approach or move beyond fair value. So too are valuing assets: discount future cash flows back to today at an appropriate interest rate for the life of the asset. The discounted cash flow (DCF) model is a commonly-used tool, hammered into every finance and business student.

But DCF models quickly deteriorate when they meet a rapidly changing world. The fact that most analysts failed to consider the impact of falling US house prices on their models played a major role in triggering the global financial crisis. Worse still, the misleading precision imbues investors with unwarranted overconfidence. Too often, models are precisely wrong.

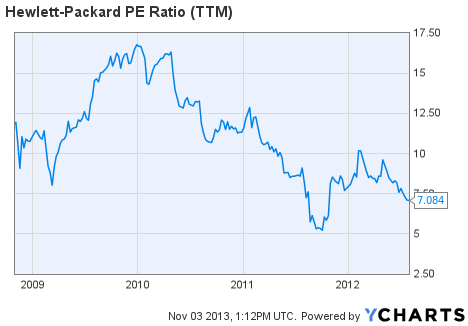

Other tools are available to help you avoid this error. The price-to-earnings ratio (PER) is a regularly used proxy for stock valuation but also one of the most overused and abused metrics. To make use of it you need to know when to use it and when not to.

PER 101

The PER compares the current price of a stock with the prior years (historical) or the current years (forecast) earnings per share (EPS). Usually the prior years EPS is used, but be sure to check first.

Last financial year, XYZ Ltd made $8 million in net profit (or earnings). The company has 1 million shares outstanding, so it achieved earnings per share (EPS) of $8.00 ($8 million profit divided by 1 million shares). In the current year, XYZ is expected to earn $10 million; a forecast EPS of $10.00.

At the current share price of $100, the stock is therefore trading on a historic PER of 12.5 ($100/$8). Using the forecast for current years earnings, the forward or “forecast PER” is 10 ($100/$10).

Its often said that the PER is an estimate of the number of years itll take investors to recoup their money. Unless all profits are paid out as dividends, something that rarely persists in real life, this is incorrect.

So ignore what you might read in simplistic articles and note this down: a PER is a reflection not of what you earn from a stock, but “what investors as a group are prepared to pay for the earnings of a company”.

All things being equal, the lower the PER, the better. But the list of caveats is long and vital to understand if youre to make full use of this metric.

Quality usually comes with a price to match. It costs more, for example, to buy handcrafted leather goods from France than it does a cheap substitute from China. Stocks are no different: high quality businesses generally, and rightfully, trade on higher PERs than poorer quality businesses.

Value investors love a bargain. Indeed, theyre defined by this quality. But whilst a low PER for a quality business can indicate value, it doesnt alone guarantee it. Because PERs are only a shortcut for valuation, further research is mandatory.

Likewise, a high PER doesnt ensure that a stock is expensive. A company with strong future earnings growth may justify a high PER, and may even be a bargain . A stock with temporarily depressed profits, especially if caused by a one-off event, may justifiably trade at a high PER. But for a poor quality business with little prospects for growth, a high PER is likely to be undeserved.

Common trap

Theres another trap: PERs are often calculated using reported profit, especially in newspapers or on financial websites. But one-off events often distort headline profit numbers and therefore the PER. Using underlying, or “normalised”, earnings in your PER calculation is likely to give a truer picture of a stocks value.

That begs the question; what is a normal level of earnings? Thats the $64 million dollar question. If you dont know how to calculate these figures for the stocks in your portfolio, now is the time to establish whether its skill or luck thats driving your returns. And if you dont know that, history may well make a monkey of you.

Greg Hoffman is research director of The Intelligent Investor.

Health is Wealth

Bullbear Stock Investing Notes