Capital Gains Tax Short and Long Term Rates Plus Other Factors to Consider

Post on: 8 Июнь, 2015 No Comment

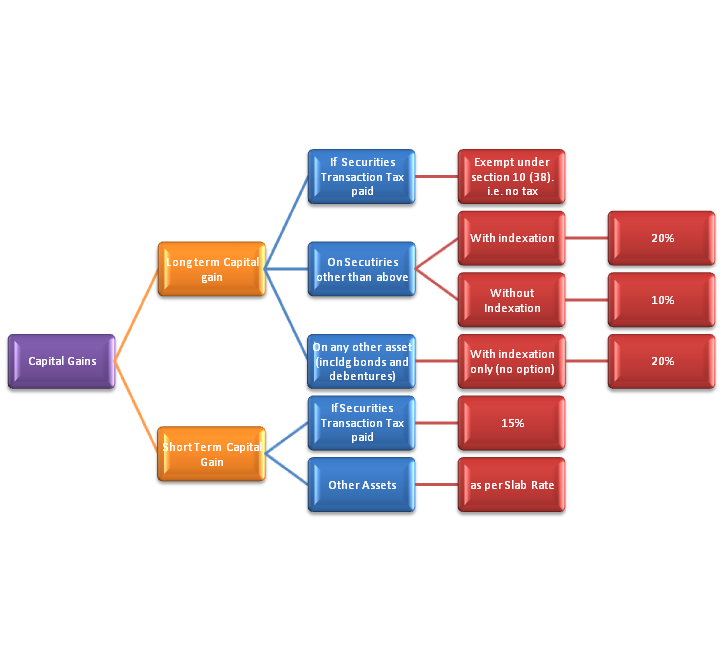

Short-term capital gains are taxed like ordinary income at tax rates. For example if Julia bought shares in Apple (AAPL ) in February and sold them in November of the same year, her gain or loss on the investment will be classified as short-term.

Long-term capital gains (assets held for more than one year) are taxed at 0% for taxpayers in the 10% and 15% tax brackets and 15% for taxpayers in the 25%, 28%, 33%, and 35% tax brackets. And under the latest tax legislation the long term capital gains rate for those in the 39.6% tax bracket rose to 20%. The 0% tax rates for those in the 10% and 15% federal income tax brackets was a special provision in the bush-era tax cuts which were extended to the current year.

If your capital losses are more than your capital gains, you can claim a capital loss deduction in your tax filing. Your allowable deduction is $3,000 ($1,500 if you are married and filing separately) and can be claimed against your ordinary income. There are various exceptions and special provisions when it comes to the treatment of capital gains or losses and you should consult IRS Publications 17 and 550 for more details. Some highlights are provided below.

Almost everything you own and use for personal or investment purposes is a capital asset. Examples are your home, investment properties, stocks, options or bonds held in your personal account. When you sell a capital asset, the difference between the amount you sell it for and your (cost) basis, which is usually what you paid for it, is a capital gain or a capital loss. Capital gains are offset again capital losses, so your net capital gain/loss is the key figure to use in your tax planning.

- If your capital losses are more than your capital gains, you can claim a capital loss deduction. Your allowable deduction is $3,000 ($1,500 if you are married and filing separately). You can use your total net loss to reduce your ordinary taxable income up to the $3,000 limit. So make sure at the end of year, to sell some “losses” up to $3,000. You can always buy back the stocks after 30 days (to avoid the wash rule discussed below), and thereby reduce your overall cost basis.

- Dividends paid out of the earnings and profits of a corporation – are generally ordinary income to you. This means they are not capital gains, and so do not qualify for the lower tax capital gain rates.

- Capital gain distributions (also called capital gain dividends) paid to you by mutual funds (or other regulated investment companies) and real estate investment trusts (REITs ) are also subject to the above tax rules. Report capital gain distributions as long-term capital gain regardless of how long you have held the investment.

- Beware the Wash Sale rule. You (or your spouse) cannot deduct losses from sales or trades of stock or securities in a wash sale. A wash sale occurs when you sell or trade stocks or securities at a loss and within 30 days before or after the sale you:

Buy substantially identical stock or securities

Acquire substantially identical stocks and securities

Acquire a contract or option to buy substantially identical stock or securities.

- Gain or loss from the sale or trade of an option to buy or sell a capital asset are treated as capital gain or loss.

- Capital loss carryover. If you have a total net loss that is more than the yearly limit on capital loss deductions, you can carry over the unused part to the next year and treat it as if you had incurred it in the subsequent year. If part of the loss is still unused, you can carry it over to later years until it is completely exhausted. When you carry over a loss, it remains long term or short term (use this first). A long-term capital loss you carry over to the next tax year will reduce that year’s long-term capital gains before it reduces that year’s short-term capital gains

- If your long-term capital gains take you into a higher tax bracket, only the gains above that threshold will be taxed at the higher rate. In other words, if your long-term capital gains bring your taxable income $1 over the level for the 25%-35% bracket, only $1 will be taxed at 15%, and the rest of your long-term capital gains will be taxed at 0%.

- Second, for single taxpayers who make more than $200,000 per year and married taxpayers who file jointly and earn more than $250,000, there is an additional 3.8% tax on investment income, including capital gains, above a certain level because of the net investment income tax.