Carry Trades For All With Currency ETFs

Post on: 28 Апрель, 2015 No Comment

Summary

- Carry trades with currency ETFs.

- How currency traders utilize carry trade strategies to turn a profit in the forex market.

- Diverging central bank policies provide currency opportunities.

By Todd Shriber & Tom Lydon

Employed primarily by professional currency traders, the concept behind the carry trade is easy to understand. In a carry trade, the trader borrows or sells a low interest rate currency, such as the Japanese yen or U.S. dollar, and uses the proceeds to buy a high interest rate equivalent, such as the New Zealand dollar.

Exchange traded funds allow regular investors to employ a similar strategy, which has proven advantageous this year as interest rates remain low in the U.S. and Japan.

Given the divergent economic tendencies among dollar-bloc currencies, carry trades that are long Australian or New Zealand currency and short U.S. or Canadian dollars still offer risk-eager investors opportunities for arbitraging yields. A long Australian or New Zealand trade, combined with a short U.S. position established at the end of last year, for instance, would have garnered risk-keen investors 6.7% and 7.1%, respectively, said S&P Capital IQ in a new research note.

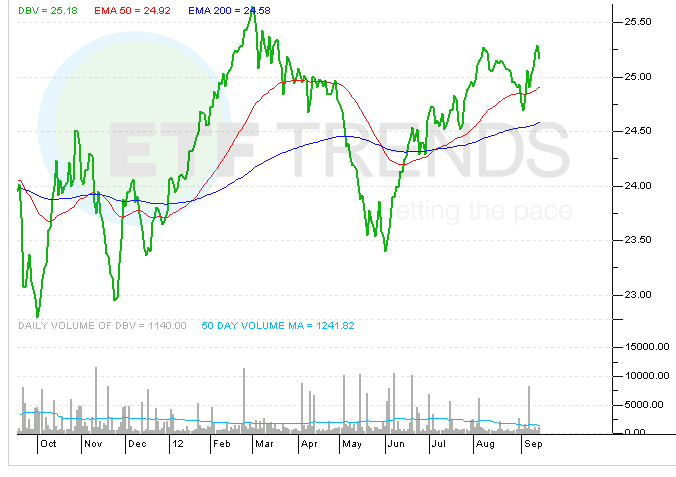

The research firm highlighted the PowerShares DB G10 Currency Harvest ETF (NYSEARCA:DBV ) as one avenue for investors looking to put on a carry trade without directly tapping the forex spot market.

DBV has lost $93.4 million in assets this year, but those sales of the ETF have been ill-timed. Ill-time because, among other factors, DBV is long the Australian and New Zealand dollar. Although Australia’s interest rates have come down over the past several years, the country has some of the highest rates in the developed world.

Add to that New Zealand raised rates earlier this year, and more of the same is expected from the Reserve Bank of New Zealand. The Aussie and the kiwi have helped DBV gain more than 4% this year.

Apart from the carry trade opportunities offered by dollar-bloc currencies, the 1.6% and 3.2% spot year-to-date returns of U.K. pounds in relation to the U.S. dollar and the euro, respectively, clearly reflect the policy achievements that have laid the groundwork for the improvement in U.K. economic conditions under the adroit stewardship of Prime Minister David Cameron and Chancellor George Osborne, added S&P Capital IQ.

Amid expectations the Bank of England could raise rates before year-end, the CurrencyShares British Pound Sterling Trust ETF (NYSEARCA:FXB ) is up 3.1% this year, and closed Monday at its highest levels since the fourth quarter of 2008.

The db X-Trackers MSCI Europe Hedged Equity ETF (NYSEARCA:DBEU ) is an equity-based ETF, though it offers its own carry trade properties by hedging exposure of fluctuations between the U.S. dollar and several European currencies, including the pound, euro and Nordic currencies.

With analysts expecting the economy of the European Monetary Union (EMU ) to display barely any energy, the ECB’s aggressive policy decision to drive a key lending rate into negative territory marks the first time a major G-7 central bank has undertaken such a bold measure to establish a floor for inflation, said S&P Capital IQ.

DBEU, which is rated marketweight by S&P, swelled in popularity in the weeks leading up to the European Central Bank meeting earlier this month. Along with a significant increases in daily turnover, DBEU has pulled in $151.5 million of its nearly $185 million in assets under management just this quarter.

Over 45% of the ETF’s weight is allocated to eurozone countries, positioning DBEU to benefit from a weaker euro. However, the fund would receive an added lift if the dollar materially strengthened against sterling, the Swiss franc or the Nordic currencies. DBEU is up 6.2% in the past 90 days.

db X-Trackers MSCI Europe Hedged Equity ETF

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article.