Career Risk Panic Only 11% Of Hedge Funds Are Outperforming The S P In 2012

Post on: 5 Апрель, 2015 No Comment

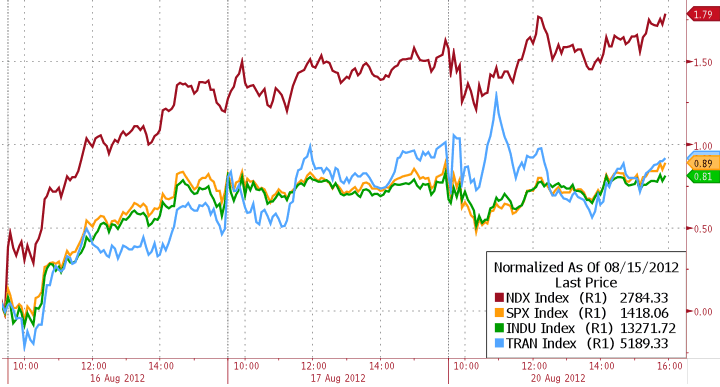

The S&P500 may be soaring to new 2012 highs, and has its all time highs within short squeeze distance, yet paradoxically this is arguably the worst possible news to the cadre of US hedge fund managers used to beating the market year after year, thus justifying their (increasingly more unsustainable) 2 and 20 fees. The reason: according to just a released report quantifying hedge fund performance so far in 2012, with an average return of 4.6% as of August 3 compared to a 12% return for the S&P, a pathetic 11% of all hedge funds are beating S&P year to date. This is the worst yearly aggregate S&P 500 underperformance by the hedge fund industry in history, and also explains why the smooth sailing in the S&P500 belies the fact that nearly every single hedge fund manager (and at least 89% of all) is currently panicking like never before knowing very well there are only 4 more months left to beat the S&P or face terminal redemption requests. And with $1.2 trillion in gross equity positions, the day of redemption reckoning at the end of the year (and just after September 30 for that matter as well) could be the most painful yet. it also explains why, just like every other quarter in which career risk is at all time highs, HFs are dumping everything not nailed down and buying up AAPL, which as of June 30 was held by an all time high 230 hedge funds (more on that later).

The typical hedge fund generated a 2012 YTD return of 5% through August 3rd compared with a 12% gain for the S&P 500 and a 10% return for the average large-cap core mutual fund (see Exhibit 1). The standard deviation of all hedge fund returns was 6 percentage points so two-thirds of hedge funds have generated YTD returns between -2% and +11%.

Distribution of returns provides more perspective than a single point estimate. Only 11% of hedge funds have generated YTD returns greater than 12%, outperforming the S&P 500, while 10% of funds of returned more than 15%. 79% of funds had positive returns.

Popular long positions have lagged both the index and popular short holdings in 2012. Our Hedge Fund VIP Basket (Bloomberg ticker:

Hedge funds reduced risk as the market pulled back in 2Q and their long positions suffered. Hedge fund net long exposure fell to 43% in 2Q 2012 from 49% in 1Q 2012, above the recent low of 36% in 3Q 2011 but well below the 52% high in 1Q 2007. S&P 500 fell 3% in 2Q while the VIP basket returned -7%, likely reflecting both a cause and symptom of fund underperformance and de-risking.